Hello Grasshoppa

When we got our first job or when we got pay raise, we think its time to buy or to upgrade a brand new car. Have you ever thought of the cost to actually own a car & how much we really need to pay just to maintain it? I bet some of you dont because I used to be like that when I started to buy my first car. LOL. Dream of buying the latest 2017 Honda Civic with your salary? Below is the estimated cost on how much does it cost to own it.

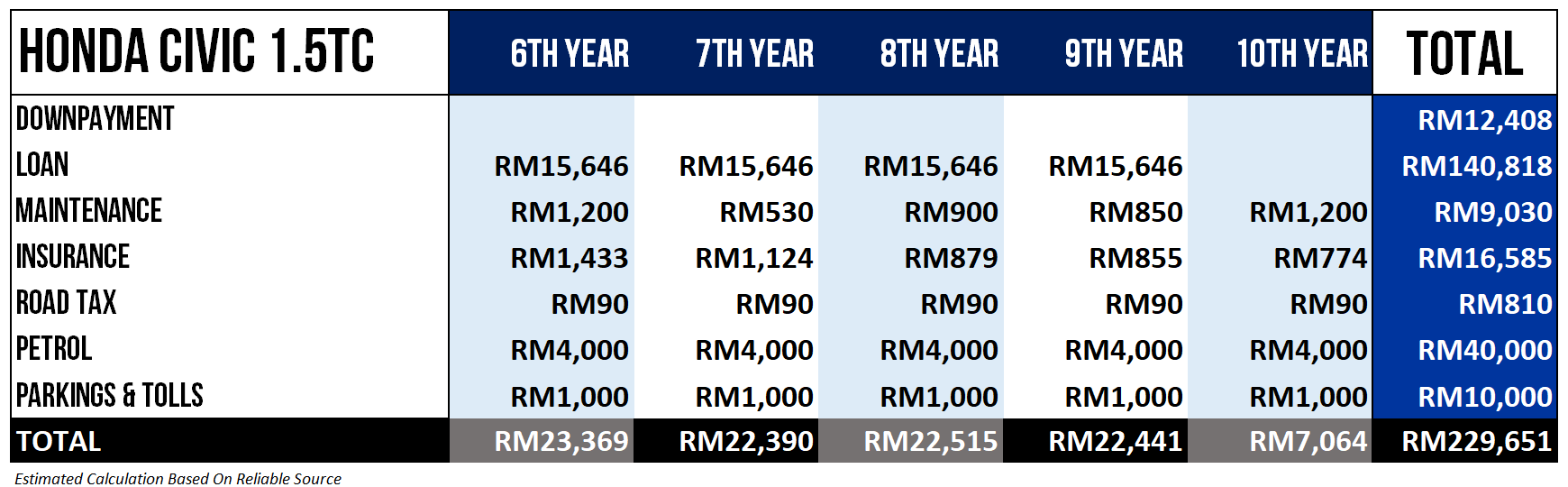

Usually when we plan to purchase our brand new car, we will only look at the down payment & the monthly fee. We tend to forget that there will be more cost that will be included throughout the whole year. Total estimated cost to own a brand new Honda Civic is RM229,651 for 10 years. That is RM22,965 a year. You can use that money to deposit for a second hand house or go for a luxury holiday. The reason why I use Honda Civic as an example is because its the hottest car in Malaysia & many people would love to own it.

Yes, sometimes some people assume that car actually represents their wealth. Think about it, do you prefer to have more cash with affordable car or having a better car with lesser cash? Lets explore further.

First Year :

- Down Payment – This is where people will take their savings or bonus to pay for car down payment. For certain car model, they are able to mark up the price to minimize the down payment.

- Car Loan – Maybe in your first you will feel OK about paying for your loan but during the second year, you might regret on buying a car unless you are a true car lover.

- Maintenance – When you buy your brand new car, whats the first thing you will do? Tinted? Yes that will be one of the most expensive cost for your first year. Lets not forget the first 12 month maintenance.

- Insurance – Paying RM3,185 for the first year? Painful.

- Road Tax – First Year Road Tax is included with your car purchase. 2nd Year onward is RM90 a year for 1.5 liter engine.

- Petrol – Based on average petrol price

- Parking & Tolls – We cant escape from paying for parking in the mall or office building. For our KL folks, your daily tolls & jam must be taking a toll on you 🙂

Sixth Year Onward :

- Car Loan – Still paying after 6th year. There might be an increase in your salary but spending a chunk of money on a car seems to be not worth it.

- Maintenance – Usually this is where the maintenance is getting more expensive after the warranty period is over & parts are getting old.

- Insurance – Insurance getting lower due to car value is dropping.

Tenth Year :

- Car Loan – This is where we celebrate when we finally stop paying for our car loan.

- Maintenance – Usually on the 10th year, you maintenance will be as high as a brand new car. Perhaps, its time to buy a new car.

- Insurance – Based on your car value by then, the amount will drop significantly compare to your 1st year.

Conclusion :

Its good to have proper planning before you own a car. Take into consideration of the other expenses aside from the loan & maintenance. Here is a formula that I recommend before you consider to purchase a car.

Cost To Own A Car Per Month : (12 Month Loan + Estimated Yearly Maintenance + Estimated Yearly Insurance + Estimated Yearly Fuel + Estimated Toll & Parking) / 12 Month

My recommendation is you use Your Monthly Salary / Cost To Own A Car Per Month to see if you can really afford to own your dream car. If the Cost is at 1/5 or 1/6 of your salary, then it might not take a pinch on you. Or… you can choose to drive your old car. Taking public transport such as Grab or LRT might help you to save money too.

Owning a car is not cheap. In fact Malaysia is 2nd Most Expensive Countries to Own a Car behind Singapore. Yes, we are the 2nd Most Expensive Countries to Own a Car. Dont spend your hard earn money on car you cant afford. Save your money to invest in your second house or other investment. Dont burn your money on a liability.

OSS!