Hello Grasshoppa,

It has been almost 1 year since I switched my credit card to Alliance Infinite Credit Card. In my previous feedback, I have highlighted what I liked & what I didn’t like about the card. Generally, this is still the best credit card that suits me since I love traveling & their points system (Timeless Bonus Points/TBP) is the best with no expiry date.

In recent months, they have made multiple changes which in a way, increased the redemption points. Previously, I used to be able to redeem 3,000 TBP for 1,000 AirAsia points but with the recent changes, I need to use 6,000 TBP to redeem 1,000 AirAsia points. That means that the redemption points have doubled from what they used to be in the past.

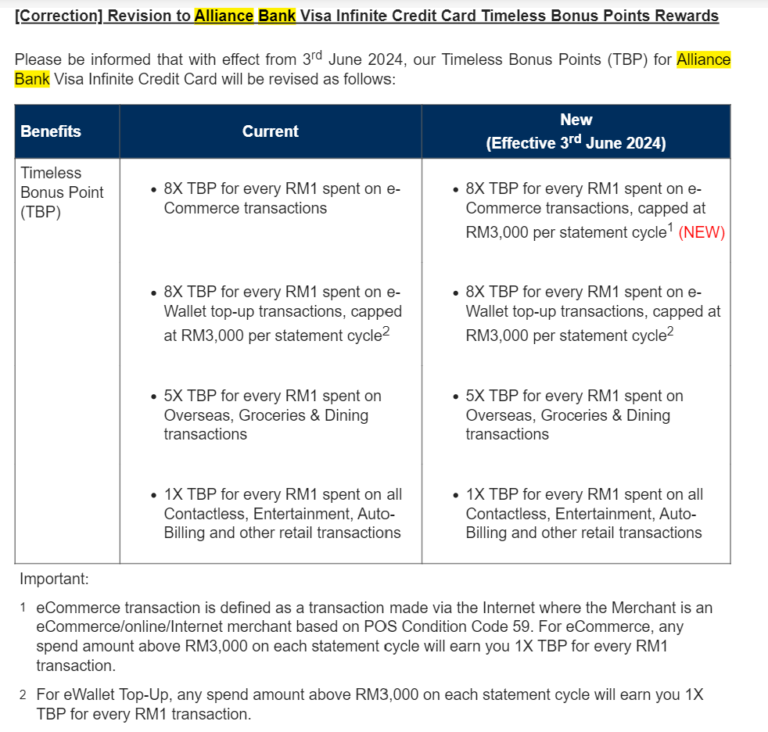

They have also sent a revision to TBP rewards effective 3rd June 2024. The latest changes are on the e-commerce transitions where they are having a cap of RM3,000 per cycle.

Aside from that, they have also increased the list of complementary Plaza Premium Lounge & added Travel Club Lounge which is located mainly in Malaysia. In total, you get to enjoy 2 Plaza Premium Lounge & 1 Travel Club Lounge access annually.

In my recent purchase of the latest iPhone, I was considering to convert it to a 3-6 months installment so I can use that cash for investment. I have discovered that Alliance Bank does not support installments as such. It can be a good or bad thing depending on how you utilize the installment.

As of now, this is still the best credit card that suits me. In my upcoming holiday with my wife, I have managed to redeem over RM900 worth of AirAsia points where our flight is almost free except I have to pay a little for our luggage fees. The only thing I hope to see them improve on is the instant reflection of my spending rather than me waiting 2-3 days for the spending to be reflected on the app. If they could improve on this, it would be the most perfect card that I’ve owned so far. I am also keeping an eye on any new credit card that I can convert to in the future to enjoy the best perks.

OSS!