I have an upcoming trip to Thailand which will be my first trip since the pandemic started. I have also written on the AirAsia Super+ which is the subscription that I have used to redeem my “free” flights. A friend of mine has recently recommended an app & card called Wise that he claimed to have the best exchange rate compared to our existing credit card or even BigPay. After I did some studies on the card, I decided to apply for the card & try it for my upcoming trip.

What is Wise?

It is a multi-currency card that was launched in 2011 with a vision to make international money transfer cheap, fair & simple. You can pay & get paid without any hidden fees & without having any international bank account in different countries. Aside from that, with Wise Card, you can spend in 150 countries with the real exchange rate without foreign transaction fees. It was launched in Malaysia at the end of 2021.

How Can It Benefit Malaysians?

Receive Money For Free

It is based on the real-time exchange rate, and currency conversion at low fees & the best part of all is the receiver will receive their money for free. If you have experience using PayPal or foreign money transfers using your bank account, you will notice that there are high fees involved in it. I remembered using PayPal years ago to make an online purchase & the seller indicate that I have to put a note “family & friends” or else they will be deducted 4% from the actual amount that was transferred to them. Based on my experience, PayPal exchange rates is usually higher than any other exchange rate platform out there.

Open Currency Account

You can also open up to 50 currency accounts for selected currencies. That also means that you can keep the currency that you are using frequently without even converting them to your local currency.

Save Money When You Withdraw Overseas

Comparing most of your ATM or debit cards out there, the Wise card is offering free withdrawals for amounts less than RM1,000. But if you are withdrawing more than RM1,000, BigPay is offering a cheaper withdrawal fee or RM10 compared to Wise at RM35.

Set Aside Your Money For Your Savings

They have a function which is called Jars where you can store all your money there but it can’t be spent with your Wise Card unless you convert it over to your currency account. This function helps people who want to save money over the long term for any upcoming holidays, big purchases, or emergencies. The only disadvantage of this function is, that they do not offer any interest rate.

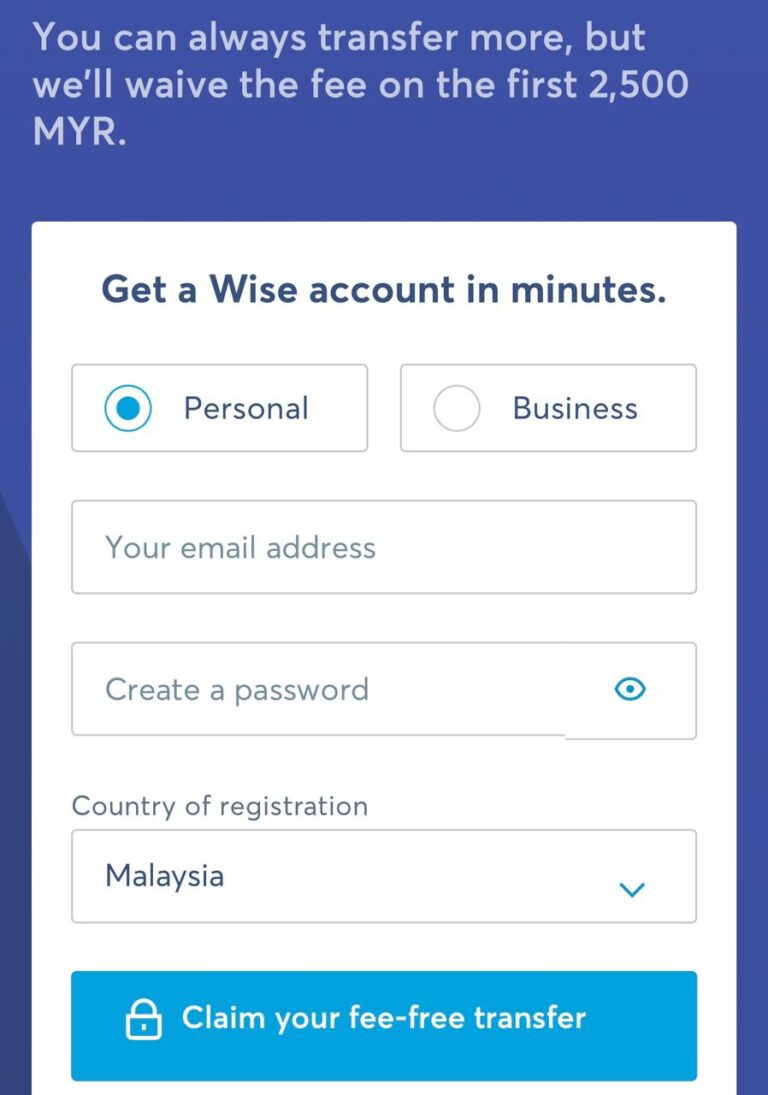

How To Register For Wise?

The steps are actually pretty simple. You just have to indicate whether it is meant for personal or business, your email address & password.

On top of that, you can also request a physical card which they are charging RM13.70 to deliver to your house. I am currently applying for the physical card for my upcoming trip. There is some identity verification that you have to complete as well which includes your selfie & IC photos. To set up the currency account, all you have to do is deposit a minimum of RM101 to get started.

I will be sharing more with all of you once I receive the card & use it for my upcoming trip. My only setback with using this card is that I will not be able to capitalize on collecting points with my existing AirAsia Hong Leong card. In my previous trips, I managed to earn up to 10,000 Big Points from overseas spending. Perhaps with the better exchange rate offered by Wise, I will be switching it over to save more money on the currency exchange. Another dilemma of me using it is on the deposits where they only allow deposits using bank transfers, not credit or debit cards. That means that I can’t be collecting Big Points by using my existing AirAsia card to deposit money to my Wise account. Anyway, as of my writing, I just applied & will be getting my physical card soon & the next update on Wise will be after my upcoming trip so I will be updating you guys in the months to come.

You can also use my referral link to apply for Wise account & card.

OSS!

You can also check out my latest YouTube video on How To Invest Like Warren Buffett: