Hello Grasshoppa, We’ve all seen it—the flash of luxury or second-hand luxury cars, expensive designer clothes, & exotic vacations that flood our social media feeds. Showing off has become almost a norm in today’s culture, but what many don’t realize is that this behavior can silently drain their wealth. We all have friends like that […]

The Importance of Emergency Funds in Personal Finance

Hello Grasshoppa, An emergency fund is a crucial component of any solid financial plan. It serves as a safety net, providing you with the financial cushion needed to handle unexpected expenses like medical bills, car repairs, or sudden loss of income. Without an emergency fund, you might be forced to rely on credit cards or […]

Understanding Tax Reliefs & How to Utilize Them in Malaysia

Hello Grasshoppa, We are months away from approaching 2025 & it is time for us to utilize our tax relief benefits. Tax reliefs are a great way for Malaysians to reduce their taxable income legally, thus paying less in taxes. However, many aren’t fully aware of the available reliefs & how to maximize them. Let’s break […]

The Rise of Financial Minimalism: Simplifying Your Path to Wealth

Hello Grasshoppa, In the hustle & bustle of modern life, the concept of minimalism has become increasingly popular. But minimalism isn’t just about decluttering your home or wardrobe like Marie Kondo but it can also be applied to your finances. Financial minimalism is a growing trend that focuses on simplifying your financial life to reduce […]

Maximizing Rewards: How to Choose the Right Credit Card for Your Spending Habits

Hello Grasshoppa, Choosing the right credit card can be a game-changer when it comes to maximizing your rewards, whether it’s for cashback, travel points, or other perks. With so many options out there, it’s crucial to find a card that aligns with your spending habits. Over the years, I’ve experimented with different cards, & I’ve […]

How to Leverage Government Incentives for Personal Finance Growth in Malaysia

Hello Grasshoppa, In Malaysia, the government offers various incentives & schemes to help citizens improve their financial well-being. From tax reliefs to homeownership programs, these incentives can play a crucial role in enhancing your personal finance strategy. This week, let’s explore how you can leverage these government incentives to grow your financial health. 1. Tax […]

Navigating the Rise of Digital Banks in Malaysia: What You Need to Know

Hello Grasshoppa, The financial landscape in Malaysia is undergoing a significant transformation with the rise of digital banks. These fintech innovations promise convenience, lower fees, & improved customer experiences. This week, let’s explore the benefits & potential challenges of digital banks, & how you can make the most of this new wave of banking technology. […]

The Impact of AI on Personal Finance: How Malaysians Can Benefit

Hello Grasshoppa, Artificial Intelligence (AI) is transforming various sectors, & personal finance is no exception. From automated financial advice to smart investment strategies, AI is reshaping how we manage money. This week, let’s explore the impact of AI on personal finance & how Malaysians can leverage these advancements to enhance their financial well-being. 1. AI-Powered Financial […]

Navigating Malaysia’s Latest Personal Finance Trends: What You Need to Know

Hello Grasshoppa, In the ever-evolving landscape of personal finance, staying updated with the latest trends is crucial for making informed decisions. Malaysia has seen significant shifts in personal finance trends recently, driven by technological advancements, regulatory changes, & evolving consumer behaviors. In my opinion, it’s essential to understand these trends & how they can impact […]

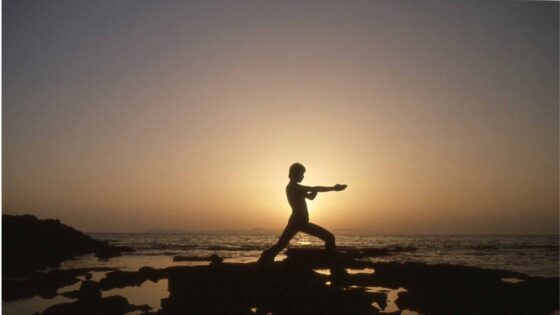

The Art of Discipline: How Martial Arts Principles Can Transform Your Financial Life

Hello Grasshoppa, Being a martial artist & a financial nerd, I understand the powerful synergy between martial arts & financial mastery. Both require discipline, strategy, & a relentless pursuit of excellence. In this post, we’ll explore how the core principles of martial arts can be applied to achieving financial success & building a prosperous future. […]