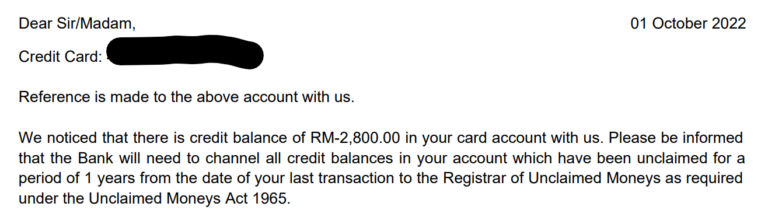

Recently, I received an email from Citibank on my unclaimed money even though I have stopped subscribing to any of their services for a while now. This email surprised me, especially since I had already canceled my credit card 3 years ago with them. My first thought was that it was a scam since there are so many scams out there right now & when I canceled my card, the customer service team did not notify me that I have extra credit on my card.

Upon verifying the email source & cross-checking my old credit card number, it seemed that the email was from actual Citibank instead of any potential scam out there. With the recent scam that I heard from many friends & from the media, these scammers can easily access your bank account login & change your contact number to their contact number to obtain TAC number. It is too complicated how those scammers managed to scam & steal money from your bank account which is why I am truly careful before I open the attached file or call any of the numbers provided in that email.

I proceeded to call Citibank call center and I was also quite cautious, but the customer service definitely doesn’t sound like a scammer due to their professionalism. After receiving too many calls from “LHDN”, “Bank Negara” & other “government-related agencies scammers”, I am able to differentiate between scammers & actual agencies or companies by the way they speak. Most scammers are not able to speak proper English & for some reason, their Bahasa Melayu sounds like Bahasa Indonesia. Anyway, I have verified & confirmed that it was the money I overpaid years ago.

I remembered that I actually activated this card in October 2017 after my business trip to Singapore where the hotel insisted that I provide a credit card upon check-in as they do not accept debit cards. There was a period where I was not able to apply for a credit card due to my history of having high debt & it came to a point where I was functioning without a credit card. Everything was fine until I realized I needed to have a credit card to make my life easier. Prior to my Citibank card, I had 3 credit cards for which I have issues of overspending and it has caused me to avoid having a card as I was afraid that I would not be able to control my spending again.

Due to my bad credit card history, I have decided to develop a habit of overpaying for all my credit card spending. However, overpaying it by RM2,800 was definitely shocking for me too even though I was only using it for 2 years. I have to admit that at one point in my life, I despised credit card due to the bad history that I had with them but as of now, credit card is definitely my best friend especially since I am able to enjoy the perks that my card provide to me while I am still overpaying it out of fear. Assuming that I am spending RM103 on my card today, I will be recording it manually on my notes that my spending is RM110 & the estimated amount that I am potentially overpaying each month is between RM100-RM200. With that way of paying, I will not have any fear of underpaying & whenever I notice that there is an accumulation amount that I overpay, I will be using that to splurge on something I like.

Since I canceled the card in October 2019, the letter was issued to me to claim the money before 1st January 2023 or it will be transferred to the Registrar of Unclaimed Money. Thankfully I managed to contact Citibank before it was transferred or else, it will be a hassle for me to claim my money. Upon providing my bank account details to them, they are supposed to credit the amount of money back to my bank account within 3-6 working days. That cash will definitely be used to invest in some stocks that I am observing right now rather than it be used to splurge as the current economy provides many good opportunities to invest. We are entering a recession period & this is the best time for us to invest.

OSS!

You can also check out my latest YouTube video on How To Invest Like Warren Buffett: