Hello Grasshoppa,

As we all know, Pakatan Harapan government is working hard to fulfill their 10 Promises in 100 Days. One of it is to delay PTPTN repayment for Malaysians earning less than RM4000. According to Education Minister Dr Maszlee Malik, they will lift travel ban for PTPTN blacklisted borrowers too.

This is a Celebration to some of our fellow Malaysians especially for those who love travelling.

So What Can You Do With The PTPTN Repayment Money?

1.Plan Your Next Holiday Trip

So where is your dream holiday destination? Japan? Korea? Europe? USA? Before your salary hit RM4000, you can travel all you like to your dream holiday destination.

PS : IM JUST JOKING.

What Can You Do With The PTPTN Repayment Money?

1.Continue To Pay Your PTPTN Loan

Yes Im not joking about this. End of the day, we will still have to pay for it after our salary exceed RM4000. So why not start to pay now to avoid more debt in the future? As a Patriotic Malaysian, isnt it our job to help our country by paying back the money we borrowed to study? If it is too heavy for your current commitment, there is always another option by using your EPF Account 2 to pay for your PTPTN loan.

2.Donate To Tabung Harapan

Why not? Donation as little as RM50 will actually help the country. As of my writing, Tabung Harapan has collected RM27million. This is all donated by us to ease our beloved country burden.

3.Grow Your Money via Investment

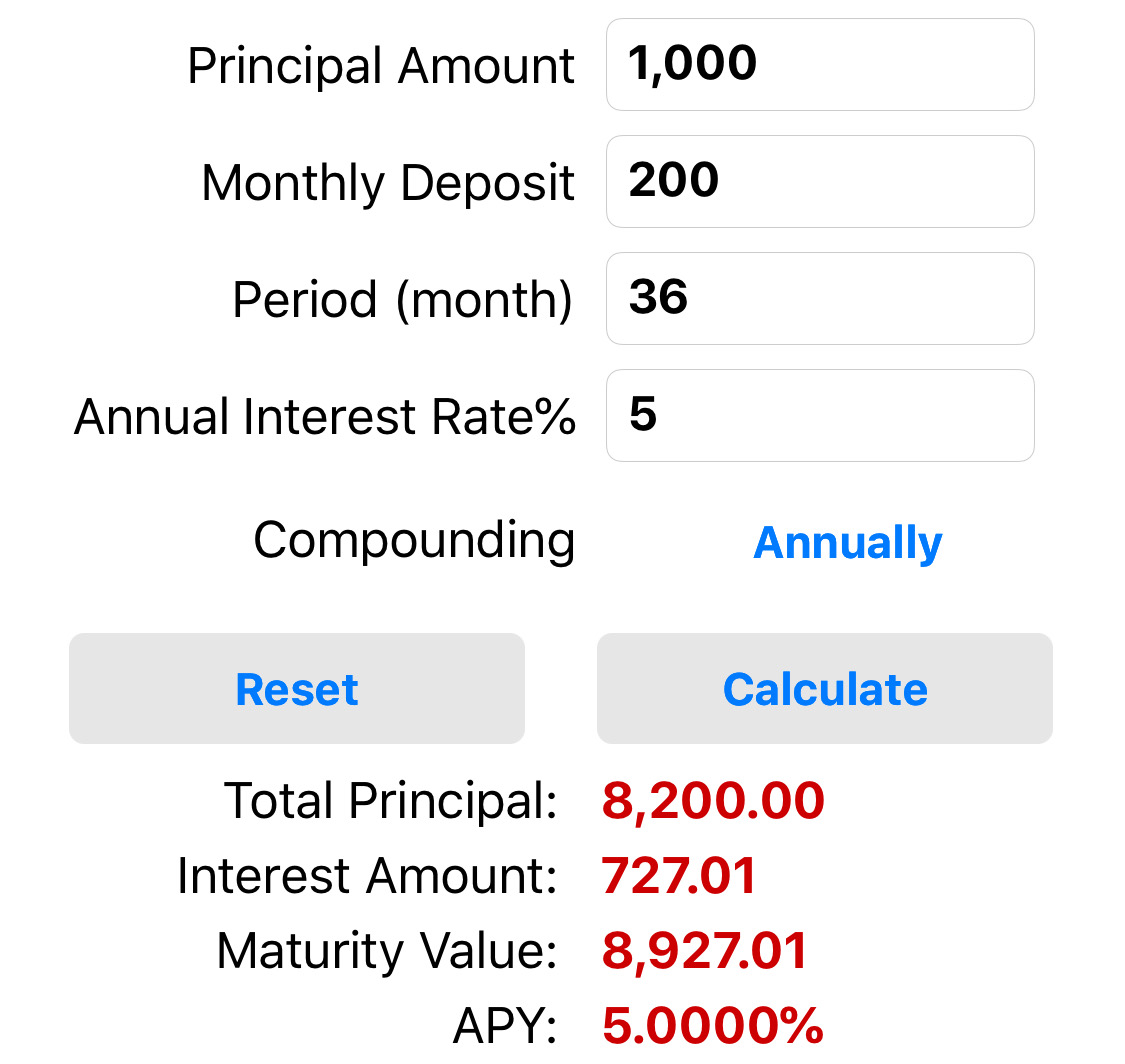

Since government allows us to hold our PTPTN repayment, you can actually grow your wealth by investment. Example : Lets assume you start to invest with as low as RM1000 & you add additional RM200 for next 36 month. With 5% return annually, you will have additional RM727.01. At the end of 36 month, you can take that money to pay your PTPTN loan. No idea on how to invest? You can read my post on What Can You Invest With RM1000.

4.Keep That Money For Your First Home

Started to work & struggle to buy your first house? You can start to keep money by allocating your current PTPTN monthly repayment. Once it reaches the amount that sufficient enough to pay for your house deposit, you can start to purchase your first home.

5.Charity Donation

With as low as RM50 per month, you are able to make a change & help those in need. Believe it or not, donating will also make us happier. UNICEF Malaysia have a monthly or one off donation to help the needy. You can lay a helping hand by donating in this link.

Conclusion :

Based on what we observed with current Pakatan Harapan government, they are trying their best to ease Malaysians expenses by lowering the cost of living. Their initiatives including reducing GST from 6% to 0%, maintaining current Ron 95 price, EPF for housewives & etc. Delaying repayment for PTPTN borrowers for salary below RM4000 will help the borrowers to reduce their cost of living as well. It is important to manage your PTPTN repayment money wisely or you might be facing more debts even your salary exceed RM4000. Remember Grasshoppa, be a smart spender. It will make a huge difference in your life.

OSS!