A few weeks ago when I wrote about i-Saraan, I wanted to compare both Private Retirement Scheme (PRS) & EPF i-Saraan for your better understanding. As both are considered voluntary contribution schemes, which is a better choice for you?

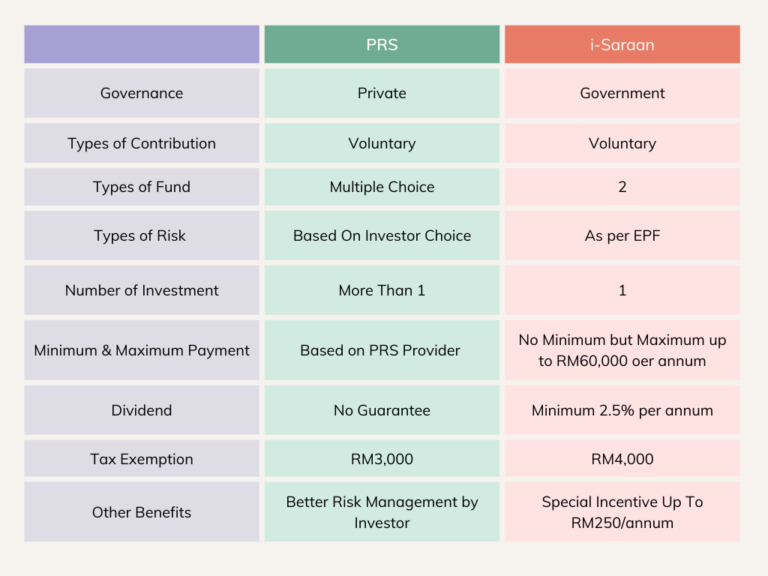

Below I have listed some of the differences between both PRS & i-Saraan:

The overall picture shows a simple difference between both investment schemes. i-Saraan is also mainly for self-employed individuals & it is not applicable for individuals with an existing full-time job while PRS allows any type of contributor whether you have a full-time job or are self-employed. Aside from that, PRS funds are mainly linked to banks & other providers that are approved by the Securities Commission of Malaysia. You can invest in multiple funds of your choice to spread the risk or you can choose the funds that you prefer to invest in as per your risk appetite. Under the i-Saraan contribution scheme, you can only choose between Conventional or Shariah similar to the existing EPF investment funds.

When we look into the investment risk of both platforms, EPF investment is purely based on the KWSP team investment risk. If we look at their year-over-year dividend return, we can expect an annual dividend between 5-6% on average. EPF also guarantees a minimum of 2.5% annual dividend for their contributors. As for PRS, there is no guarantee on the PRS provider’s annual dividend.

What Is My View?

Personally, for me as a full-time worker, I am investing in PRS while contributing to EPF under my full-time employment. For those who are self-employed & have a stable income that you can afford to contribute to both, I would recommend maximizing each contribution to enjoy the tax exemptions & also the guaranteed dividend by EPF. If you have non-fixed income & you can only pick one, I recommend you choose EPF’s i-Saraan as a stable investment since it offers higher tax exemption & you are guaranteed a minimum dividend annually. But if you are looking into something with a higher risk, PRS will be a good choice for you as there are multiple PRS providers you can choose from low-risk to higher-risk funds. All you have to do is to study each fund & determine which fund suits your risk appetite.

OSS!

You can also check out my latest YouTube video on How To Invest Like Warren Buffett: