If you have an account with HelloGold, you should have received an email from them on the closure of their Malaysia & Thailand office which made headlines on many social media pages. There is also some feedback that the app was having some issues & there was lots of panic selling happening within that few days. When I was reading the comments on social media about the HelloGold closure, there were no bitter feelings but in fact, the netizens actually empathized with the closure & some of them were quite worried about what was going to happen with their money.

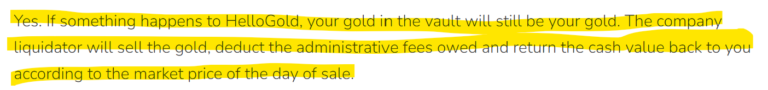

Although HelloGold is not regulated by Bank Negara since gold is not a regulated product under the Banking & Financial Institution Act 1989, they have done a lot to ensure that their investors money is protected. They have even collaborated with multiple financial bodies & they are Shariah Compliant. They have even made it clear that if anything happens to their company, the gold in the vault will still be yours. So in another word, with their closure, our investment will still be safe & we will be getting our money back.

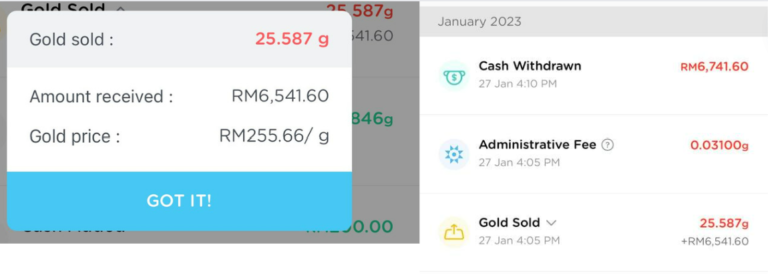

After receiving their email on Thursday, I was waiting for more updates from them on the procedures to withdraw my money. While waiting for updates, I was also exploring what should I do with the money that I will be getting from them since I don’t want to dump everything into 1 platform or stocks. I sold all my gold on 28th January & my total loss was only RM4.90. I have sold 25.587 grams of gold worth RM6,541.60 & the extra was the return from my Smart Saver that was supposed to be invested each month. Since I have been investing with them since July 2019, it is actually a good amount of money that I have accumulated over the years with just an average of RM200 a month.

HelloGold Smart Saver was truly a superb concept that I enjoyed while investing with them. Aside from the fixed amount that you can set each month, they also allow you to invest with your e-wallet which I find to be great for me to accumulate my GrabPoints. Overall, it is truly an interesting investment platform compared to other gold investment platforms but with the closure of HelloGold, I have surveyed other investment platforms such as Wahed, Versa, Maybank Gold & CIMB Gold. After comparing, I have decided to invest in CIMB Gold again. Previously I sold it to deposit for my car & I still have 1 gram that they don’t allow me to sell.

Over my years of investing, I am a true believer in dollar cost averaging & instead of investing all the money I received from HelloGold to buy gold in CIMB Gold, I plan to only buy 1 gram each month like what I did in the past. The balance of money that I received from HelloGold was invested in S&P500 Index Fund & also other local stock investments to strengthen my existing investment portfolios. Guess, I have to invest for another few more years to accumulate the amount of gold I used to own over the years but it is definitely worth it as I manage to make a clean profit of RM2185.30 in the past from just investing 1 gram each month. Dollar-cost averaging definitely is effective in most parts of my investing history & I am sure it will be helpful to you too.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?