Hello Grasshoppa,

Budget Planning, Managing Money & Investment have never been easier with the latest technology & mobile app. Some of you might remember or have came across someone that write their expenses or savings amount in a notebook. Or maybe you are actually the one that track your expenses or savings with a notebook. I got to admit, I still do that on monthly basis to plan for my monthly expenses.

Today, there are more than hundreds or thousands of Financial Apps that you can download via Google Play or Apple App Store. There are many good apps & there are many average apps. I assume that most of you are on smartphone so lets explore on which are the Best Financial Apps that you should have on your phone for 2019.

1. Mobile Banking Apps

This is something that most of you definitely have. Depending on which Bank Apps, different Bank may have different feature. The most basic feature include your Savings or Current Account, Fixed Deposits, Investment Account, Loan Account & Credit Card Account.

List of Apps : Citibank, CIMB, Maybank, Bank Islam, Public Bank, RHB Bank, AmBank, UOB, Affin, OCBC, Alliance Bank

2. Money Manager Apps

Why do you need a Money Manager Apps? It helps to track your expenses, your income & your wealth. It requires discipline to key in each time you spend or receive money but it will make your life easier. Some you of may think that its stingy people app but once you are used to it, you are able to plan your financial better. Best part of all, checking your bank balance or wealth is just an app away. Even if your phone crash, some of the app have backup & you are able to export your expenses to Excel file.

List of Apps : Money Manager Pro, Expenses OK, Money Lover, Spendee Budget & Money Tracker, Spending Tracker, Monefy

3. Stock Trading Apps

Remember back in those days we watch movies where people trade via phone call? That may be 20 years ago or maybe some of you might still trade via phone call. Why need to call or trade using website when you can trade using your phone?

List of Apps : Rakuten, CIMB iTrade, HLE Broking, Public Invest eTrade, RHB TradeSmart

4. HelloGold

HelloGold allows you to invest in Gold with as low as RM1. What can you eat with RM1 today? 1 piece of Roti Canai. LOL. So do you prefer Roti Canai or Gold?

5. StashAway

The first SC-Licensed Robo-Advisor in Malaysia. I started to Invest using their platform recently & I find their platform to be user friendly. It is really easy to understand & advantage of using a Robo-Advisor is their low management fee. You can checkout my post on Robo-Advisor & StashAway HERE.

6. FSM Mobile

FSM Mobile or FundSupermart allows you to keep track of your Mutual Fund & PRS performance. The disadvantage is, you are unable to purchase your fund via mobile app & there is no Touch ID for their app. Perhaps we might see better update in near future.

7. P2P Lending Apps

Remember the feeling when you borrow someone money without getting any interest? Now you get to lend your money via mobile apps. All you have to do is register & you are good to go. Activate “Auto Invest” & you might just refer it once a month. It’s that simple.

List of Apps : FundingSociety, Fundaztic

8. CTOS

Keeping your CTOS Score in Green is definitely a good thing. They are offering 2 different package for you to choose. 1 is Free & another is RM25 per report. If you plan to apply for any loans, do check your report from time to time.

9. EzCalculators

If you are into Investments or looking to apply for Loan, this is the best app for you. You can check on your ROI, Compound Interest, Auto Loan & many more by using this app.

10. Mobile Payment Apps

Most of us know PayPal but recently Malaysia have launched few other Mobile Payment Apps such as WeChat Pay & many more. Even Touch&Go have launched their Mobile Payment Apps. Now you might not need to carry your cash anymore.

List of Apps : PayPal, Touch&Go, GrabPay, WeChatPay, BigPay, Razer Pay

11. EPF

This is another hassle that you might remember. We use to go to EPF office or EPF mobile machine to print our EPF statement. Now you have to just register & you can access to your EPF statement with your phone.

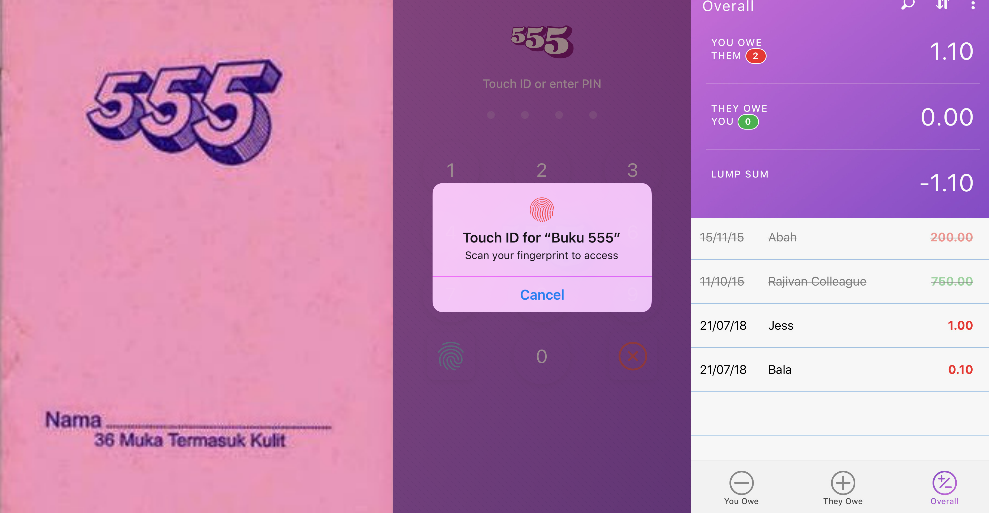

12. Buku 555

Not sure if anyone of you remember Buku 555. There are many function for Buku 555 back in those days. I used it as mini note book since its small but it seems that many people are using it to record the money the lend. The cool thing is, now you can use it via Mobile App & they even have Touch ID for privacy purpose. LOL.

Conclusion :

All the above apps is a good tools for your Financial Planning. Maybe some apps are new to you & you might need some time to get used to it but do give it a try. One of the app that I definitely cant live without is Money Manager Pro. I strongly recommend it to you & do leave a comment on what you think of the app.

OSS!