Hello Grasshoppa,

As per headline, you hear it loud & clear “Stop Investing Now. The Market is Bad”. With all our so called “experts” creeping our ears with such info, do you think now is a bad time to invest? Looking at the current market situation, with the global situation of Trade Wars happening between China & USA, and also Malaysia economic situation where our current government claims that they have insufficient funds due to past government issue. Do you feel that you should spend less & keep all your money in form of cash instead of investing it?

Generally in situation like this, many investors will actually switch their investment to forms of gold or cash. Of course this is one of the main options where investors will choose. There are also many other options that other investors will choose where they will invest in reverse ETF or short sell their investment.

Before we go further, let’s rewind back to some good times in the past. What will those “expert” tell you? Don’t invest now because market is too good? It is too expensive to invest now? Stock market is hitting their highest point & it will fall very soon?

What is my view & what will I do during bad market situation?

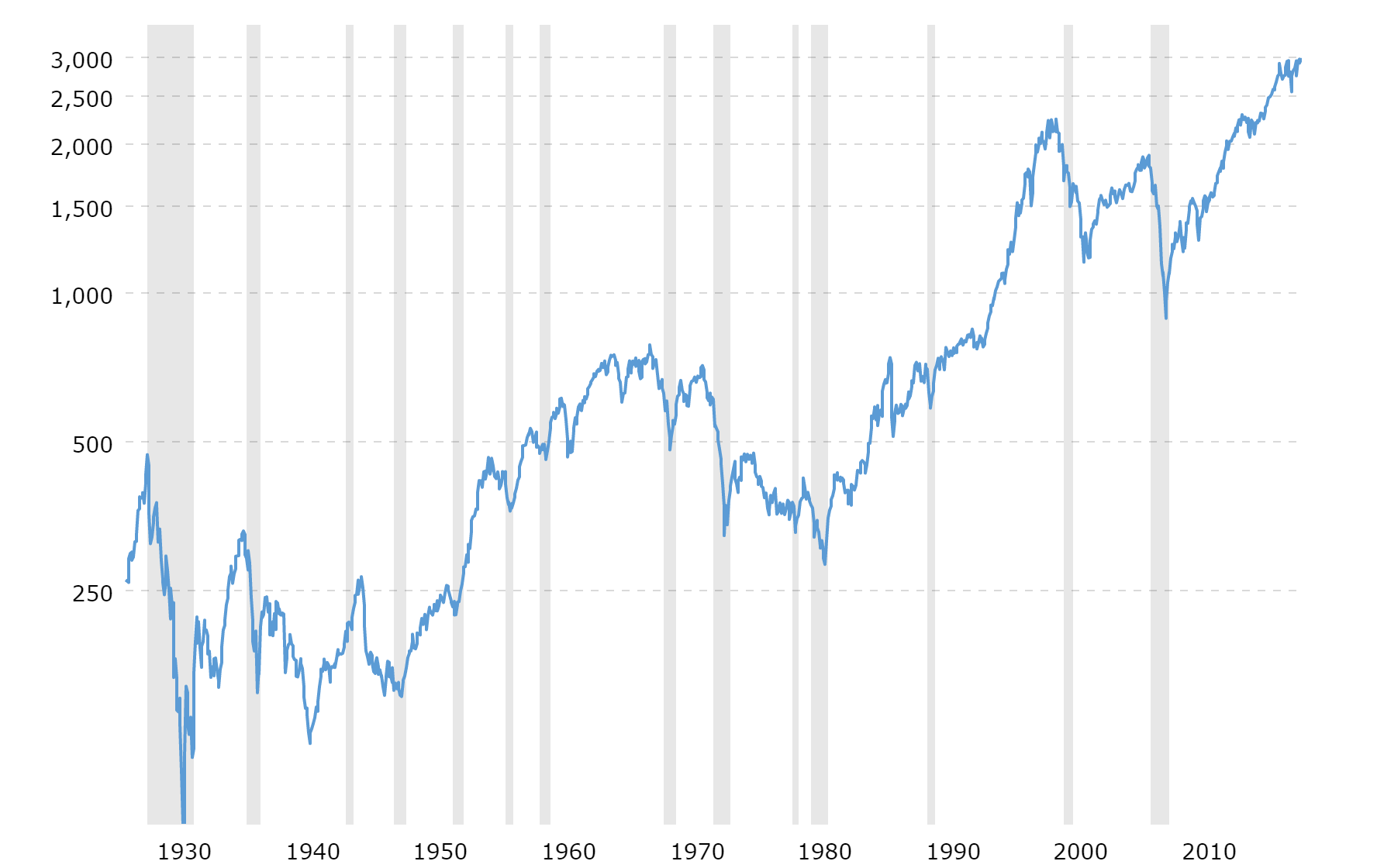

Looking at the 90 years trend of S&P500, long term trend has been heading upwards despite multiple crashes & economic situations. There will be bad times for sure but do you think you are able to predict the future? I personally can’t, that’s why I would rather stay invested no matter how the market will be. Some will agree & some will disagree with my view.

Part of my consideration during period like this is on my asset allocation. Where will I allocate or invest my money to? Switching my asset allocation may happen but as for now, I am hunting for cheap stocks that I’ve been buying for awhile. Time to time, I may find some stocks to be at a really good price & below their Price-to-Book Ratio.

In the past economic situation, I’ve known some people that got burned pretty badly especially during 1997 situation although I didn’t invest or had any knowledge back then. Does that mean that no one actually got burned during good economic situation as well? The answer is, I’ve know many people that got burned badly especially from investment scams. You may find my point to be contradicting but my point is, we should know what are we investing in & be equip with knowledge to put us through any type of economic situation.

History has also shown that investor like Sir John Templeton & Warren Buffett have made money during bad market situation. Stories like Sir John bought 100 stocks of each NYSE listed companies & selling it when the market bounces back made him a fortune. Warren Buffett has also made his fortune from bad times & most recently from exercising his warrants in Bank of America which made him almost $12 Billion.

Conclusion :

I have mentioned this multiple times that investment should be long term but that does not mean that you are able to be profitable from your investment. Aside from looking at long term investment, it is important to know what are you investing in. Since I am looking at long term investment, the stocks or investment that I am investing in are those companies that have long term sustainability. You don’t have to wait until the market is picking up because nobody will know when will it really happen.

You can also refer my previous posts on :

7 Things You Can Do To Survive A Falling Market

11 Useful Guide To Select The Best Stocks

OSS!