Hello Grasshoppa,

2017 was a good year for my stocks investment as I was up 20% for my overall stocks excluding my dividend earnings. 2018 was a bit rough for my side especially beginning November & currently I am down by 6%. It seems that overall market is rough with the Trade Wars, Oil Prices & many other factors.

I’m not sure whether it’s due to bad economy or me over thinking but I felt that malls are quite empty during Christmas & other restaurant seems empty too. Is the current Malaysian State of Economy affecting Malaysian spending power? Or am I just over thinking?

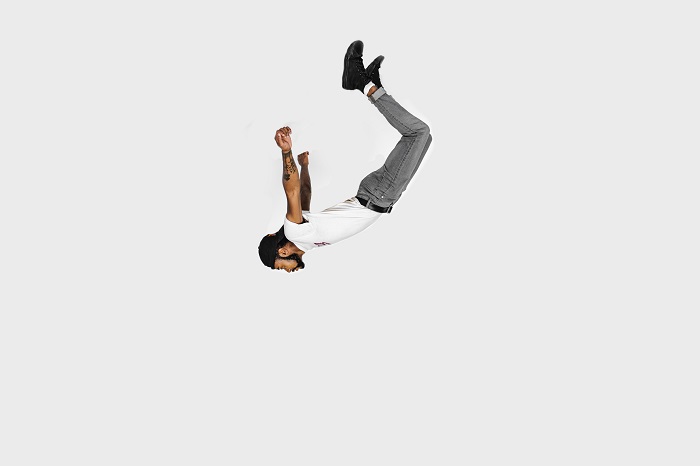

So What Can You Do To Survive A Falling Market?

1. Stick To Your Investment

It’s a panic time for many people during this period. Some investors may cut their losses during this period or exit the market before it goes lower. Should you exit or should you stay invested? Depending on how you view your investments or stocks. Despite the volatility of the market during this period, those companies that you are invested in are still running their business as usual. Perhaps it’s better to stick with your investment rather than speculating the worst.

2. Lookout For Some Good Deals In The Market

During each year end, we do have 11.11 Sales, Black Friday Sales & Christmas Sales. During times like this, there will be plenty of sales happening in stocks & even properties. Now it’s time to use some of your cash allocation to invest in some good companies or any properties that are up for sale.

3. Review Your Asset Allocation

Whether it’s in a bull market & bear market, it is important to review your asset allocation from time to time. During times like this, I would recommend you to review your asset allocation to ensure that your portfolio is able to weather any possible storm.

4. Cash Is King

Cash should be an important allocation in your investment. Good thing about having extra cash during this period is that you are able to purchase stocks or properties that are currently on sale.

5. Dollar Cost Averaging Along The Way

You may hear this very often especially from your Mutual Fund Agent. If you are investing in the long run, buying at low or high regardless the price may help to average your stocks price.

6. Manage Your Risk

Some investors may have higher risk tolerance compared to other investors. As an investor, do you know how many % of risk you are willing to tolerate? If you don’t have any idea on this, you may want to look into this NOW.

7. Do Not Speculate

Does anyone know when the market is going down or going up? There are many speculators out there that try to speculate the market but the fact is, how many of them actually able to get it right?

Will Market Stay Down Forever?

Let’s look at historical chart of both KLSE & S&P 500. Past historical chart shows that market is always volatile but each time it went down, it will always bounce back higher.

KLSE :

S&P 500 :

Conclusion :

There’s this quote from Warren Buffett that I always keep in mind “Be fearful when others are greedy and greedy when others are fearful.” I think that it’s good to stay optimistic during periods like this but at the same time, it’s better to be more careful with your decision. It is important not to act impulsively towards any decision whether to buy or sell. Keep calm & invest based on data & facts not feeling. If you are keen to invest in stocks but don’t know how to invest, I would recommend StashAway. The first SC-Licensed Robo-Advisor in Malaysia. You can read my previous post on StashAway HERE.

OSS!