Hello Grasshoppa,

In 2022, Bank Negara Malaysia (BNM) unleashed five digital bank licenses like hungry tigers into the financial jungle. One of those tigers, GXBank, just roared to life last September, and let me tell you, it’s gonna change the game. I have recently seen the news on the launch & after seeing it multiple times on the Grab app, I have decided to try it as they are offering RM8 instant cashback for a minimum deposit of RM88. The good deal doesn’t stop there, you will also get another RM8 cashback when you link your DuitNow to GXBank. That is an instant ROI upon your deposit. Aside from that they are also offering 8x GrabRewards (valid until 15 February 2024), free GrabUnlimited & you get to earn 3.00% interest per annum. It is a good deal to grab during their campaign period.

Why Digital Bank like GXBank is the future?

1. Ditch the old dusty bank branches & queues

GXBank is all about bankin’ on your phone, 24/7. Open an account in four minutes flat?

2. Still skeptical? Worried about safety?

Chill, Grasshoppa. They are backed by PIDM & deposits are insured up to RM250,000. It is safer than your mattress stash, and way more profitable.

3. Earn Unlimited Cashback each time you pay with your Debit Card

You can earn unlimited 1% cashback each time you spend with your GXBank debit card. It applies to Bills, Petrol, Tolls, Shopping & more. Imagine if you spend an average of RM1,000 per month, you will earn RM10 cashback. No other traditional bank has offered such an offer to you.

4. Earn 3% Per Annum Daily Savings

They have a feature called Daily Pockets where you can save money based on your goals. From what I am observing, it is similar to Touch&Go GO+ service but GO+ is offering 3.6% as of my writing.

5. RM1 waiver across 10,000+ MEPS ATM Nationwide

Worry about being charged RM1 when you withdraw money with another MEPS ATM, they will waive RM1 for all your withdrawals with an MEPS ATM.

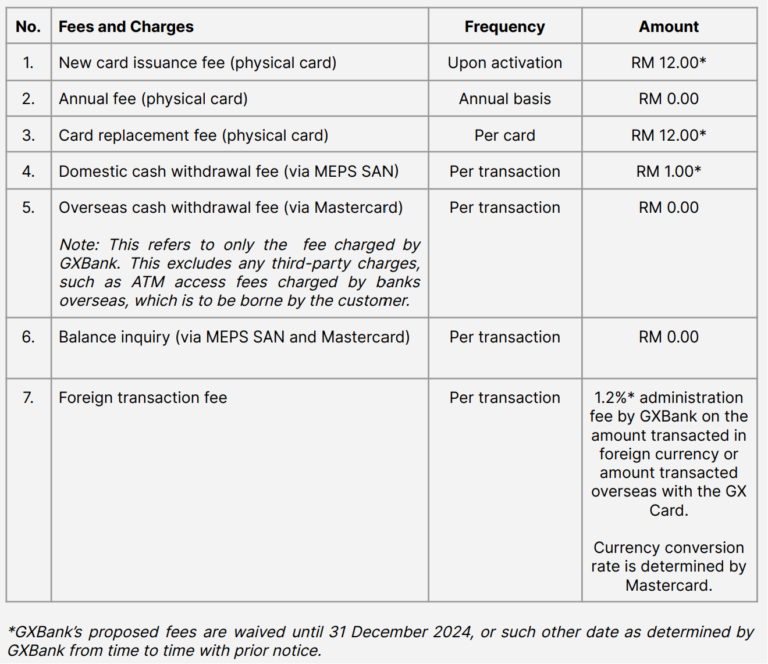

6. Other Fees Waiver

Below are the other fees that they will charge in the future. As for now, it is mostly waived until 31 December 2024 except for the Foreign transaction fee.

So, should you jump on the bandwagon?

My answer is YES! It’s free to try, easy to use, and could be a game-changer for your needs. But don’t just blindly follow the crowd. Do your research, compare fees, and find the bank that fits your lifestyle. If GXBank isn’t your jam, wait for the other four tigers to pounce. This digital banking revolution is just getting started! We do not know what the future may hold for digital banks but perhaps in the future, they may also offer other services similar to other traditional banks such as loans, credit cards & other banking services.

Now go forth, Grasshoppa, and conquer the financial jungle with your smartphones! Remember, knowledge is power, and financial freedom is the ultimate goal. Train hard, stay smart, and bank like a champion!

OSS!