With the discontinuation of the AirAsia credit card, I was struggling to find a replacement credit card that is able to suit my lifestyle. While the Sutera credit card is an option, I find it to be rather a mediocre card for my needs. Perhaps for some users, this is the best credit card of their choice but for me, I made a decision to explore around to find the best credit card that is able to suit my lifestyle. This was not something that I learned in the past. When I was younger, all I did was apply for a credit card for the sake of owning a credit card without knowing the perks of it. I don’t even know the perks of my first 3 credit cards.

To help with my decisions, I have researched multiple credit cards based on my few criteria. Since I love to travel, it was easy to narrow down the best card that has travel perks. One of my few criteria was access to Plaza Premium Lounge. There are multiple credit cards that are offering free Plaza Premium Lounge, but they have different locations that you can access & limitations on the number of times you can access per year. There is also some travel credit card that offers free travel insurance for their users which can be also a value add to some users that want to have free travel insurance. Some other perks such as the Annual Fee waiver or even a Grab ride discount are also perks that were offered by different credit card companies. For travel credit cards, their main perks are usually their Airmiles conversion based on the points that you accumulate from your credit card spending. The more you spend based on the credit card retail category, the higher your points will be.

To be honest, most travel credit cards offer around the same perks as per another & it is really hard to find the most outstanding ones compare to other competitors. Since most of them offer around the same perks, all I have to do is to narrow down the one that suits me the most. For Plaza Premium Lounge, some credit card companies offer only access to the Malaysia lounge, some offer only KLIA Premium Lounge & some other cards, they are offering more locations worldwide. Since I am based in Penang, those credit card that offers Premium Lounge in KLIA only is definitely out of my selection. As for Airmiles, there are some credit card companies that offer better points conversion to different airlines but the difference is not really significant.

After thorough studies & surveys, I have narrowed down my choices to 3 different credit cards that I find to be the ones that suit me the most.

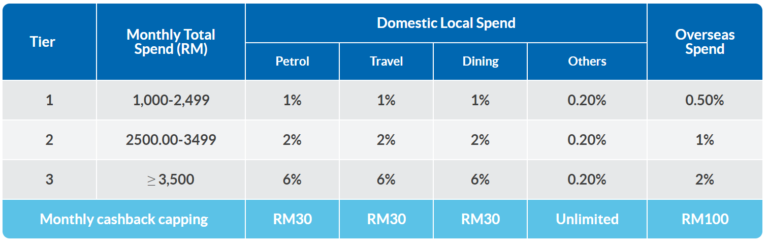

1. RHB World Masters Credit CardThey offer 5 times complimentary access to Malaysia Plaza Premium Lounge annually, travel insurance & they offer cashback for all your spending. The best part of all, they offer a free Annual Fee without any minimum spending per annum. You can refer to their cashback details below:

2. HSBC Visa Signature Credit Card

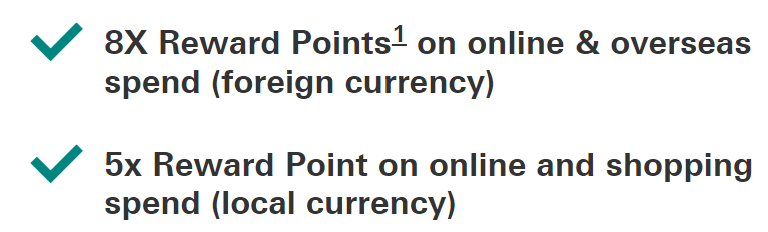

They offer 6 times complimentary access to Plaza Premium Lounge in selected locations in KLIA, Singapore & Hong Kong. Based on your spending of RM1 on oversea or online currency, you get to earn 8x Reward Points & for local spending, you will earn 5x Reward Points.

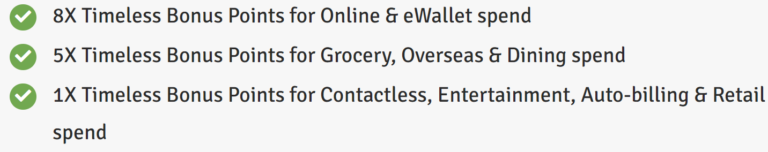

3. Alliance Bank Visa Infinite Credit CardThey offer 2 times complimentary access per annum to Plaza Premium Lounge where they cover more than 100 locations worldwide. They are charging an Annual Fee of RM438 per annum but that can be waived when you spend RM12,000 per annum. They are also offering Timeless Bonus Points (TBP) which you can use to redeem airmiles or other products & services with no expiry date. That also means that you can collect it over the years & not worry about the expiry date. Since we are now mostly spending online & top up our e-wallet with credit cards, it is easy to achieve 8x TCP.

So which credit card did I choose? I actually selected the Alliance Bank Visa Infinite card as that card is the best choice for me. First of all, the selection of Plaza Premium Lounge is more & I treat it as a bonus for myself since most of the time I travel in pair or a big group. I definitely won’t use that frequently unless I am traveling alone. Secondly, among the 3 cards, the Alliance Bank credit card is the only card that offers Airmiles redemption for AirAsia. Comparing both HSBC & Alliance points systems, it is easier to earn higher points to redeem any rewards with the Alliance credit card. The best part of all, Alliance’s card Timeless Bonus Points (TBP) have no expiry date. With the Alliance card, I can continue to still claim my AirAsia points to redeem free travel like how I used to do with my old AirAsia card.

My experience applying for the Alliance card has been both good & bad. The good thing was, the salesperson in charge was very responsive & accommodating. I was requesting for early delivery of my card which I received 2 days after it was approved. The only bad thing was, I had to go to the bank to print my EPF statement using their computer. It has been almost a week since I’ve gotten my card, aside from the perks, this card is the most beautiful credit card I’ve seen or owned so far. In my initial experience using the credit card app, it is not as good as other credit card apps I’ve used so far such as Citibank or Hong Leong app. The reason is, the transaction was not shown immediately or it is not even reflected after 48 hours. All I am seeing is my credit limit reduced but I was unable to see the transaction details. My 4 day ago transaction was still not reflected in the app transaction details. I have not faced such a situation with both Citibank or Hong Leong app. It is still early to tell since I am still new to the credit card & the app. Will share more details once I am used to it.

As for the rest of you, what can you do to select the best credit card for yourself? To help you to select the best credit card, you have to understand your lifestyle in order for you to select the best card for yourself. Do you travel oversea often? Do you travel a lot by car that your petrol consumption is high? Do you prefer to have a credit card that offers you cashback for your spending or do you prefer to have a credit card that offers you reward points that you can use to redeem something later on? Those are some of the questions that you need to ask yourself when you apply for a credit card. Once you have decided on the type of credit card that you want to apply for, next you have to survey the best comparison websites that can offer you the best credit card application deals. Different websites offer different deals therefore you should compare them before you start applying for the card. Some smart consumers will even go the extra mile to apply for a new credit card just to redeem some gift. It sounds like a hassle but there are some people who do it & they cancel the card once they have redeemed the gift.

Credit cards can be your best friend or your worst enemy. No matter what, you have to spend wisely to ensure you don’t fall into any type of credit card debt.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?

Hi, does the 8x points applies for all online transactions or just online shopping at shopping websites? (except gov body or utilities) how’s your experience so far?

it applies for online transactions & e-wallet reload. I have also written on my thoughts on their card as below:

https://theblackbeltmillionaire.com/my-honest-review-on-alliance-infinite-credit-card/