Private Retirement Scheme (PRS) was introduced in 2012. Its a voluntary long-term savings & investment scheme that designed to help to you save extra for your retirement. The administration behind PRS is Private Pension Administrator (PPA).

Why is PRS important to you? It helps you to save more to prepare you for your retirement. You must be thinking you have EPF for your retirement so its ok right? Then you should continue to read this Grasshoppa.

According to EPF, 68% of Malaysian EPF member at age 54 & below have less than RM50,000. EPF also mentioned that 50% of them finished their savings within 5 years of their retirement. Sounds scary?

What is the Pros & Cons of PRS?

Pros

- Youth Incentive – For Malaysian between age 20-30, you are entitled for RM1000 incentive if you contribute RM1000 within a 2 year period. (2017-2018)

- You Are In Control – You get to choose which PRS provider & types of fund to invest.

- Affordability – You get to invest as low as RM50 to any amount that suit your investment budget & best part of all, you can invest anytime you want.

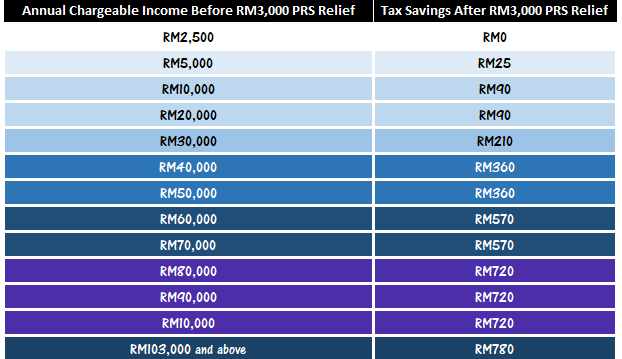

- Tax Relief – You will have Tax Relief up to RM3000 a year.

Cons

- No Early Withdrawal – Similar to EPF, you can only withdraw when you are 55 years old. Or if you need it for emergency, there will be 8% tax penalty.

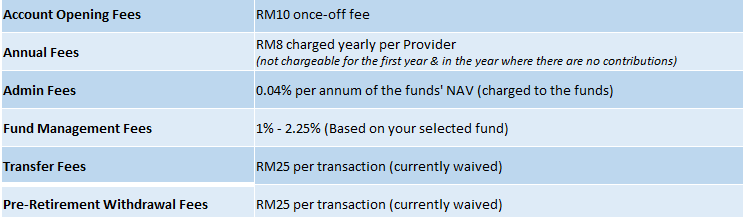

- Management Fees – Yes they have management fees. You can refer below for some of their fees.

List of PRS Provider :

- Affin Hwang Asset Management Berhad

- AIA Pension and Asset Management Sdn. Bhd.

- AmFunds Management Berhad

- CIMB-Principal Asset Management Berhad

- Kenanga Investors Berhad

- Manulife Asset Management Services Berhad

- Public Mutual Berhad

- RHB Asset Management Sdn. Bhd.

Or you can go to Fundsupermart website where they have list of all PRS Provider except Public Mutual for comparison.

Whats next?

First you have to setup your PPA Account by filling up the application form from any of your PRS Provider or from PPA website. Select your Fund & you are good to go.

OSS!