Hello Grasshoppa,

We always hear people talking about how bad Goods & Service Tax (GST) is but how much do we actually know about GST? According to former Deputy Finance Minister Datuk Haji Ahmad Maslan, the price of goods will drop due to GST. Is it true? Enjoy his video as below :

https://www.youtube.com/watch?v=_IT_jeem4sU

The question is, did the price of goods actually dropped during GST implementation? Recently during GE14, most Malaysian have voted for Pakatan Harapan as the New Government of Malaysia. With the New Government in, former & current Prime Minister of Malaysia Tun Dr Mahathir Mohamad have reduced GST from 6% to 0% & will be reintroducing Sales & Service Tax (SST) effective 1st September 2018.

Today, we will be hosting a SST vs GST Battle to explore which is better for Malaysian. Are you ready Grasshoppa? Let the Battle begin!

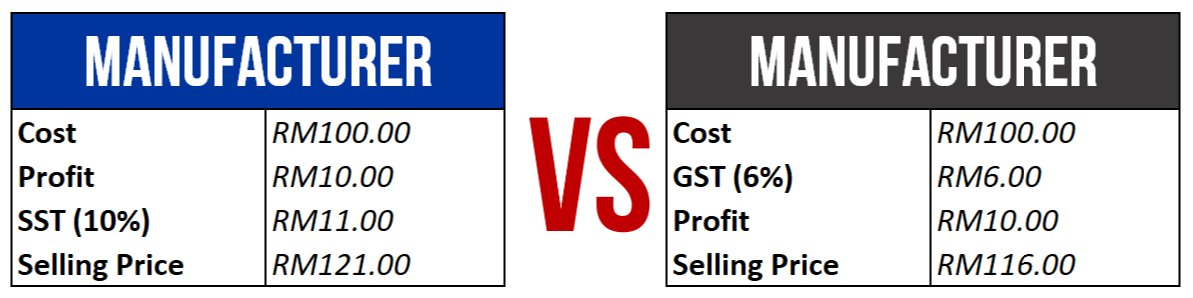

Lets look at the cycle from Manufacturer-Wholesaler-Retailer-Consumer to have the overall picture on which is better for Malaysian.

Blue Corner : SST

Black Corner : GST

Round 1 :

For SST, Manufacturer will be charged only after profit is added while GST will be charged before profit. Looking at the above calculation, tax for SST will be higher due to tax after profit. GST won this round with lower tax compare to SST.

Round 1 Winner : GST

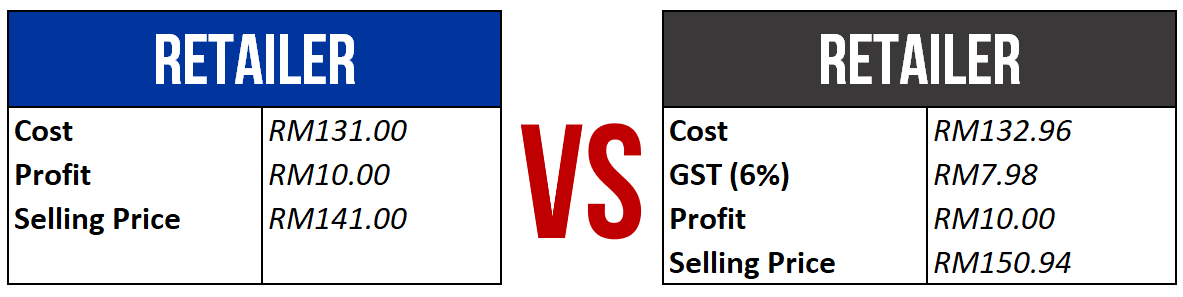

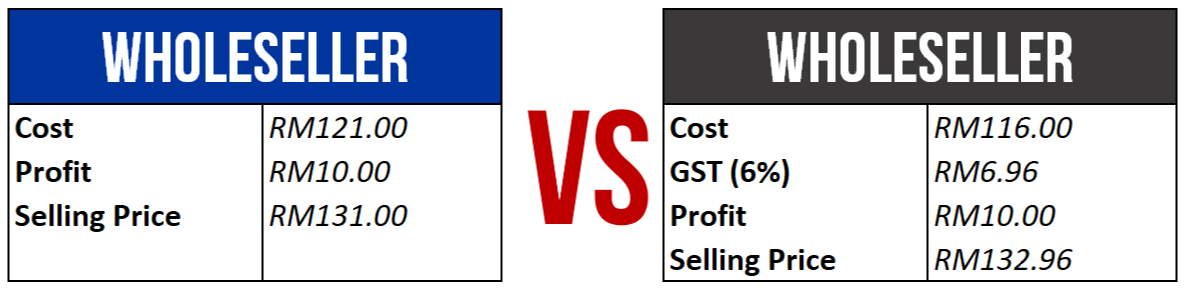

Round 2 :

From Manufacturer, they will be selling their goods to Wholesaler. For SST, there will not be any additional tax for SST from Wholesaler onward. As for GST, there will be additional 6% tax.

From Manufacturer, they will be selling their goods to Wholesaler. For SST, there will not be any additional tax for SST from Wholesaler onward. As for GST, there will be additional 6% tax.

Round 2 Winner : SST

Round 3 :

Similar to Round 2, there wont be any SST for Retailer but for GST, there will be additional 6%. Winner for this Round will be SST.

Round 3 Winner : SST

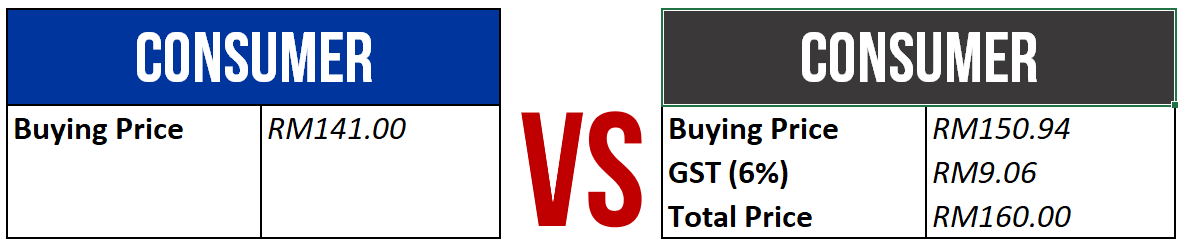

Round 4 :

Now, this is the critical & final round to determine the winner of SST vs GST. As a consumer, each time when we go to KFC or Starbucks, you will notice there is GST charges on top of your purchase price. Looking at the final price for the goods with SST & GST, it is obvious that goods with SST is cheaper compare to GST.

Round 4 Winner : SST

How Much Tax for SST vs GST

Let the drumroll begin!!!!!!! And the Total Amount of Tax for SST vs GST is……..

And yes Ahmad you are half right, the price of goods did dropped at Manufacturer Level. But as we move up the cycle, price for goods with GST did increase at each level.

Looking at the above comparison, it is obvious that SST is better for Malaysian compare to GST. Perhaps Malaysian are not ready for such duty at this moment & the vote of Malaysian proved that each of us disagree with the implementation of GST. But this is the question we should ask ourselves, is SST collection is enough for the development of our country?

Bonus :

There are many Unsung Heroes that influence our daily life with their talent & effort. One of the Unsung Heroes is Zunar. With Pen & Paper, he have entertained us & spread awareness with his drawing. You can refer some of his drawing at this link. A simple support in form of Donation or Purchase of his Product will help him to spread more awareness with his creativity. His sample drawing as below :

Source : Zunar

OSS!