In 2019, I stumbled upon the AirAsia credit card by Hong Leong Bank which caught my attention. With my love for traveling & since I was already using BigPay to accumulate my AirAsia Points (formerly known as BIG Points), I immediately signed up for the credit card. I remembered that there was a sign-up bonus & with my business travel at that point, I managed to accumulate more than 10,000 AirAsia Points in less than a month.

Prior to the pandemic, I managed to redeem a flight to Vietnam but because the traveling time was during the outbreak, that trip did not happen. Since the trip did not happen, I was credited with cash credit that I can use for my future traveling. As we all know, the whole pandemic situation was pretty bad & most of us had to stay at home, unable to travel with minimal social interactions. At that point, despite not being able to travel, I was still accumulating my AirAsia Points since my credit card spending was ongoing. To be honest, the point accumulation at that point was so irrelevant as there are some points that are due to expire & I remembered I had to redeem a TGI Friday RM100 cash voucher.

To be honest, AirAsia Points were not so attractive during the pandemic since the main usage of AirAsia Points is used to redeem free flights or free hotel stays. Their other vouchers or gift redemption is not attractive enough for me to redeem with my points. With the changes in AirAsia’s internal structure from an airline into a Super App, they have launched AirAsia Ride & AirAsia Food where I can use my points to redeem free rides or food. Up until today, I did not use my points to redeem free food or rides. Even with my subscription to AirAsia Super+, I did not purchase any food or rides as there are lack of drivers, choice of food & promo is not as good as Grab.

With the pandemic over & we are good to travel again, this card is truly a gem for me especially since I can redeem free flights or hotels. Since 2019, I have managed to redeem 1 flight to Kuala Lumpur, 1 flight & hotel stay in Kuala Lumpur, 1 flight to Vietnam & recently, I managed to use my 90,969 AirAsia Points to pay 37% of my return flight to Japan. I only have to pay RM1,567.71 for my flights with some upgrades on the seats & also luggage due to long hours of traveling.

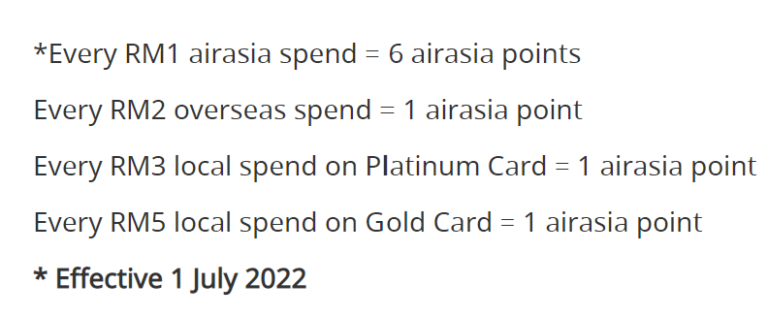

The collection of AirAsia Points is not as hard as what you think it is, especially if you are an AirAsia Platinum credit card user. Since my average usage of credit card is high, I can easily accumulate more than 1,000 points each month. With the bonus of 5,000 points when I spend more than RM5,000 per quarter calendar, I have no other reason to not spend with my AirAsia credit card. Aside from that, in order to get a waiver for the annual fee, I have to spend a minimum of RM20,000 in a year. Since I am using their platinum card, I am automatically upgraded as an AirAsia Platinum member where I can enjoy priority boarding & Xpress Baggage for my flight. It has been definitely helpful so far when I travel as I can skip the long lines during boarding & get my luggage the soonest upon arrival.

My view on credit cards is always a love-hate relationship where I love it for the convenience & perks but I hate it when I abuse it. My mismanagement of credit cards in the past has caused me to go into bad debt twice & to avoid things like this to happen, I have developed the habit of overpaying to avoid any debts. But, the perks of the AirAsia credit card are definitely a plus point for me as I have managed to access all different types of benefits from it. It is definitely recommended if you love traveling. Just take note of the annual fee which you need to have a minimum spending of RM10,000 for the Gold card or RM20,000 for the Platinum card in order to enjoy the annual fee waiver of RM200 (Gold card) & RM350 (Platinum card). Aside from that, this is definitely one of the best or the best credit card for traveling in Malaysia.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?