Recently, the Malaysian government has stated that Malaysians need to have at least RM240,000 in savings when they reach 55 years old. This will allow them to have RM1,000 for the next 20 years until age 75 based on the average Malaysian lifespan. Based on that article, Finance Minister Anwar Ibrahim has also stated that only 19% of EPF members had savings that enabled them to withdraw RM240,000 & another 81% do not have enough savings to retire. One of the solutions that was given by Deputy Finance Minister 1 Ahmad Maslan is to contribute voluntarily via EPF Self Contribution. Another solution is to work in companies that pay higher salaries.

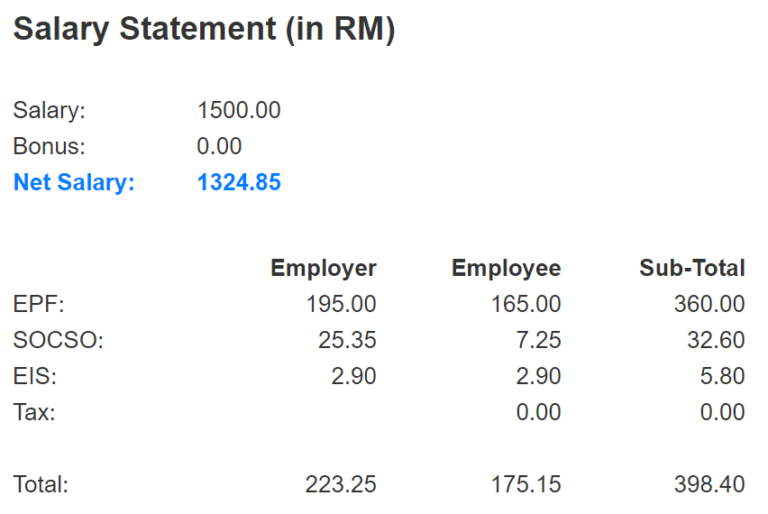

If we look back at the numbers that the government is aiming for which are RM240,000 or RM1,000 for 20 years, is it enough for Malaysians to survive with such an amount of money? Technically yes if for individuals that retire with no any debt such as loans, credit cards, house, or car. But is it really enough? Before we go further into RM240,000 for retirement, let’s backtrack on how can we achieve that amount if we take the average working age of 25 & retirement by 55 years old. Malaysians would have 30 years for them to accumulate RM240,000. Rough calculation without any compounding interest, Malaysians would need to save RM666.67 a month for 30 years for them to have RM240,000 in their EPF. Another factor to look into is the minimum wage which is effective 1st May 2022, our current minimum wage is RM1,500. If we look at the below, based on minimum wage, Malaysians will have an RM268.27 (RM666.67-RM398.40) gap. Your take-home pay is RM1,324.85 & it is almost impossible to save an additional RM268.27 monthly.

EPF self contribution is something that I do recommend for Malaysians especially if we look at the previous year’s dividend where we can earn 5-6% dividend income each year. It is way better than what Fixed Deposits can offer looking at both trends & the risk factor. With the power of compounding interest & the special conditions of EPF withdrawals (almost impossible to withdraw before 55 years old, especially for EPF account 1), you should be able to have more than RM240,000 if you have income that is more than RM2,600 each month for over 30 years. For those who have an income less than RM240,000, it is highly recommended that you look into EPF self-contribution.

The next question is, is RM240,000 or RM1,000 for 20 years truly enough for retirement? Perhaps with zero debts, it is for self-usage & with health insurance, it may be enough. The more money you have in your EPF, it will be more than enough for your retirement. This is an unpopular truth but a fact that many parents withdraw their EPF money to fund their kid’s education, wedding, car deposit, house, business & others. This is to help their kids & some parents have hope that their kids may take care of them when they are old by providing pocket money & other care. But can they really rely 100% on their kids? 2 things that parents can do almost immediately not only to plan for their retirement savings but also for their future is to ensure that they have a proper plan for their kids. This comes in the form of a child education fund which many insurance companies are offering & also kids’ financial education where you can train them on financial literacy from a young. This will help to ease the parent’s burden when the kids get older when they need funds for education or other expenses.

Investing in another platform other than EPF can also be a solution to build your retirement fund when you retire. You can consider investing based on your age & investing appetite to ensure that you are well-prepared for your retirement. If you find that investing in other investing platforms is a hassle, do consider EPF self-contribution as it consistently pays a 5-6% dividend yearly.

Now that you have funds prepared when you are 55 years old, what is the ideal plan in order to survive the yearly inflation for the next 20 years? You can consider partial withdrawal each year from EPF based on how much you plan to spend each year. Currently, EPF allows its members to earn yearly dividends up until the age of 100. If you prefer to withdraw 100% of your EPF savings, you can also consider putting all your savings into a Fixed Deposit where you can earn interest to beat the yearly inflation rate. When you are 55 years old, it is important to invest in the safest place where they can pay you interest or dividends at a very low risk.

OSS!