Recently, my cousin introduced us to an insurance package she bought for my uncle for his old age as he has no savings or insurance in his 60s. Despite him being in his 60s, he is still working a day job with no retirement plans as retirement means he will not be having any income anymore due to his lack of savings. When we reach a certain age, going to the hospital will be inevitable as we will be facing some health conditions whether it is minor or major. For those who can’t afford to pay for their hospital bills & have no insurance, going to the general hospital is the only option for them.

There is nothing wrong to be admitted to general hospitals but if you have been to both general & private hospitals, you will understand that the conditions between both hospitals are totally different. Having life insurance is also important as it will help your family members go through any hardship when you die. When my cousin introduced the SSPN Plus package to me, I have to admit that it can be really inconvenient for me to understand it as it is 100% in Bahasa Malaysia but thankfully, my background in Malay school has helped me a lot with it.

What Is SSPN Plus?

It is a strategic collaboration between PTPTN & 3 different Takaful (Islamic insurance) providers (Hong Leong, Great Eastern & Takaful Ikhlas) to provide Takaful coverage for Malaysians. Aside from Takaful protection, SSPN Plus provides saving schemes for SSPN depositors which are meant for parents to save for their children’s future education.

What Are Their Key Benefits?

1. Annual DividendFor the past 5 years, their annual dividend ranged from 3-4%. It is higher than the current fixed deposit rates in Malaysia (as of my writing) but it is lower compared to EPF annual dividend rates for the past 5 years (5-6%).

2. No Health Check NeededYou can apply for it online without going through any health check.

3. Hospital AllowanceDepending on the Takaful package & providers, the allowance can be as low as RM20 to a maximum of RM250 per day.

4. Tax ExemptionThe tax exemption is valid until 2024 where depositors can enjoy up to RM8,000 under the SSPN scheme exemption & RM7,000 under Life Insurance & KWSP exemption.

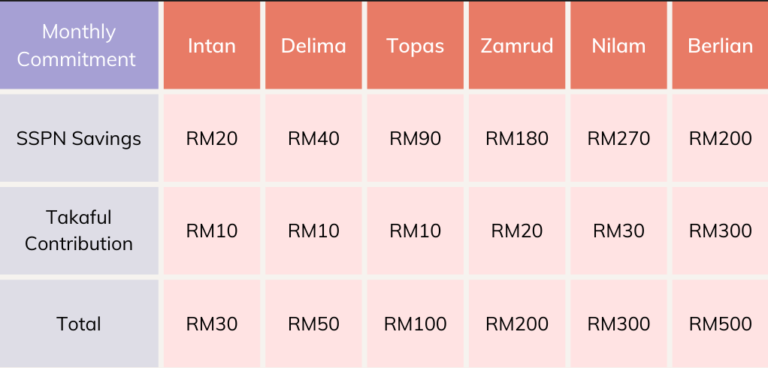

5. Affordable Plans

The plans are as low as RM30 & the highest is RM500 per month depending on your budget.

6. Saving For Children As Young 1 Days Old

Receivers are able to enjoy the benefits as young as 1 day old up to 29 years old.

7. Government Guaranteed Savings Since this is under the Ministry of Higher Education, it is also a guaranteed savings by the government of Malaysia.

8. Death BenefitsDeath benefits range as low as RM30,000 up to RM1,200,000 depending on the package & cause of death.

9. Takaful CoverageThe coverage includes critical illness coverage for 36 illnesses which range between RM12,000 to RM120,000.

10. Shariah ComplianceSince this is under Shariah Compliance, the Takaful & saving scheme is fully governed by the requirements of Shariah law & the principles of Islam.

Conclusion:

When my cousin introduced this to me, I personally did not see any benefits to myself at this point as I do not have any children at this point. Perhaps in the future when I start to have children, SSPN savings is definitely one of my considerations for my children’s future education savings. Aside from using it as savings, the Takaful package is an affordable package that you can consider for your loved ones since it is affordable & applicable to all Malaysians below age 65 & they can enjoy the Takaful coverage up to age 70 (depending on Takaful providers).

If you are interested to know more, you can also read their FAQ here.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?