For some people, with the increase in income each year, they are using this as an excuse to increase their expenses to “enjoy” their lives better. The fact is, with the increase in income, we have a choice to actually live a better life by having more flexibility in our spending but if we “abuse” it, it will also lead to us to being poorer. This is a true fact about many people in how they manage their money over the years when they have higher income.

Personally, I have gone through multiple phases in life where I am able to sustain with RM880 salary after deduction to living a life that I am living now where I have multiple sources of income. When I reflect on how my life used to be, there are definitely lots of changes in my spending habits from having a lower salary to a higher salary. Things that I used to not be able to afford back then are something that I can afford now. Those years of having an increase in income have thought me good & bad lessons in so many different aspects. The bad one is that I had multiple debts which lead me to clear them off and learn how to manage my money better & which also lead to the birth of this blog.

As of now, I am very comfortable with my income where I can spend better & live a comfortable life while pursuing my passion. Despite all that, with my yearly increment of income, my main focus each year is to invest more than last year. It is honestly easy since I just have to replan it based on the increase in my yearly income. The problem is, I find that there are gaps that I am able to save just from my expenses in a sustainable way. If I go through on a “cheapskate” way or “penny wise, pound foolish” method, I can still save but it will not be sustainable over the long term.

To do it long-term, I have to dive deep into my monthly or yearly expenses. Although it is my yearly practice to look into ways to save my money, this time, I am taking it to another level to ensure that I can save more effectively & in a sustainable way. To be honest, it was not easy at first as my monthly expenses seem to be “low” enough & I don’t spend on any unnecessary expenses. When I look at my fixed expenses, my insurance is not something that I plan to reduce since I can use it for my tax relief. It is also important to have good coverage for both my life & medical insurance as we won’t know what will happen in the future. My house’s internet bill is also at a minimum even though it is expensive but it helps me with my work since I need good internet for work.

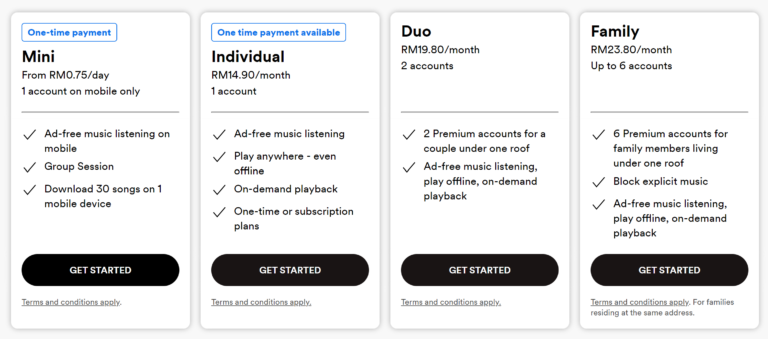

I have to actually look into my monthly subscription on where I can reduce my expenses. My view is simple. If I can reduce RM50 a month, that is actually RM600 a year. That money can be used to invest in my retirement. This is where I start to look into my Digi subscription where I am paying RM100 each month which includes unlimited data, calls & Spotify. I decide to lower my Digi subscription to the lowest package since I rarely make phone calls & I rely on my home wifi more than my phone data. As for Spotify, I have shared it with my brother under the family package. It is way cheaper compared to the premium package.

I am also looking at cutting my subscription to Disney+ since I don’t use it frequently enough which cost me RM54.90 every 3 months. By just downgrading my Digi plan, changing my Spotify subscription & canceling Disney+, I am projecting to save RM700 per year. Since this “downgrade” was done in early January, I honestly don’t see any changes or any difficulties that are affecting my life from the “downgrade”. Since January, I have also looked into cooking more frequently at home to save more money. Although I have initiated this effort since January, I don’t see any significant savings yet since I just came back from a long holiday. I will update all of you on this in the months to come. Aside from the cooking-at-home initiative, I am also working on reducing my coffee expenses which I will also update all of you about in months to come. As I mentioned earlier, it is all about doing it sustainably to ensure that I can do it over a long period of time.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?