Hello Grasshoppa,

After 12 years of driving my old Naza Suria, I have finally decided to buy a new car. To be honest, it was not part of my plan to buy a new car but I was actually on a standby mode since my car is an old car. Years of driving with multiple wear & tear have cost me some money to repair from time to time. With the recent announcement by the government to waive off the sales tax, car prices have dropped & many new buyers can enjoy saving of a few thousand ringgit on average. It is actually a good time for people that want to change their car.

Buying a new car is definitely not my priority especially when I don’t want to spend any extra money on liability or extra debt. I would rather use that money to invest in stocks or properties but what drove me to buy a new car?

For the past few years, my old car has been giving me lots of problems but the repair cost was not that high comparing to a hire purchase instalment, therefore, it is not worth for me to change. Early last month while I was driving home, my car engine started to heat up & it broke down right after Penang bridge. I later found out that it was due to overheating of the engine but after spending RM500 to repair it, the same problem occurred again after a month. Thankfully, my friend came to the rescue & a good samaritan helped us out & even gave us 2 bottles of mineral water for emergency use. That incident itself has triggered me to start to survey on a new car.

I remembered sleeping around 3.30 am that night because of my hours-long survey & few of the cars that I was surveying were the newest Proton X50 & Toyota Yaris. I was still unsure about buying a new car until the next day when I found out that my car issue was still not solved. In fact, it got worse after the gasket started to leak & water started to enter my car engine. To repair it, it will cost me additional RM2000. That’s when I knew that buying a new car is the best decision. As we all know, the bank will only allow you to loan up to 90% of the car value & I need to source for 10% of the car value as my deposit. Honestly, since the pandemic, I have spent most of my savings for my house minor renovation, MOT, my gym relocation & also my new finger tape business which caused my savings to be running low. To pay for my car deposit, I actually sold 39 grams of my CIMB gold which was valued at RM9606.60. I have invested 1 gram of gold a month and over the years with the increased gold price, I am actually able to make a clean profit of RM2185.30.

Over that weekend, I went on to a Toyota showroom to test drive the Toyota Yaris & I paid my deposit all in just 30 minutes. I guess that salesperson must be shocked by how fast I made the decision but I actually did my survey before making that swift decision. At first, Toyota EZ Beli instalment scheme caught my eye as they have an option of paying lower instalment for the first 3 years & it will increase after the third year & the sixth year. The only problem with this plan is their interest rate is at 3.6%. After checking on current bank interest, I realised that I can get more savings from the conventional bank loan.

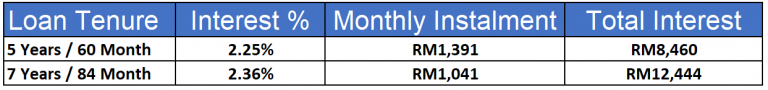

Currently, the conventional bank is offering 2.25% for 5 years & 2.36% for 7 & 9 years. I have the option of RM1,391 for 5 years & RM1,041 for 7 years with 90% loan for Toyota Yaris G which is RM75,000. To help with my calculation to see how much I am actually paying for the interest, I am taking RM1,391 x 60 months = RM83,460 & RM1,041 x 84 months = RM87,444. That means I am paying RM8,460 for 5 years & RM12,444 for 7 years. Guess which one I picked?

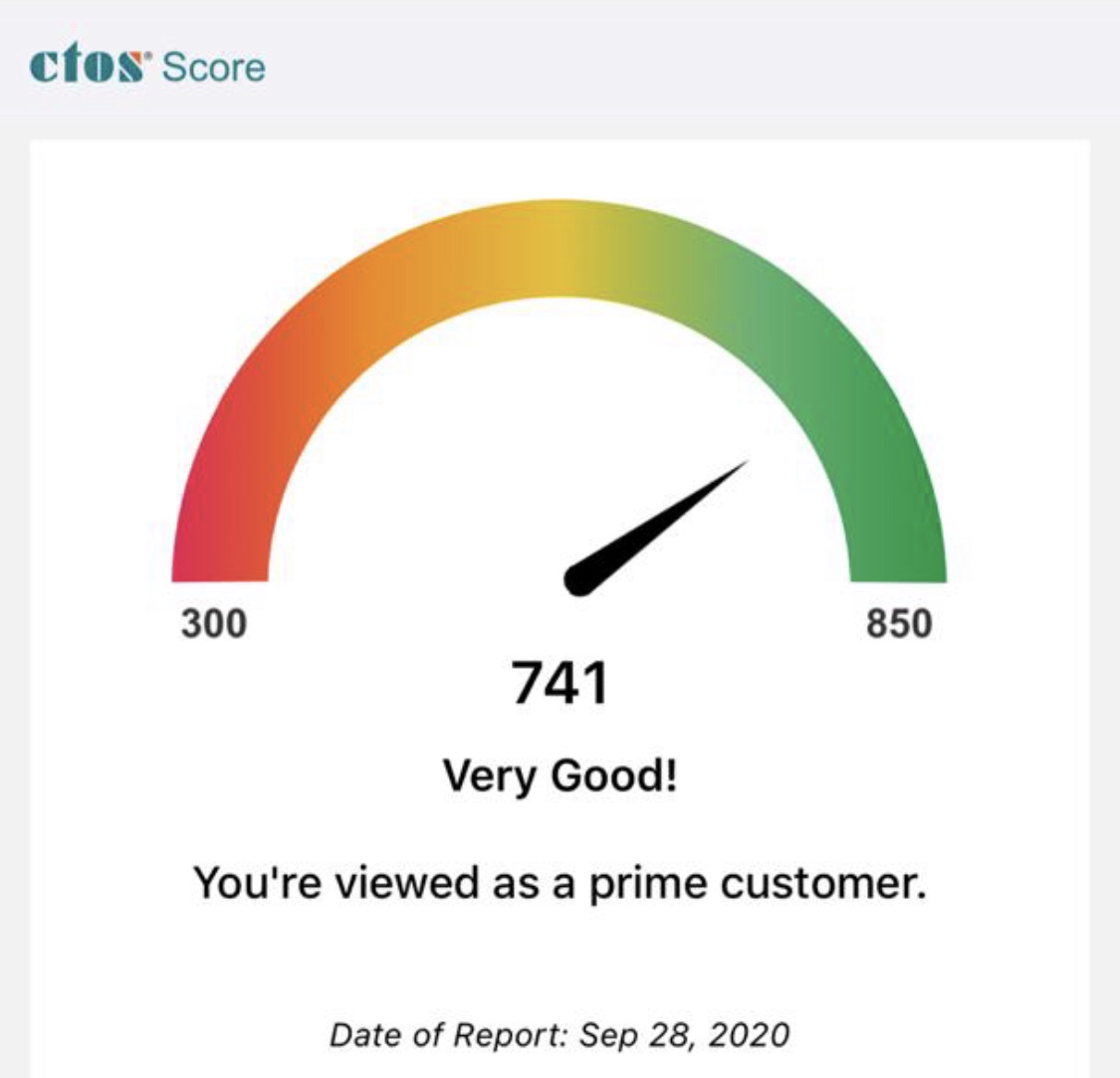

Choosing 5 years loan is definitely my first choice because of the lower interest amount but I have to pay additional RM350/month in comparison to a 7 years loan tenure. Will that additional RM350 affect my lifestyle? The answer is yes but I would rather pay more than paying additional interest to the bank. For housing loan, we have a flexible payment plan where we can pay the minimum & pay more to reduce the principal amount but for a car loan, the interest amount is fixed so there is no point for me to take longer loan & pay higher interest. Applying car loan is simple where the bank just needs 3-months payslip, 3-month bank statement & photocopy of my ic. My car salesperson applied it on Monday afternoon & I have gotten the loan approval the next day at 9.30 am. I actually asked the banker on why it got approved so fast & she mentioned that it was related to my good credit score. To be honest, I was worried about it because I did not apply for any car loan for so many years & I actually bought my CTOS latest credit score to check on my credit score.

It’s been awhile since I last checked my credit score & I am glad to see my credit score is at 741/850. My car salesperson also gave me an additional discount of RM1,775 & I just had to pay RM7000 for my car deposit. That is a good deal that I am getting. With that additional savings, I actually used that to purchase Trapo Mats that cost RM667.83, number plate RM310, 5 layer car coating RM2080 & other car accessories from Shopee. Since my car comes with tinted glass, I am actually able to save on that. I also learned that I can claim back prorated amount from my old car insurance since I am not driving it anymore which my salesperson will be processing the refund for me.

Buying a new car is definitely not my preference as I prefer to use the loan amount to invest to grow my wealth but since my car is spoiled, I have no choice to get a car that I can drive for the next 12-15 years. My goal is always the same, to ensure I can invest consistently to grow my wealth & although buying a new car may affect my investment, I still believe that I can grow it slowly & surely.

OSS!