Recently, EPF has announced that members are allowed to purchase insurance via their platform by using members EPF Account 2. This is actually good news to many Malaysians, especially for those who do not have any insurance protection. Personally, I did not realize the importance of insurance until when I was 27 years old when I started to buy my first insurance.

Over the years, I have received much advice from friends & insurance agents on the importance of insurance but during that time, I was too stubborn to accept the idea & I honestly did not see any benefit of having insurance coverage until I was in my late 20s. I trust that many Malaysians do have the same view on insurance as I have some friends who are still not covered under any sort of insurance. The good news is, with i-Lindung, you can now purchase insurance by using your EPF Account 2.

What Is i-Lindung?

It is a self-service platform for all KWSP members to purchase protection products that are related to life insurance & also critical illness under their approved insurance companies & takaful operators (“ITO”). To qualify for their requirements, you will need to have at least RM100 minimum in your EPF Account 2, Malaysian & i-Akaun (member) user. The duration of each coverage is 1 year term. Another good news is, that i-Lindung is also eligible for tax relief.

How To Apply?

To apply for i-Lindung, you will have to log into your i-Akaun page via the KWSP website. I have tried to use the mobile app but I am unable to find any page that has anything related to i-Lindung. Upon logging in, you will see the i-Lindung panel on the top right. Once you click on it, you will end up on this page.

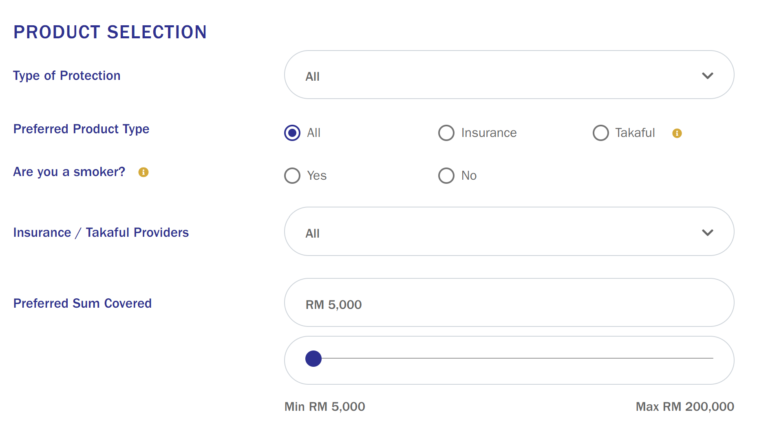

Once you click on ‘Get A Quote Now’, they will show you the details of your birthday, gender & payment frequency which you are not able to change. Then they will have the product selection column where you can choose the ideal coverage that suits your needs. Type of protection consists of either Life Protection, Critical Illness, or Both. You can also choose to be covered under different product types & if you are looking at coverage that is Shariah-compliant, you can select Takaful. They have also a list of Insurance or Takaful providers that you can choose from. Your preferred sum of coverage will determine how much the value you are willing to be covered which can be up to RM200,000.

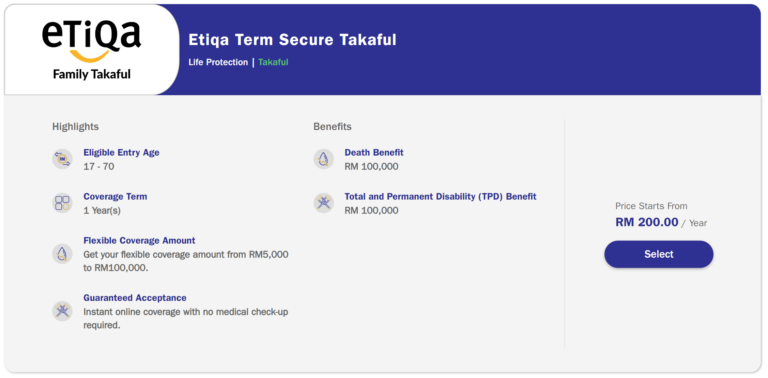

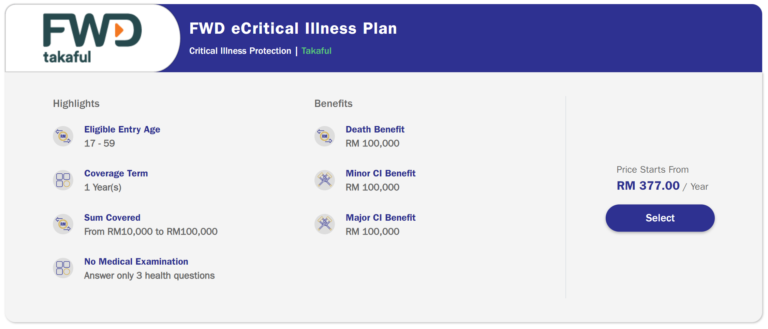

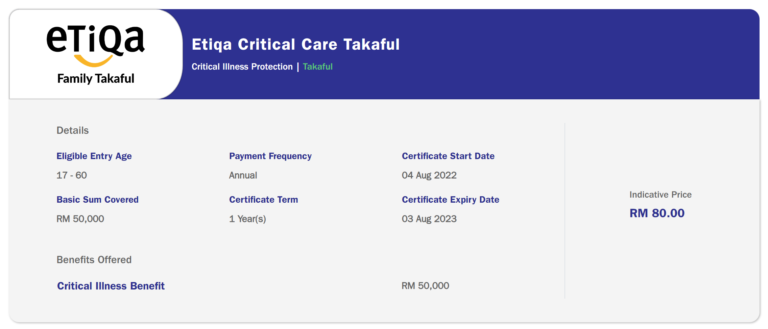

Upon submission, they will have a long list of proposals that will be available for your reference. Below is some of the sample for your reference. I am using the cheapest & the most expensive Life Insurance coverage for your reference. As you can see, the benefits are different for each price that you pay. For RM200 per year, you are getting only basic benefits compared to the higher package. For those who are above 60 years old, you can actually opt for the cheaper one since the eligible entry is up to 70 years old. They also guarantee your acceptance with no medical check-up required.

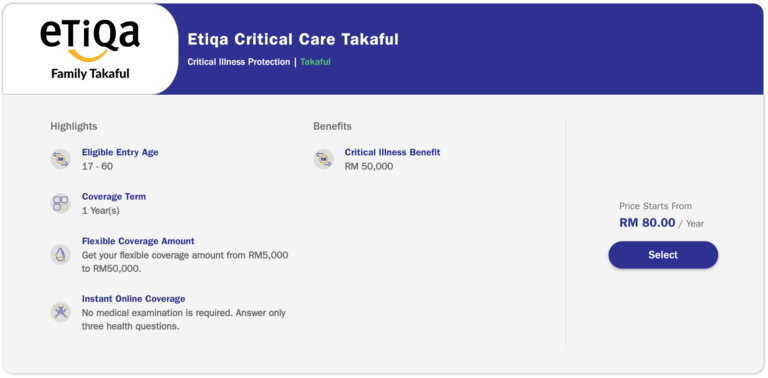

As for Critical Illness insurance, the basic package has only RM50,000 critical illness benefit vs the other which have a death benefit and major & minor critical illness benefit.

Upon selecting each product, you will be on the page where they will go into detail on your desired coverage. Next, they will bring you to the last page to confirm the agreement of your purchase. The coverage will start based on the actual purchase date. Upon clicking Proceed, they will proceed with the purchase of your desired coverage.

What Is My View On i-Lindung?

I honestly think that it is good insurance coverage that is offered by EPF for its members. Although you may find better coverage insurance out there, the main target for i-Lindung should be those who do not have any insurance at this moment & want to use their EPF Account 2 to purchase insurance. It is actually quite affordable compared to the ones that you purchase with your agents although the benefits can be different. It is definitely a good option for Malaysians that do not have any insurance coverage at this point but do make comparisons with other insurance packages out there to get the best benefits for you.

OSS!

You can also check out my latest YouTube video on How To Invest Like Warren Buffett: