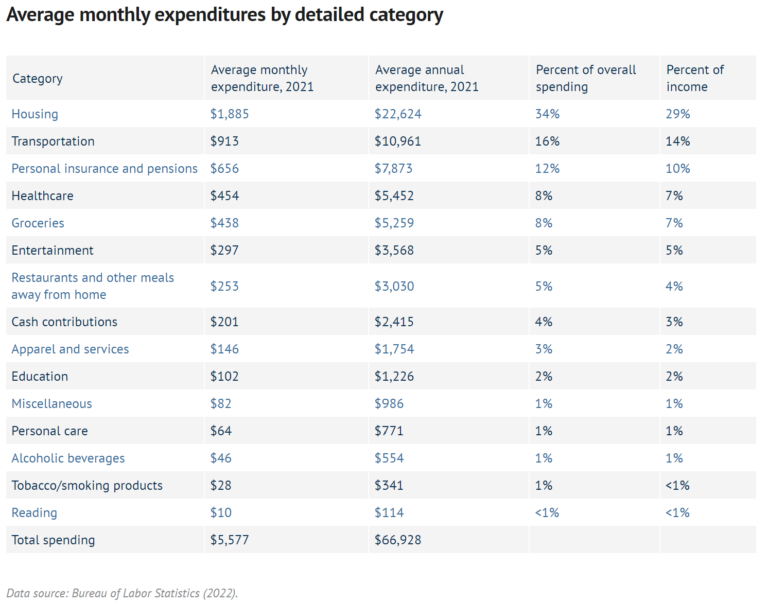

Recently I stumbled upon data on American Household’s Average Monthly Expenses which shows that our TWO biggest expenses are house & transportation. Despite the data being based on Americans, this also applies to Malaysia since most of our biggest expenses revolve around house & transportation. To some of us, it is obvious but have you ever thought about how can you save from it?

For many of us, whenever we have a higher income, we tend to upgrade our lifestyles. Especially for parents, they want to upgrade to a bigger home & car to fit their growing family. On average, our housing expenses (loans, utilities, maintenance, taxes, housing supplies) will take up between 20-30% of our total monthly salary. If the housing expenses exceed by 30%, there will be some struggle for those individuals to be able to afford to pay it. Even if they can afford it, they will end up with no savings. Imagine if you have RM6,000 income each month after EPF & other deductions, 30% of your housing expenses is RM1,800 per month. A simple breakdown of loan (RM1350), utilities (RM150), maintenance & tax (RM200) & housing supplies (RM100) which makes up of total RM1,800. To find a house that you can buy with a monthly loan of RM1,350 for 35 years, the house value is estimated to be around RM280,000. What house can you find in the main city that is around RM280,000? Even affordable house cost around RM400,000 nowadays.

As for transportation expenses, due to our not so convenient public transport in most parts of Malaysia except KL & Selangor, most of us own a car. Your transportation cost should be limited to 10% and should not exceed 15% of your total monthly salary. Similar to the take home salary I’ve used above at RM6,000, your transportation expense should be between RM600 to RM900. To be able to limit your transportation expenses at RM900 each month, your average expenses breakdown should be car loan (RM450), petrol (RM200), maintenance (RM500 every 3 months or RM166.67 per month), road tax & insurance (RM1000 per annum or RM83.33 per month). For a car loan of RM450 per month, you can only afford a car that’s worth RM50,000 & below with 9 years loan such as Perodua or Proton.

The crazy part about our country is, although the cost of living is high & our average salary is low. With the new Unity Government initiative, hopefully, we can see the cost of living go down & our average salary is higher. While hoping for the new government initiative to work, there are a few ways that we can do to reduce our overall expenses for both household & transportation expenses. For household expenses, if have yet to purchase your first house at this point, you should really reconsider before making such a commitment. Taking your maximum 30% of your monthly income to commit to your house for 35 years can be a huge pain. That is like marrying to that house for the next 35 years. When your family grows & you realize you need a bigger space or upgrade, you will find it to be another hassle to sell it.

Not all areas or houses can be sold at a profit. Even if it does, most probably you will be using that for your next property deposit or renovation. Then your loan will be for another 35 years. If you are 30 years old, you will need to pay for your house until you are 65 years old. That is based on the overall scenario for your reference. It depends on different individuals. You can also opt for rental as one of the solutions. Many of our old parents, uncle & aunties will always tell us the importance of owning property & how can they make money from it. That was back in the ’80s or ’90s or ’00s when properties were doing well. Nowadays, most property owners are renting their property at a loss. Not only are they renting at a loss but most of them are absorbing the monthly maintenance fees & tax as well. If there are some defects or damage in the property that is not caused by you, most owners will also absorb the repair cost as well. With lots of supplies of vacant properties vs demand, you can get good deals for rental properties of your liking. When you are single & have a limited budget, you can opt for room rental & when you are married, you can rent the house of your liking. When your family grows, you can upgrade accordingly based on your family size & budget. The upgrade is way easier compared to owning a property. The only downside is, you have no property of your own.

If you are at the stage of already owning a property, your simple goal is to find ways of paying your property loan ASAP. Using your EPF account 2 savings is a good option you can explore aside from maximizing your 30% income to pay for your property. Aside from that, you can still maximize 30% of your monthly income by minimizing other expenses to pay for your loan. Based on my earlier example of 30% of RM6,000 take home salary, loan (RM1350), utilities (RM150), maintenance & tax (RM200) & housing supplies (RM100) which makes up a total of RM1,800. You can reduce expenses for housing supplies & utilities and use the balance to pay for the loan.

Transportation expense mainly comes from car loan. If it is not necessary to own a car, use public transport to save all those expenses. Grab is expensive nowadays due to higher demand but you can also opt for other ride-sharing apps such as InDriver or AirAsia Ride. If a car is needed, you can explore second-hand car options as your first choice. You can also survey cars that have the most demand such as Perodua, Proton, Honda, Toyota & Nissan. When they have more demand, that also means that the replacement parts, service & maintenance are affordable & easily accessible. For cars that have lesser demand, maintenance cost is usually higher & there are times when parts need to be imported which costs more. You should also service your car in the authorized service center even if it is slightly more expensive for reliability & service accountability. Most important is, to make sure your loan is based on a maximum of 5 years to reduce the high bank interest. For those that already own a car & currently paying for it, you can only save by reducing the amount of drive to save petrol & maintenance. Once the car is fully paid off, DO NOT UPGRADE unless it is fully necessary for a situation such as your car repair fee cost is too high & happens too frequently.

Optimizing our expenses from time to time should be our annual practice whether it is for our existing expenses or fixed expenses. You will be surprised at how much you can save monthly or annually by just optimizing it. Recently, I have also done another round of expense optimization by just reducing a few expenses to save extra. Even if you can save RM10 a month, that is RM120 per annum. It is not about being cheap or finding a ridiculous way to save but it is about saving in a sustainable & long-term way.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?