We may have people around us that put the extra effort to look rich just to impress themselves or the people around them. There are also people who “reward” themselves with luxury goods with a certain achievement or milestone by putting themselves in debt. Unfortunately, I used to be one of them. I remembered years ago, when I just got myself a higher-paying job in a different company, I did actually reward myself with an RM4000 Tissot watch. Even before I joined the company, I have already put myself in debt by using my credit card to pay via installments for it. Just by thinking about it, I just feel so immature & dumb for making such a stupid decision back then. The only good thing is, I managed to correct all these bad habits for the better.

It is a common scenario where we have people in our surroundings that put themselves in such a situation by wanting to enjoy life & impress people that do not care about them. As a result, they either have lesser savings, or they have put themselves in debt by just doing so. We may think that some people that drive luxury cars & live in the most luxurious houses are rich but in fact, they have more financial debts compared to many of us. Of course, they are able to pay it off in years to come if they manage their finances well but putting themselves in financial debt may not be a good thing. Imagine if you are earning RM15,000 a month net but you have RM1.5 million debt for both car & house. It just doesn’t make sense to put yourself under such financial stress.

When we look at social media such as Instagram or Facebook, we see people spending money on luxury meals such as Omakase which may cost RM400-RM1,000 per person. We see some people drive a second-hand BMW or Mercedes which cost around RM1,500 per month for 9 years. This is excluding repair, service, insurance & road tax cost which are considered hidden costs. People spend money on fake luxury goods or even second-hand luxury goods. Whether to impress themselves or others, they are putting themselves under bad financial stress. If they are using credit card & can’t afford to pay it, when they opt to pay for the minimum payment, they are prolonging their debt with a higher interest. Is it truly worth it?

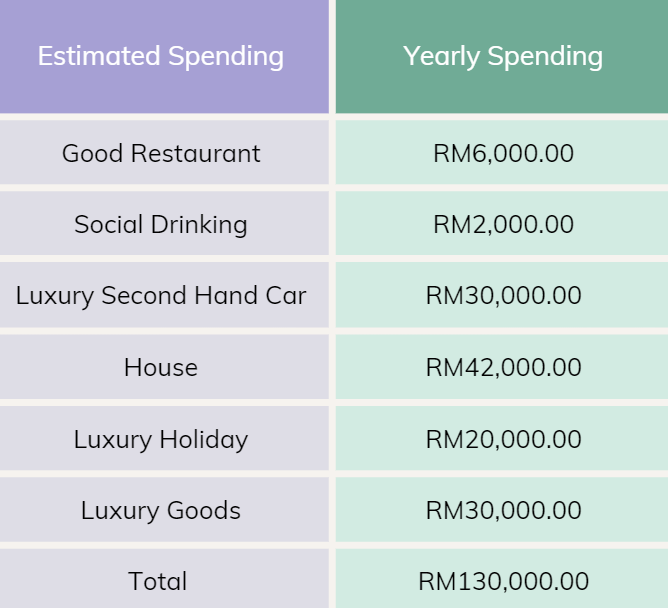

The impact of being fake rich is usually on their cash flow & also their uncontrollable debt which can be never-ending especially when they need to keep up with the latest trend. Just to impress others & getting their acknowledgment but at the expense of their financials. Just for your reference, I have created a sample but it truly varies between different individuals. It can be lower or higher depending on the individual. These are all their extra pending aside from their day-to-day spending. What I am trying to point out is, the total amount can be huge when we look at the big picture.

Whether the amount is closely accurate or not, imagine if you can save & invest this amount to actually be rich. Within 8 years, they can be an actual millionaire by just saving that money up (RM130,000 x 8 years). When you factor in investment with compounding interest, you can see your money grow even more by just investing that money over a period of 8 years. Don’t get me wrong that you are not supposed to reward yourself whenever you can,y but you need to know your limit before you reward yourself. To celebrate a certain milestone & if you are looking to reward yourself, only look for things or rewards you can afford & make sure that it does not affect your financials or savings. Even if you can use flexi payment with your credit card to buy something for yourself, you should plan ahead on how to pay it & limit yourself on the total amount. If you are looking to buy a car or house, always factor in all those side or hidden charges that will affect your financials too.

You can also plan way ahead which I think it’s the best solution if you want to truly enjoy your life to the fullest without sacrificing your financials. If you want to plan ahead, you can look into planning a few years ahead which requires long patience but it is worth it & it is safer for your pocket. A few examples are, you can save ahead & invest that money in investments that can generate your return or dividends. After a few years, you can use those interests or dividends to reward yourself. Credit card flexi payment works too if you have plans & can afford it for that period of time. Personally, I don’t like flexi payment even though it is 0% interest since I hate to put myself in unnecessary debt.

End of the day, to live like a fake rich, it will take a lot of financial burdens in order for us to do so & ask ourselves, do you think it is worth it? Is it worth putting yourself under such financial stress just to reward yourself or to impress others? Or do you want to make yourself rich by making better decisions in life such as investing now & reap the reward later? Some people may say that “You Only Live Once (YOLO)” but don’t forget, you can’t YOLO if you don’t have money to afford it. So rather than you think of “YOLOing” your spending, manage your financials properly & you will be able to reap the reward later.

If you want to invest but don’t know where to begin, you may check out my latest post on How To Start Investing In 2023.

You can also refer to my 11 Financial Rules that I use to manage my money well.

If you want to be a millionaire by 60 years old, you can also refer to my post on How Much To Save & Invest To Be A Millionaire By 60.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?