Hello Grasshoppa, Throughout my years of investing, there are times when investing can be boring especially when it becomes a routine. Don’t get me wrong. The whole point of investing is about making it a routine & automating it so that you are able to invest consistently based on your investment goals. It can also […]

My HelloGold 4 Years Investment Update

Hello Grasshoppa, It’s been more than 3 years since I invested with HelloGold. Prior to investing with them, I invested in gold via CIMB Gold which I later sold to pay for my car deposit. My investment with them started in July 2019 after I met the team to discuss a possible collaboration. After the meeting, […]

Private Retirement Scheme (PRS) vs i-Saraan. Which Is Better?

Hello Grasshoppa, A few weeks ago when I wrote about i-Saraan, I wanted to compare both Private Retirement Scheme (PRS) & EPF i-Saraan for your better understanding. As both are considered voluntary contribution schemes, which is a better choice for you? Below I have listed some of the differences between both PRS & i-Saraan: The overall […]

Option For Self-Employed To Contribute To Your EPF Account Via i-Saraan

Hello Grasshoppa, Recently I stumbled upon i-Saraan when I was in the KWSP office to run an errand. Even though it was introduced a while ago, the scheme seems less popular, or perhaps it is just something I am unaware of. What Is i-Saraan? It is a voluntary contribution program with a retirement incentive for […]

What Can I Do To Afford A Nomadic Life

Hello Grasshoppa, I am currently on a holiday & training on the beautiful island of Phuket, I am starting to be in love with this beautiful island despite being here from time to time over the past few years. Being able to retire, spread my love for BJJ & live a nomad life has always […]

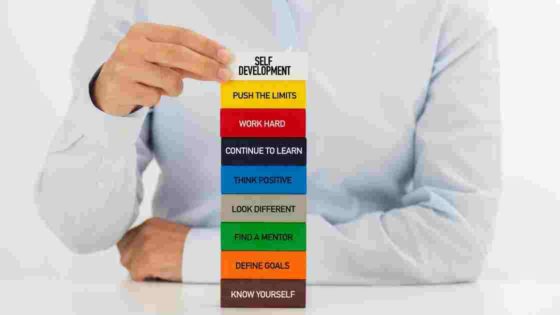

How Much Did I Spend On My Self Development Over The Years?

Hello Grasshoppa, Have you ever thought about how much you have invested in yourself over the years? This thought actually came to me, especially since I had a realization of wanting to invest in my own self-development more after investing most of my money into investment & my other business. Prior to starting my blog, […]

My 4th Year As A Personal Finance Blogger. How Is My Journey So Far?

Hello Grasshoppa, When I started BBM Blog, my main reasons were to share my personal finance journey towards my retirement & also as a guide to my readers out there. Over the years, I grew my blog from a small blog with a few readers to one of the top bloggers in Malaysia. Aside from […]

My Experience Being Part Of HSBC Wealth Webinar Panelist

Hello Grasshoppa, Recently, I was one of the panelists alongside Suraya (Ringgit Oh Ringgit) & Ken (HSBC) moderated by Roshan Kanesan (RinggitPlus). Being part of the HSBC webinar has definitely been a momentous experience since I started my blog. With the attendance of over 400 people, I am glad to hear lots of positive feedback […]

Should You Consider Withdrawing Your EPF Savings For 2022?

Hello Grasshoppa, EPF has recently announced a Special Withdrawal facility effective 1st April 2022. As of my writing, there are not many details announced yet on the procedure but members below age 55 can withdraw as low as RM50 & up to a maximum of RM10,000. Members are required to utilize their EPF Account 2 […]

Is The 4% Rule Still Applicable For Your Retirement Planning?

Hello Grasshoppa, The ideal amount that I need to retire is to have RM4 million by the age of 40 with no debts. Once I have retired, I will be traveling the world & I aim to travel to at least 200 countries before I die. It is just 5 years from now before my […]