Hello Grasshoppa, Do you prefer to have professionals manage your investment, or do you prefer to manage your own investment? I used to think that investment is tough to understand & it is a common misconception among many people. Sometimes when I asked my friends to invest, their answer is always that they don’t know […]

My 2021 Preferred E-Wallet

Hello Grasshoppa, In 2019, I have written a post on Which Is The Best E-Wallet in Malaysia based on my opinion. In my list, I added Fave as my number 1 option followed by GrabPay & Boost. Since the pandemic situation & other factors, I noticed that my e-wallet usage trend has also changed. I used […]

Investment Portfolio Suggestions That You Can Build Within Your Budget

Hello Grasshoppa, There is a common question that many of my readers, family & friends have asked me on the suggested investment portfolio that I will recommend for them. My recommendation is always based on the investment that I personally invest in or believe in. Over the years, one of my highly recommended investment platforms […]

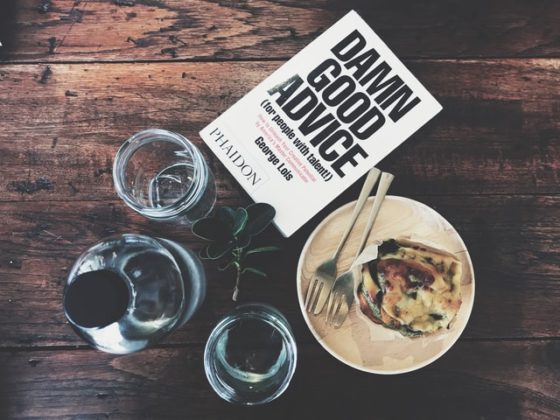

The Best & Worst Investment Advice That I Have Ever Received

Hello Grasshoppa, Since I was young, I have gotten a lot of investment advice from many people. Some of them have changed my view on investments in a good way while some of them have brought a negative light towards my investment journey. Advice and opinion is always free but varies as some of them […]

Improving My Personal Finance Skill Over Time

Hello Grasshoppa, Our personal finance journey starts from the moment you receive your first allowance from your parents or family. We learn to manage our money differently & our parents play an important role in educating us to manage our finances. No doubt, some of us are taught well by our parents, however, some may […]

#BBMGetInspired With Roshan Kanesan – Radio Broadcaster and Personal Finance Nerd

Hello Grasshoppa, It was my pleasure to be featured in the first episode of Ringgit & Sense for 2021 where we discussed money goal setting for 2021. I’ve been listening to Ringgit & Sense for the longest time and it was a pleasure being able to finally speak with Roshan. After the interview, I’ve actually […]

My 2020 StashAway Review

Hello Grasshoppa, 2020 was a rough year for most of us & 2021 seems to be a better year with the vaccine distribution. Soon enough, most of us will be vaccinated & our hope of living the old normal will be back in no time. My overall investment for 2020 was in the red especially […]

What Makes You Rich & What Makes You Poor?

Hello Grasshoppa, Many people have a different way of defining wealth in life. Most of them link it to having a lot of money & but some may define it by having a Financial Independence Retire Early (FIRE) life. Some of them even link it to being rich with knowledge & skills. No matter how […]

2021 Personal Finance & Investment View From My BJJ Friends

Hello Grasshoppa, My Saturday is always BJJ training & spending time with my BJJ family. It is a bit unusual for me this time around as my coach has just left back to his home country to take over his father business & I am taking up the role as a BJJ coach alongside with […]

My BFM Interview Experience

Hello Grasshoppa, Recently I participated in Ringgit & Sense Podcast interview alongside Kevin Neoh (Licensed Financial Planner) from VKA Wealth & Roshan Kanesan, the host of BFM Ringgit & Sense. Being part of Ringgit & Sense definitely feels like a dream to me as I’ve been listening to their podcast over the years. One thing […]