Hello Grasshoppa,

It has been more than 5 years since I started to invest in P2P financing. When I started to publish my first post on P2P financing, it was quite new in Malaysia. During that time not many Malaysians understood much about P2P & it required lots of marketing & publicity to educate the crowd on what is P2P financing. I remembered meeting both Fundaztic & Funding Societies to discuss the potential collaboration & I have actually written paid posts for both companies.

Aside from collaborating with them, I am also investing with them & still am an investor today. To date, I have invested a total of 472 Notes with Funding Societies & 295 Notes with Fundaztic with an average investment of RM50-RM100 for each Note. I have not made any new deposits since 2018 & all my current Note investment is based on my initial investment.

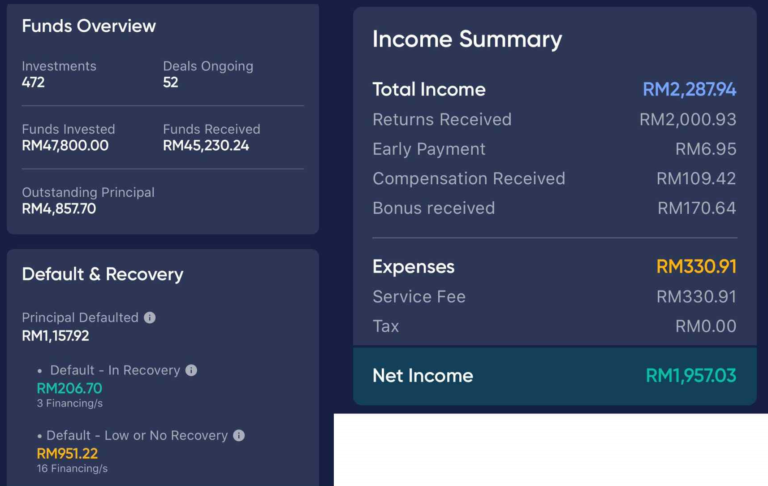

Funding Societies

With a total of 472 Notes funded worth RM47,800, I have made a total income of RM2,287.94 with each specific breakdown as above. The total expenses based on Service Fee charged by Funding Societies is RM330.91 which makes my Net Income is at RM1,957.03. If you look at the total default that I am having under In Recovery & Low or No Recovery, I have a total default of RM1,157.92. This means that with my total income minus total default, I am only making a total of RM799.11 with my initial investment principal of RM3,000. Since I have invested for over 5 years, I am making an average of RM160 per year or 5.3%. Based on my 472 Notes funded, I only have 19 defaults which make my total default rates at 4%.

Fundaztic

I have invested a total of 295 Notes worth RM17,650. To calculate my estimated profit, I am taking my Total Nett Investment Receivables (RM23,202.16) minus my Total Investment Amount (RM17,650) which makes my estimated Net Income RM5,552.16. So far, I have 68 Notes default out of 295 Notes (23.5% default rate) which total RM3,096.19. After minus the total recovered notes (RM716.12), I still have a loss of RM2380.07 from the default notes. Since I am unable to check my total profit as Fundaztic data is slightly complicated, I can only calculate based on estimation by using my estimated Net Income (RM5,552.16) minus non-recovered default RM2380.07 which makes my estimated profit RM3,172.09 if there is no further default. On the estimated average based on my 5 years of investment, I am making RM634.42 per year or (if there is no further note default).

Which Investments Do I Prefer?

To be honest, each P2P financing platforms have its own strengths & weaknesses. What I like about Funding Societies is their app functionality where all my investments are automated & all I have to do is to set it under auto-invest based on my investment preference. For Fundaztic, their app is quite slow & it looks really cheap. Aside from that, their investment is all manual & I have to log in every few days to invest on my preferred Notes. The good thing is, I get to choose which Note I want to invest. Since both companies are targeting different segments of borrowers & they set different rules for the borrowers, investing in both Funding Societies & Fundaztic will allow me to mitigate investment risk by not putting all eggs into one basket. So instead of me comparing which platforms are better than another, I am using both platforms to get a balance of profits from my P2P funding funds.

What Do I Think Of P2P Financing?

After my 5 years of investing with them, I would still continue to invest with them for at least 5-10 more years to see how much my initial investment is able to grow. If you are looking into something that is high risk with high return, this is a platform that you can invest in but you need to be prepared for possible defaults as those borrowers that borrow are usually those borrowers that are having a hard time obtaining bank loans which resulted for them to approach those P2P financing companies which charge higher interest with less hassle approval. Aside from that, this should be a long-term investment since some of the repayment terms can go up to 36 months. So, if you are looking for something with shorter terms, this may not be a suitable platform unless you are funding notes with less than 12 months. Also, in order for you to minimize your investment risk, you have to invest in as many notes as possible since there is a chance that some notes that you invest will default. P2P financing is one of the simplest investments you can invest in & you are looking for something that is simple to invest in, this is definitely the right investment for you.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?