Hello Grasshoppa,

Effective 1st September 2018, we have witnessed many complains about SST Implementation & it seems that there are some Malaysians that are unhappy due to SST. Some even mentioned that there are no differences between GST & SST. Is that true?

When we look deeper into SST, it splits into 2 Types of Tax :

1. Sales Tax

2. Service Tax.

How are we subjected to both taxes? Lets explore further :

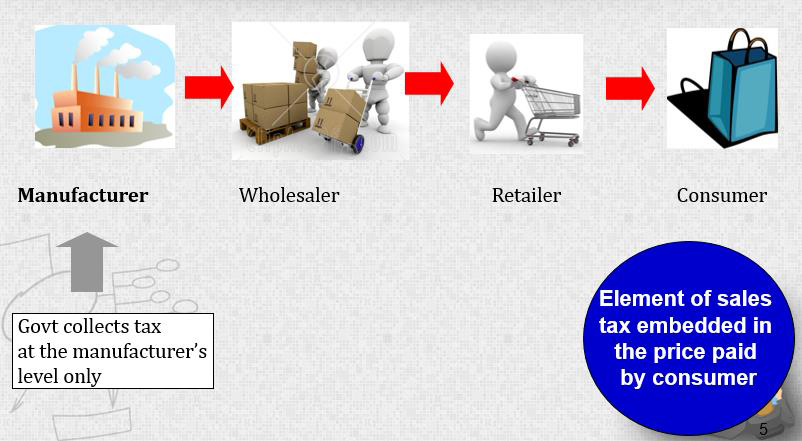

1. Sales Tax

Sales Tax are charged based on taxable goods manufactured in Malaysia & taxable goods imported into Malaysia. The difference between GST & SST is that GST will be charged at each layer from manufacturer to wholesaler to retailer to consumer. SST will be a single layer Tax where the Government only collect Tax from Manufacturer.

Source : MYSST

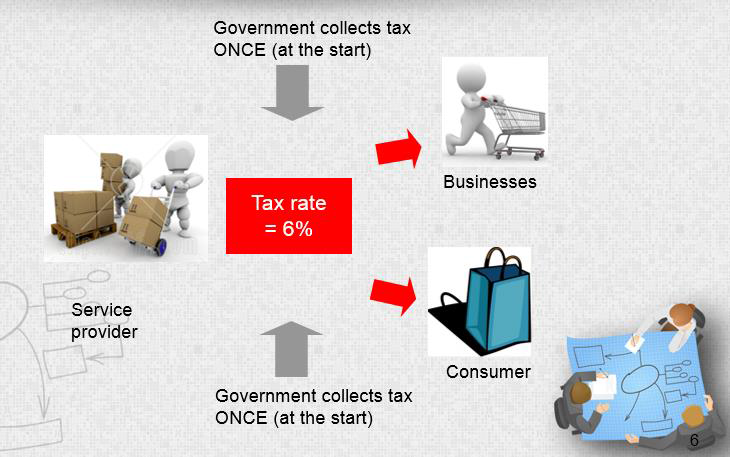

2. Service Tax

There will not be any differences for Service Tax amount compared to the old GST since the percentage is the same. Government will collect Service Tax at 6% for services as below :

Source : MYSST

Source : MYSST

Source : MYSST

List of Goods that are subjected to SST can be obtain here.

You can also download their latest updated SST guide here.

Before we move to conclusion, lets hear some awesome “Pantun” by my favorite “Pembangkang”, Ahmad Maslan.

Conclusion :

Perhaps the message was not conveyed clearly by the Government or it might have been misunderstood by some of us. Some Malaysians seems to be angry at current Pakatan Harapan Government due to SST & some of them are defending the Government. Whatever it is, lets hope for the best & lets hope that the new Government are able to develop our beloved country better for the future generation.

OSS!