Hello Grasshoppa,

2020 has been a rough year for many of us especially with the Trade Wars, change of government &tje global pandemic that is hitting the world. Month by month passes by & now we are approaching the end of 2020. Last year we heard the previous Pakatan Harapan government presenting us with quite a satisfying budget where it can help to grow the nation with the theme of “Driving Growth And Equitable Outcomes Towards Shared Prosperity”. With the pandemic situation, this year budget will include the government plan to fight against the Covid-19 Pandemic.

How Can Malaysians Benefit From Budget 2021?

Fighting Covid-19 for Frontliners

The Malaysian Government will allocate a budget of RM1Billion including buying Covid-19 medical test kits & Personal Protective Equipment (PPE) for medical frontliners. Medical frontliners will also be receiving RM500 one-off as a token of appreciation.

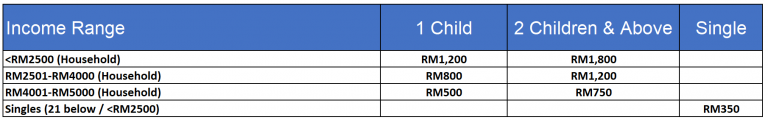

Bantuan Prihatin Rakyat (BPR) / formerly known as Bantuan Sara Hidup (BSH)

Total RM6 Billion allocation to benefit 8.1 million Malaysians.

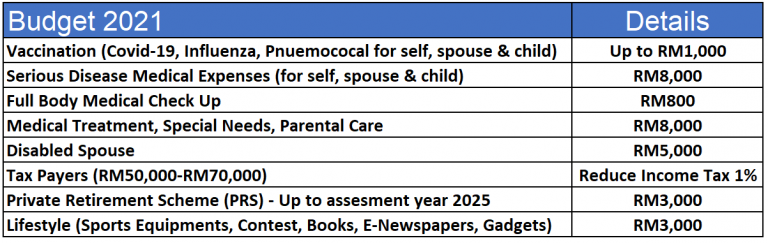

Income Tax Exemption & Relief

Employees Provident Fund (EPF)

Effective 2021, contribution by employees will be reduced from 11% to 9%. EPF will also allow withdrawal of RM500 from Account 1 for Malaysian who lost their jobs. This is effective from January 2021 for a duration of up to 12 months. Malaysians are now able to buy life & medical insurance for themselves & family members using the funds from their Account 2.

Other Benefits

One-Off E-Wallet Credit (RM50) for youths between age 18-20

RM180 telco credit (internet/new phone) for B40 low income group

RM30 unlimited travel pass for bus & rail to be extended to Penang & Kuantan

Wage Subsidies to be extended for another 3 months for selected sectors such as retail & tourism

E-Rebate for energy-efficient made in Malaysia air conditioners & refrigerators

First Home Buyers will be exempted from Stamp Duty for houses with SPA price below RM500,000 until December 2025

Civil servants will earn RM600 one-off aid if they are grade 56 & below

Government veterans & retirees will receive RM300 one-off

My Thoughts :

Personally, I like PRS tax exemption as I am able to save & get exempted from it. This is a good investment for the long run for those that don’t have EPF or wanting to save more. As for overall income tax relief, the new government has increased the percentage of selected tax exemption items that is able to benefit many Malaysians. It is a good step up for Malaysians, especially for the B40 group. What I personally don’t like is on the reduction of EPF contribution from 11% to 9%, however, I understand the rationale of why this is done which is to allow Malaysians to have more money in their pocket. That reduction amount may make a difference to some but it may also not make z difference to some. As long as we are able to plan it right, that 2% will not be a huge difference to us. Overall the budget 2021 looks really good especially for a government that is having multiple infighting. In a time like this, it is best for the government to stay united & work closely with all parties to ensure the country is safe & will be able to recover from this pandemic.

OSS!