Hello Grasshoppa,

Have your trading websites been crashing recently? I remembered buying stocks from Rakuten twice within this month and I have noticed many notification errors in the web, slow loading time, failure to connect to server & other similar issues. It is crazy especially when I am trying to buy some stocks but it kept logging me out or disconnect me from the server. Not sure if any of you are aware of various news that recent trading volume in Bursa is at an all-time high. With the current pandemic & market uncertainties, why are we seeing such a high trading volume in various stocks exchange platforms?

We see the rise of stock prices for selected industries or companies such as glove, rubber, medical & also gold-related stocks. Some other industries or companies are not doing well especially airlines, hotels and tourism-related industries. We can see that companies like AirAsia & AirAsiaX are struggling with the limitation & fear to fly. Other airlines have gone bankrupt while some are seeking government funding or even bank loan to stay afloat. Situations like these have never happened in our lives before & this is the first time we are experiencing how much a pandemic can affect us. With the pandemic, what has led investors to invest at a time like this? Are they being purely optimistic in certain stocks or are they seeking for a good bargain?

Below are some of the examples we can refer to one of the best-performing stocks during this pandemic. Top Glove stocks were traded around RM5.70 in March & currently it is trading at RM28.14 (as of my writing). Do you think it’s a good company to invest in?

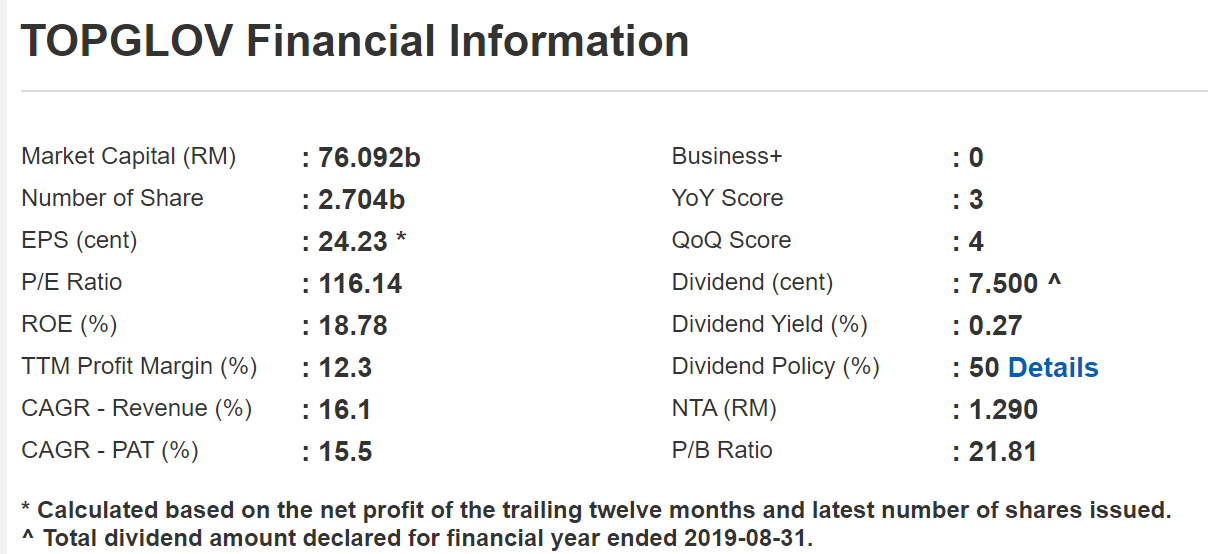

Next, we look at their company financial information. Their Price to Earning (P/E) ratio is at 116.14. Isn’t that a bit too long for you to earn back your investment amount? If you are a dividend-driven investor, 0.27% dividend is way lower than Fixed Deposit. Is it worth it to invest for a 0.27% dividend? Next, we look at their Net Tangible Asset (NTA) & their Price to Book (P/B) Ratio. Imagine going to a bank for a property loan of RM4mil but the bank tells you that your house actual valuation is RM500K. Don’t you think that it is overpriced?

With my analysis on Top Glove, does that mean that it is a bad investment? No, I don’t mean that. Based on my analysis, the high demand for gloves are causing the rise of the stock price. Will it stay that way for the long term? Honestly, I have no answer for that but it may be that high until the pandemic is over. Their recent earnings also shows that the quarterly revenue is at an all-time high but with the data above, is it really worth it?

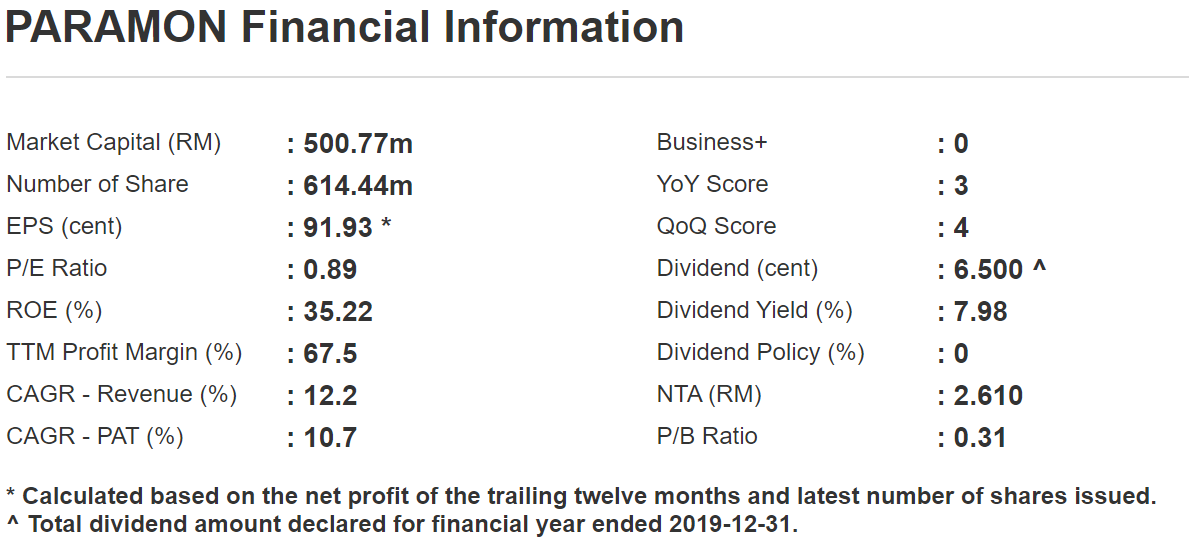

Let’s look at another stock that may be affected by the pandemic which I personally think it’s an underrated stock. It was trading around RM0.60 in the month of March & currently it’s trading around RM0.815 (as of my writing). As of this year, I have gotten RM0.29 special dividend from the divestment of their pre-tertiary education group & additional dividend of RM0.045.

What about their market capitalization? With the current stock price of RM0.815, this gives them market capitalization of RM500mil. With the divestment of their pre-tertiary education group, they are able to purchase a land for their Bukit Banyan township in Sungai Petani & RM244mil prime land in Kuala Lumpur in cash. A company with a market capital of RM500mil but buying prime land in cash? Is there something wrong with the market valuation? P/E Ratio is reflected based on their recent dividend. Net Tangible Asset (NTA) & P/B Ratio shows a higher valuation comparing to market value.

Conclusion :

Based on the comparisons made above, do you see any difference between how both stocks are valued? Firstly, it is based on forecast & optimism & secondly it is strictly based on actual value & numbers. There are many investors out there & each have their own indicator to define a good or bad stock. My personal valuation of stocks or companies are strictly based on their earnings & valuation. There is no right or wrong on investing as long as it is helping the investor to earn money and achieve their financial goal.

If you are interested to start investing but have no experience in investing, you may refer my previous post on :

How To Start Your Investment Journey Without A Financial Planner

OSS!