Hello Grasshoppa,

As a user of both GXBank & AEON Bank for months, I have come to the conclusion of which is my favourite digital bank. Before I go further into which is my favourite, the launch of the digital bank has truly been a game changer in Malaysian banking industries, especially for users like us. In the past, the traditional banks have not been doing much aside from giving a super minimum offer to their users. The best interest I have received each month for my CIMB Bank savings account is around RM0.01 to RM0.03 & each year, I need to pay more charges to the bank compared to the interest I’ve earned.

With the launch of digital banks in Malaysia, we are seeing these few banks giving their users different types of perks that I find to be something that their users truly need & deserve. What are the perks & edges between both GXBank & AEON Bank?

GXBank:

1. Unlimited Cashback:

Users can enjoy unlimited cashback (1%) each time they spend with their GXBank debit card. I usually use this a lot to replace some of my credit card-related expenses since I know I can earn cashback from it.

2. Earn Daily Interest:

You can enjoy 3% interest per annum which they will be paying you on a daily basis. What’s good about this is, it is paid daily & calculated based on your daily balance. The more savings you have, the more you will get on a daily basis. I find this to be an edge as my bank balance changes all the time as I have both inflow & outflow of money. It encourages me to plan my finances differently.

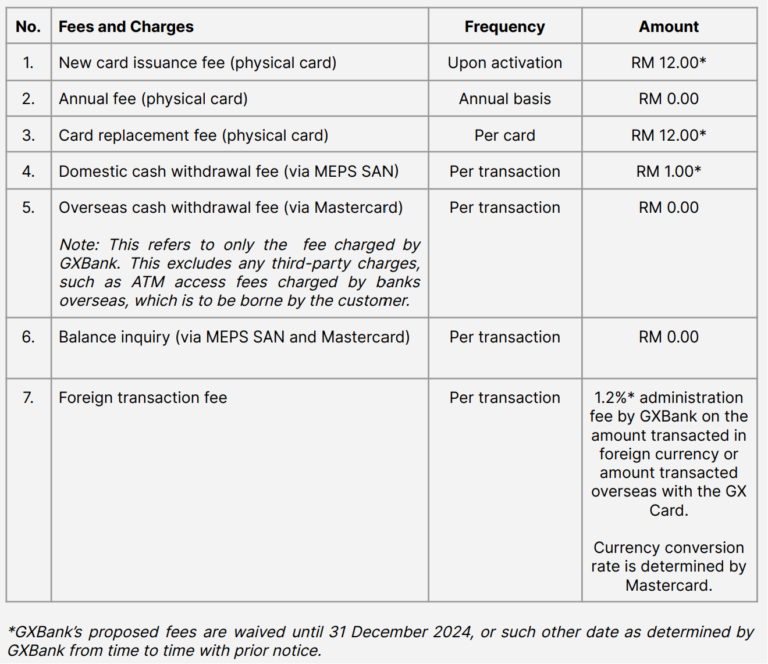

3. Physical Card Fee Waiver:

Many banks & credit card issuers usually charge between RM10-RM25 per annum

4. Other Fees Waiver:

They may change their fees in the future but as of now, these are valid until 31st December 2024.

AEON Bank:

1. Shariah Compliant:

They are the only Shariah-compliant digital bank at the moment

2. AEON Points Program:

This is something that I truly enjoy as a user of AEON Bank. In the past, although I am a frequent shopper at AEON, I have never registered for AEON members as I am too lazy to line up & fill out the form. I wonder how many points I have missed out over the years. By registering as an AEON Bank customer, I am also registered as an AEON member. If you are a frequent shopper at AEON, you can make full use of your AEON Points where you can redeem the points for cash. You can also earn 3x AEON Points when you spend with your AEON debit card.

3. Annual Profit Rate:

Their annual profit rate up to 31 August 2024 is 3.88% per annum but they have not announced what is the annual profit rate after that date. The main difference between AEON Bank & GXBank is on the interest payment where GXBank pays on a daily basis & AEON Bank pays on a monthly basis. The payment of interest makes you plan your financials differently if you are planning to maximise the way you earn your interest from both banks.

4. MEPS Fees:

They are charging RM1 for MEPS fees

Conclusion:

I find GXBank usage to be super straightforward where I can earn daily interest & 1% cashback whenever I use their debit card. AEON Bank on the other hand has slightly higher interest compared to GXBank. They also offer 3x AEON Points when you spend with their debit card & you can use the points to redeem cash. Just for convenience, GXBank is my clear favourite choice if I compare it to both digital banks. Perhaps for now, it is my preferred one but it may change whenever each bank has a different offer to their users.

Boost Bank has also recently launched but with the information that I’ve gathered, I will just wait & see for a better reason for me to register as their user.

If you would like to support my blog & register for GXBank, you may use my code below:

Referral Code:

881c98g6898520982c5cc2b8db8c6cf0

https://gxbank.onelink.me/hSCE/sk4095tu

OSS!