Learning to think about “The new normal” in financial planning of post Covid-19

The COVID-19 War Is A Process Not An Event

How bad is the impact of coronavirus to the world now? Lockdown has been the effective measurement taken so far, how long should it be, 8 weeks or more? Once you start pulling back from quarantine measures, what’s life look like? What’s the economy look like? The idea that life is back to normal anytime soon is really, really overstated. What’s the new normal going to look like?

Another big question is about the asymptomatic cases? What is Malaysia’s strategy to trace them?

This is the moment I started to learn to think more after being in insurance or financial business for more than 22 years.

Assuming workplaces get fully functional with suitable personal protective equipment; feel comfortable that we’re not going to get significant additional cases. In the workplace, you organize social distancing in offices, you give people more flexibility on work from home, and everybody in contact regularly with people gets masks. You should be able to get to that point within 3-4 months to allow you to get the economy going again.

Yes, economically, everyone must get back to work. The society will always eliminate educated people, but will not eliminate people who learn or improve continuously.

“Survival of the fittest” is a phrase that originated from Darwinian evolutionary theory as a way of describing the mechanism of natural selection. The biological concept of fitness is defined as reproductive success.

Survivals are evolving to adapt in “the new normal”, physically and mentally.

During this lockdown, survivals are adapting personal financial planning more; mentally, financially and effective practices.

There will be long term continuous strategy to battle with virus, food supply chain and economy within each country. The personal protective equipment will be developed. Outbreak could possibly cause the shortage of food supply in each country, there will be preparation for that internally and then to strengthen country economy at the same time.

You will get a “new normal” once you have a working vaccine and the tech. That’s more like mid 2021 than later in this year. How effective is the vaccine will take another 3-6 months to know, according to the experts. We’ll feel like society functions more effectively, but will have taken a lot of people out of that economy.

What Have We Prepared MENTALLY, During The Covid-19 And Post Covid-19 War?

Income recess in the lockdown will trigger people to think about how long a person can afford to live without income in different stage of life. Thus Retirement Planning will become the first topic in the new normal financial planning.

Prices of everything possibly will go high for 2 main reasons, shortage of supply and inflation? The shortages of supply will mainly due to the Covid19 lockdown-destruction of supply chain, there is because many factories are not able to be operated as pre-Covid19. While the quantitative easing programs launched in many major countries will have the after effect to economy in inflation. Are you prepared for this?

There is great uncertainty about the path of the virus in the next few months, and even more about the path of the economy and society in the years ahead. Governments may be at war with Covid-19 and fiscal deficits and a shutdown of the economy may be a result of that war for quite some time. Does it will end like a normal war? That will happen gradually over time, because Covid-19 was is not an event, it is a process.

Zooming into personal finance, people shall manage the cash flow within short term and have a financial plan for long term now and future.

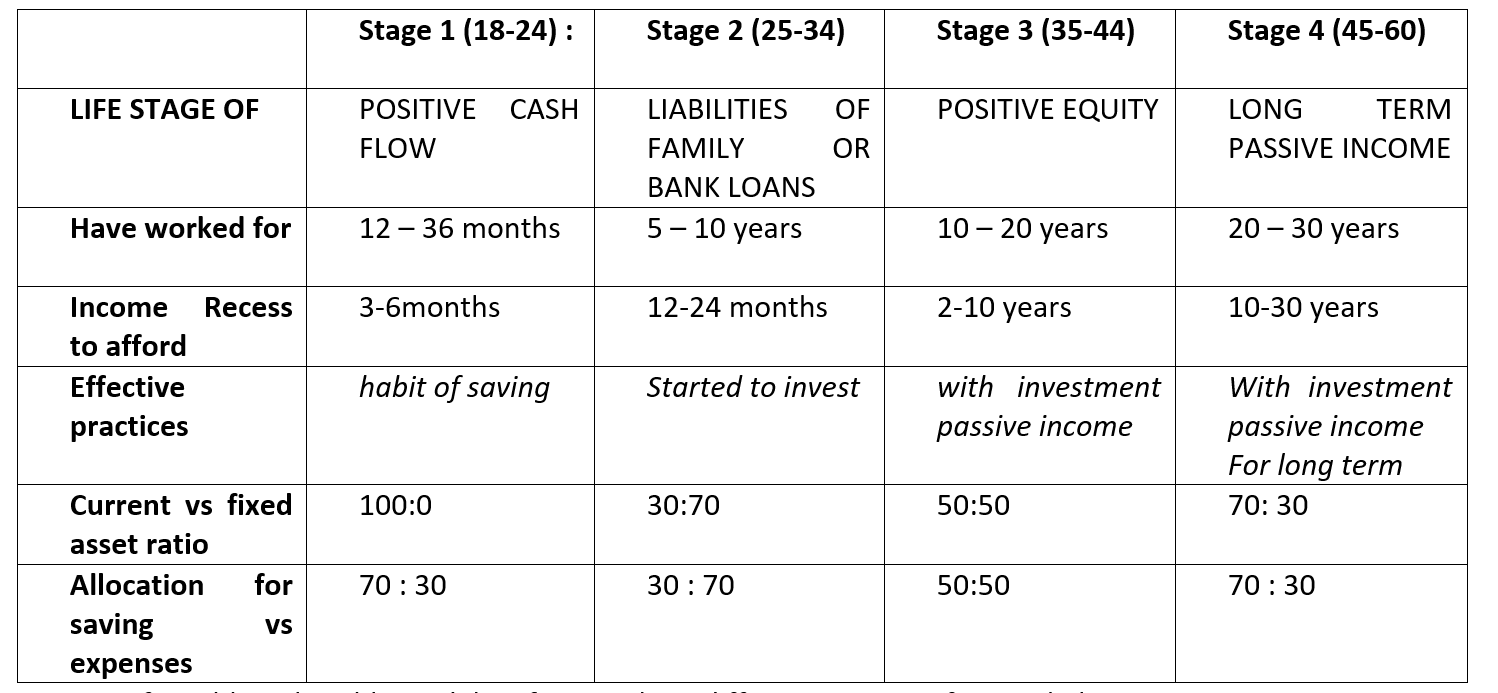

In the financial planning OF 4 STAGE OF LIFELINE (PUBLISHED IN 2014, EDITED 13/APR/2020)

Stage 1 : Positive personal cash flow, started to earn first even income.

Stage 2 : Liabilities of having a family or bank loans.

Stage 3 : Positive equity, assets more than liabilities.

Stage 4 : Accumulating long term passive income for desire retirement lifestyle.

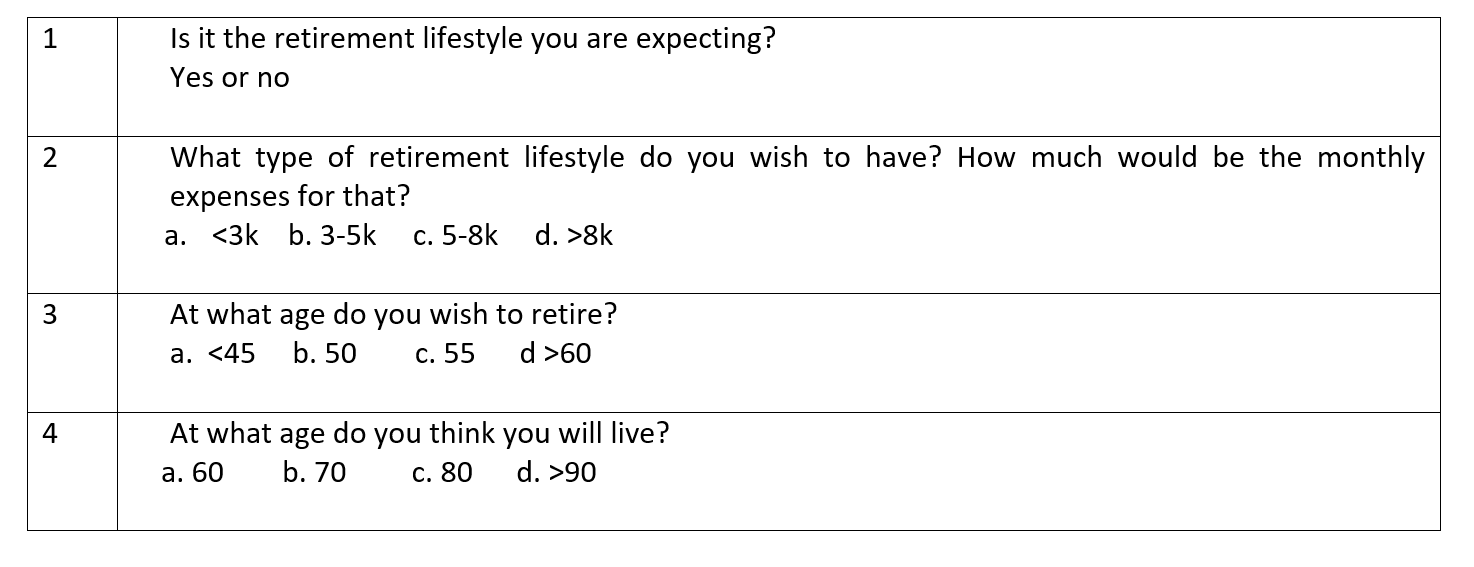

If we take the Covid-19 lockdown to simulate a trial of retirement (recess of income while lockdown with current equity we have now); there are questions to ask ourselves.

What is the EFFECTIVE PRACTICES now?

Note for table: A humble guideline for people at different stages in financial planning.

Healthcare is the first topic and finance will be the second topic during the covid-19 lockdown. Have you started to manage on what could be the effective practices as the recovery plan? Put yourself at your retirement age now and you shall build your personal cash flow management and balance sheet.

Personal Cash Flow Management

- The actual personal cash flow?

- Surplus or deficit action plan?

Balance Sheet

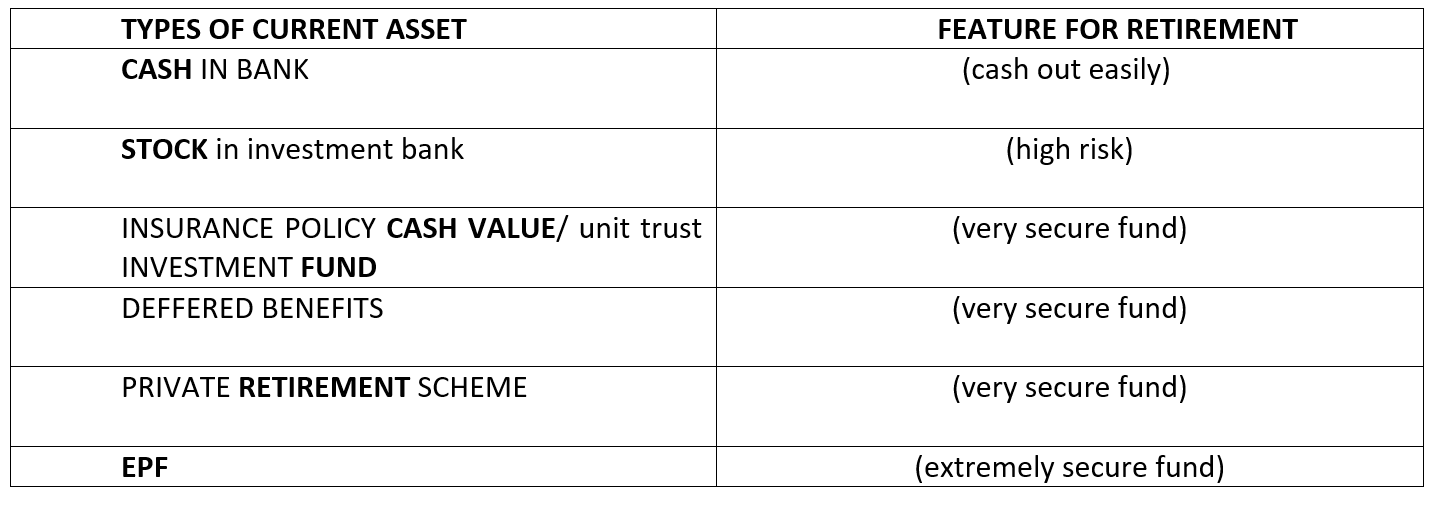

- Investment into current asset vs fixed asset ratio?

- The actual performance of your unit trust, investment link fund, stocks, property (rental income)?

Once you have worked on that, you must be able to draft out the effective practices to be taken. From the cash flow management, you will clearly segmentize the wants vs needs. Whereas from the balance sheet, you know clearly you need to have all online banking to retrieve your personal asset and liability information in order to update the balance sheet. You aware the important of cash value and unit trust fund performance as a very secure account to accumulate your cash! Whereas EPF, private retirement scheme are accounts that able to help to lock your cash for retirement.

Yes! Majority of Malaysian do not do personal cash flow management or balance sheet; like some weren’t yet users of digital retail services, over 2-3 months had to get used to that, signing up with accounts, suddenly finding it’s convenient. Many are not going to feel comfortable jumping back into a crowded store if they don’t absolutely have to. Not when you don’t yet have full information on who does and does not have the disease, who is and is not immune. If you don’t have a vaccine, how many people are going to be willing to go and watch a live sporting event or go to a crowded bar or restaurant? These things do not get back to real normal until you have a vaccine that is distributed globally with the technology information on individual people to back it up. That’s a year and a half out if you are lucky.

The artificially depressed economy – you’ve changed people’s psychology around the economy and building a new normal in financial planning. Start to be more cautious about household cash management and the personal balance sheet?

Emerging markets can’t engage in social distancing because people don’t have space. Don’t have the money to shut down their economies fully and won’t have the technology to ensure that everyone is or is not going to be identified as being a carrier, asymptomatic or not. Those economies are going to be depressed for a lot longer.

Secondary outbreaks that come seasonally are likely to be much more significant. Shutdowns of travel, from the developed countries and China, last a lot longer. Supply chains and travel chains are going to be broken – like a year or a year and a half.

JASON KOEH

FChFP, ChIFP, FChLP, RFP, B. Eng (Hons)

Managing Director

www.mqbusinesswealth.com