Hello Grasshoppa,

Recently I have met with both Wai Ken & Albert from StashAway. Prior meeting them, I remembered that their Facebook Sponsored Post constantly popped up on my Facebook that I finally decided to check them out. Looking at their name StashAway, it doesnt sound like any investment platform or company but the fact is, they are the First SC-Licensed Robo-Advisor Company in Malaysia.

What is Robo-Advisor?

It is a Financial Investment Platform that operates based on mathematical rules & algorithms. Their financial planning are customized to suit your investment needs based on the data you provide to them via list of questionnaire & survey.

Why I Sold My Mutual Fund for Robo-Advisor & Why is Robo-Advisor For You?

1. Cheaper Fee

It is a cheaper option. In another words, if you need a Financial Advisor & it’s too expensive to pay them, you can have your own Robo-advisor to do the same job for a cheaper price. It is 0% Load Fee & Low Annual Fee.

“The mutual fund industry has been built, in a sense, on witchcraft.” – John Bogle

2. Customized Investment To Suit Your Financial Goal

Depending on the risk that you are willing to take for your investments, they will be asking list of questions & survey to understand your Financial Goal & Needs. Those data will be used to process a customized investment plan to suit your Financial Goal.

3. No Emotions Just Data

Part of the reason why some investment fail is due to human emotions & gut feeling. In fact, Robo-Advisor might be better especially with no emotions & gut feeling involved in investing.

“I’m not emotional about investments. Investing is something where you have to be purely rational and not let emotion affect your decision making – just the fact.” – Bill Ackman

4. Diversification

Since most Robo-Advisor portfolio is based on Index Fund or ETF, you are able to diversify into different selection of stock asset class or bonds.

5. You Dont Have To Be A Pro To Invest

Yes. You dont have to be the pro in investing. All you have to do is to sit back & relax & your Robot aka Robo-Advisor will handle your investment.

What Happened After My Meeting with StashAway?

I immediately sold my Mutual Fund via FundSupermart & waited almost 1 week to get my fund. To be honest, I was pretty excited because I’ve been searching for a Robo-Advisor & Index Fund Company for a really long time. I was looking for an Investment Company that are able to offer Low or Zero Load Fee & Low Management Fee. It is really expensive to invest in Mutual Fund in Malaysia but I wanted to Diversify my Investment in other country portfolio since my stocks are 100% Malaysian Stocks.

How Simple To Register with StashAway?

It took me around 10-15 minutes to get my registration done. Below are the information needed by them to setup my portfolio.

Question 1 : They will ask some personal question such your age, gender, age, annual income & etc.

Question 2 : Invest for a Life Goal or General Investing

Question 3 : What is Your Goal?

Question 4 : Retirement Goal such as Expected Retirement Age, Monthly Income after Retirement & etc.

Question 5 : First Time Deposit Amount & Monthly Commitment

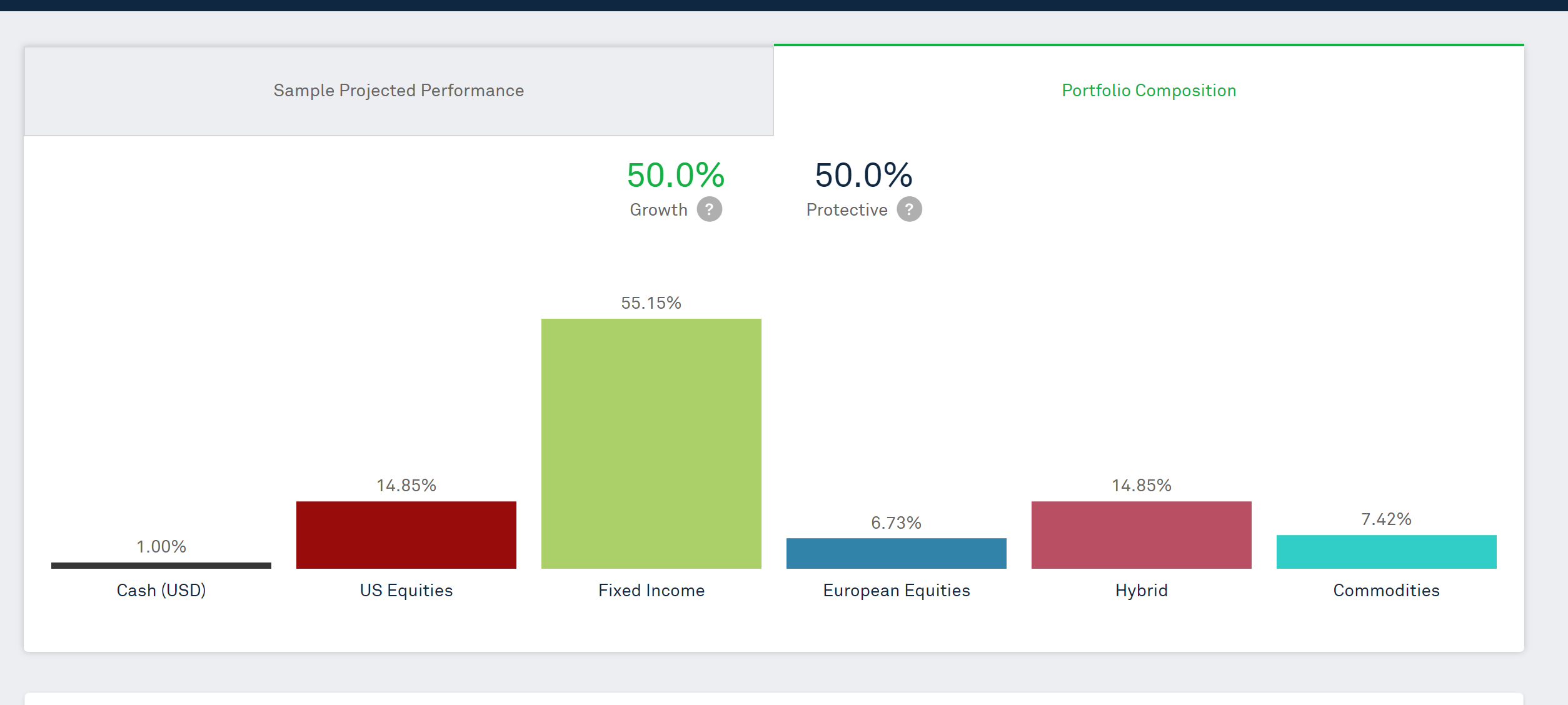

Once all this is done, they will show you your Portfolio Projection & Your Portfolio Composition. Below is how my Portfolio Composition looks like :

Of course you are still able to adjust your Portfolio Risk Preference if you think that their Proposed Portfolio Risk is too risky or low risk. After the registration done, they will reach you via WhatsApp or Email for your IC details. Usually it will take 24 hours for them to get back to you after you provide your IC for verification. Once verification done, you are able to deposit your fund to them. This might be their disadvantage as for now since the transfer is pretty manual at this point. Hopefully they are able to solve this in the very near future. The good thing is, after my transfer is done, it took them less than 24 hours to respond that they have received my fund.

Conclusion :

If you read my previous post on What Your Mutual Fund Agent Did Not Tell You About Using EPF To Invest In Mutual Fund, its quite obvious that I’m strongly support low investment management fee fund. With Low Management Fee, investors are able to enjoy higher return in their investment. To make this clear, this is not a SPONSORED POST since Im not paid to write this article but I strongly recommend StashAway to all of you. If you are interested to try this out, you can use my PROMO CODE to try it out. Best part of all, you can start to invest with as LOW as RM10. Do try it out & do share with me your experience Investing with StashAway.

OSS!

I understand that there is withholding tax of 25% as the investment is towards US indexes. there is also element of FX losses. What’s your view on the returns taking into consideration the elements mentioned?

Hi Mln. I have checked with StashAway on your concern. Below is their reply : To clarify, all dividends of US-listed securities are subject to 30% dividend withholding tax

(WHT). These taxes are applicable as long as you own US listed assets, regardless whether the

assets were bought through StashAway, or via your own broker. The WHT is held at source and

the rest of the dividends are redistributed back to your portfolio(s) and reinvested automatically.

Under the QII (Qualified Interest Income) rule, some of the dividend WHT from US domiciled

funds (e.g. US government bonds) can be claimed back. Our broker will do this on your behalf

and there is no involvement on the customer’s part. We will do this once a year, and will notify

you via email if you have any claimable WHT, which would be redistributed to your portfolio and

automatically reinvested. We recently reimbursed clients of our Singapore app (which has been

live for more than a year) their WHT refund for the year 2017. This will be done for our

Malaysian clients as well.

For further illustration, you may like to view the Dec 2017 iShares report on QII ETFs

(link:https://www.ishares.com/us/literature/tax-information/qualified-interest-income-qii-percentages-2017.pdf). Some examples of QII ETFs that StashAway invests in are 20+ Year Treasury

Bond (TLT) and 10-20 Year Treasury Bond (TLH).

Our investment team has given serious consideration to the 30% WHT and have considered

other exchanges that have lower or no withholding tax. However, at the end of the day, we have

decided to stay with US-listed securities despite the tax implications due to the its deep liquidity,

reputable fund management and most importantly, the lower tracking error. If you’d interested to

see a comparison between US-listed securities and foreign securities,

here(link:https://www.stashaway.sg/r/etf-taxes-returns-and-tracking-errors) is an article that

presents its case.