Hello Grasshoppa,

As you all may heard before of how I struggled financially that I had to sell off my first house to pay my debt. After I cleared off my debt, I decided to buy another house. I just collected the key right after Christmas & I have came out with a 10 year plan to pay my housing loan. The initial loan that I took for this house is 35 years with flexi payment which means that I am able to pay monthly installment & pay the principal amount whenever I have extra cash.

The monthly installment that I have to pay upon completion is RM1400 x 35 years. Based on my calculation, if I am able to pay RM2000 a month, I am able to pay it off within 16 years. That’s 19 years ahead. To cut short additional 9 years to pay off my loan, I am also committed to paying extra money on quarterly basis based on my other side income. It seems hard but it is possible as long as I have discipline to do it.

To also speed up my housing loan payment, I have also discovered that I am able to pay off my housing loan by using EPF. FYI, I have used my EPF account 2 withdrawal twice to pay for my first & second house deposit & I thought that I am not able to withdraw anymore but with the discovery of KWSP Housing Loan Monthly Installment, I am able to utilize my EPF account 2 to pay off my monthly installment & pay extra RM2000 from my existing allocation. That’s around RM3400 per month. This amount will be used to cover my housing loan, utilities & other extra expenses.

How Does KWSP Housing Loan Monthly Installment Work?

They have 2 withdrawal methods. First is direct payment to your housing loan principal amount & second is monthly payment to your housing loan bank account. Example if you have RM30,000 in your EPF account 2 & your monthly installment is RM1500, you may opt to pay RM30,000 directly to your housing loan principal or you may split it to 20 month based on your monthly installment amount. You may reapply once your account have more money (RM600 min) for first method or once your 20 months repayment is over.

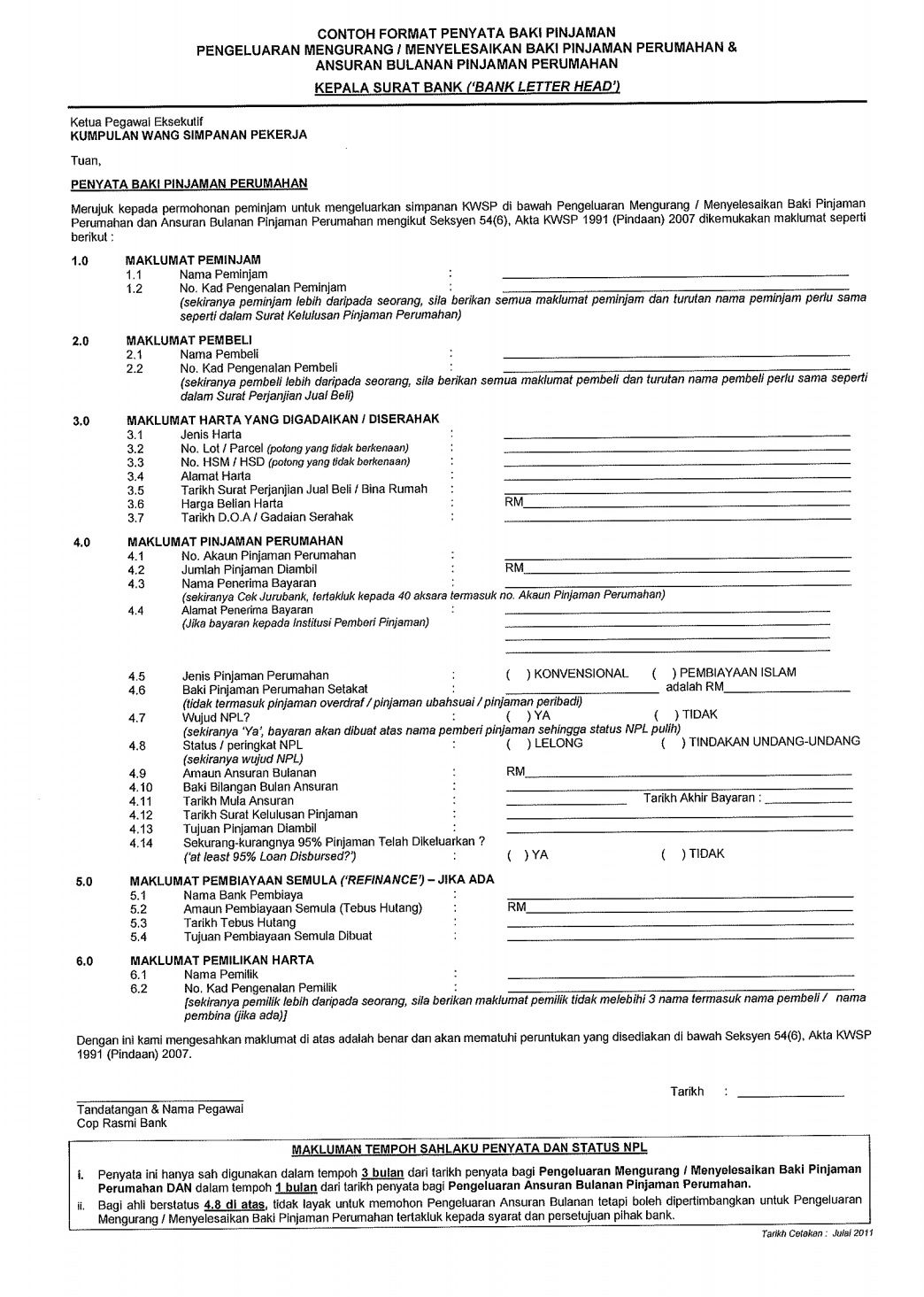

I have spoken to the staff at EPF office & she mentioned that it is best to manually apply it for first time application to ensure all documents are complete. To be honest, they are pretty efficient & friendly. For renewal, you may do it via online. For first time applicant, you need to go to your housing loan bank to get them to fill up the form based on EPF requirement format. You can refer the sample as below :

Or you may download via this link : EPF Housing Loan Withdrawal Sample

Or you may download via this link : EPF Housing Loan Withdrawal Sample

Please take note that EPF withdrawal only applies for your first 2 houses & you can only use it for 1 house at a time. This withdrawal is only valid once your house is fully completed & when you are paying the full monthly installment. It is not valid when your house is incomplete & while you are serving the housing loan interest.

You may also read their other requirement as below :

Source : EPF

Conclusion :

Purchasing a home & paying for your housing loan may be a struggle to many people as housing price is getting more expensive. If you are looking to purchase you own property for investment or to live in, the best tip is to be patient as there are plenty of property around the market. Buy the property within your means & if you are able to pay it off faster than your loan tenure, it will be better as you are able to save more on your interest. To understand more on EPF Housing Loan Monthly Installment, you can click on this LINK.

OSS!