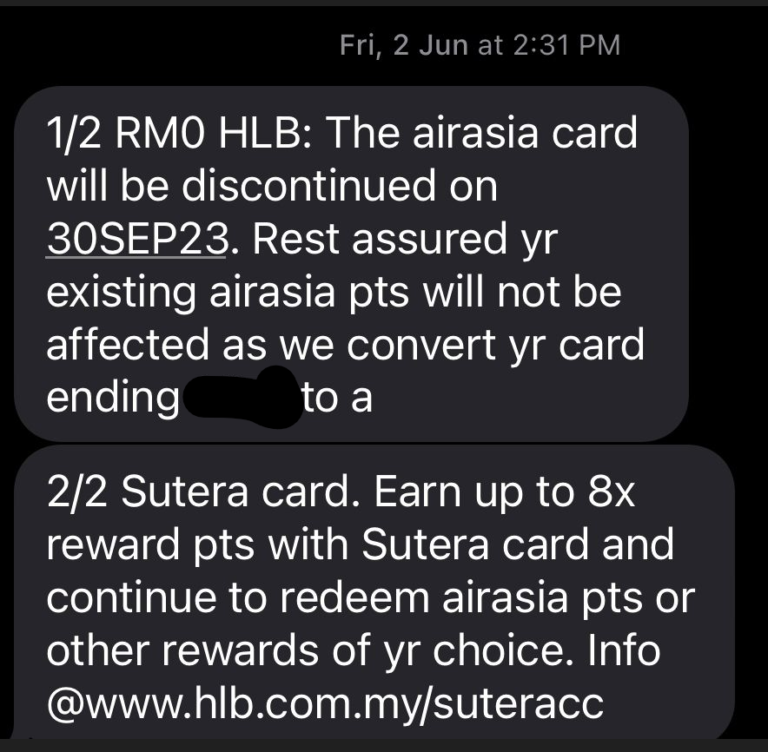

I wrote Why Should You Apply For AirAsia Credit Card 2 months ago, but 2 months later, I received terrible news on what will happen to AirAsia’s credit card. This is truly bad news for me since the card has been really useful & rewarding. Since I used this card, I have redeemed a few subsidized & free trips within the AirAsia network.

After receiving this message, my first thought was perhaps it is fake spam since I am unable to find it on the internet but with them stating my card ending number, it seems to be real. Anyway, the second thing that I did after receiving the message was to find out more about the Sutera card. Upon the first view, there is nothing much enticing about the card since the feature seems to be very basic.

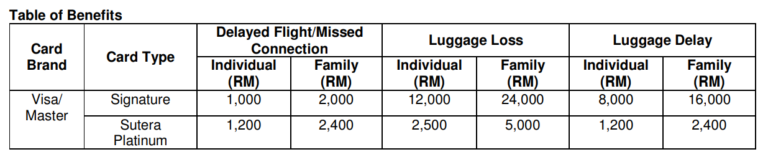

Compared to my current AirAsia card, they have their own reward points vs AirAsia points. Both cards have an annual fee waiver but the AirAsia card has higher retail spending of RM20,000 compared to the Sutera card (RM15,000) that needs to be spent in order to get your annual fee waived. Travel Insurance seems to be a plus point where you can refer to the benefits here.

Since the Sutera card is a reward card, they are giving up 8 times reward points for a selected spend category that you can use to redeem different types of rewards from Hong Leong Club Rewards. Since this card is the replacement for my current AirAsia card, I am using this example to calculate whether it is their reward points are worth it. My Touch’nGo expenses each month is around RM1,000 a month. If I am using my current AirAsia card, for every RM3 that I spend, I earn 1 AirAsia point. With my AirAsia card, I will earn 333 AirAsia points. For the Sutera card, RM1,000 spent on Touch’nGo will allow me to earn 8,000 Hong Leong points. To redeem 1,000 AirAsia points, I will need only 6,500 Hong Leong points to redeem.

Of course that is just some of the example calculation since Hong Leong reward points have many other retail categories to look into that may reduce the rewards points. Overall, this seems to be a good card if I were to use it to redeem Air Miles such as AirAsia or MAS Enrich points. Aside from that, I am also exploring other possible cards that I am able to use once my AirAsia card expires by the end of September 2023. So far I have shortlisted 3 cards which I will be sharing in the future once I have concluded my choice. One of the few criteria that I am shortlisting is also on the access to Plaza Premium Lounge. Some cards offer access to more locations compared to others. A few of my considerations are my travel frequency, the people that I am traveling with & also the locations that I am traveling to.

No doubt, my AirAsia card is a perfect card for me since it truly suits what I truly need. My next concern is, what will happen to all the benefits that I am enjoying for being their Platinum member where I can have priority boarding & express baggage which helps to skip the long queue during flight boarding & getting my luggage earlier upon arrival. Guess I may need to move on from those benefits once my AirAsia card expires & start searching for the next best replacement. Since I have until the end of September 2023, I will be fully utilizing my card & maximize my AirAsia points redemption before the card expires.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?