There are multiple sources have mentioned that we are entering a recession soon. Recession periods are usually tough periods for many as we will be seeing the global economic downturn, higher unemployment rate, high inflation rate & bear market. It is truly an uncertain period of time from the trade wars between China-USA, covid-19 pandemic to the Ukraine-Russia war.

As an investor, what are the possible ways for us to gear up towards our investment portfolio with the recession around the corner?

1. Stay Invested For Long Term

Whether you are in a recession or not, always invest for the long term. Warren Buffet once said, “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

2. Stay Calm Recession periods are usually tough for many of us, especially because they may affect some of our businesses or jobs. The market will also be affected by it & you will see your investment value drop. Most important of all, don’t panic. Past history has proven that the market will usually recover over a period of time.

3. Use Dollar Cost Averaging (DCA) It is a good strategy that you are investing the same amount of money over a period of time. Regardless of whether the market is in a downturn or upturn, it reduces the impact of volatility on your investment for the long term.

4. Search For Bargain Stocks There is a quote by Nathan Rothschild that says “Buy when there’s blood in the streets.” During this period of time, we are able to find many good company stocks that are being sold at a bargain price. Many successful investors are able to make money by buying cheap bargain stocks during the recession period.

5. Invest In The Right Sector There are multiple sectors that will not be affected by the recession. For example, industries like healthcare may not be impacted by it as whether it is a recession or not, you will still visit doctors or still consume medicine whenever it is needed. It is the same goes for food. People will still eat despite whether it is a recession or not.

6. Invest In The Right Company Search for the company based on its balance sheet. Companies with a strong balance sheet, low debt, profits & strong cash flow will definitely be able to endure during the recession period.

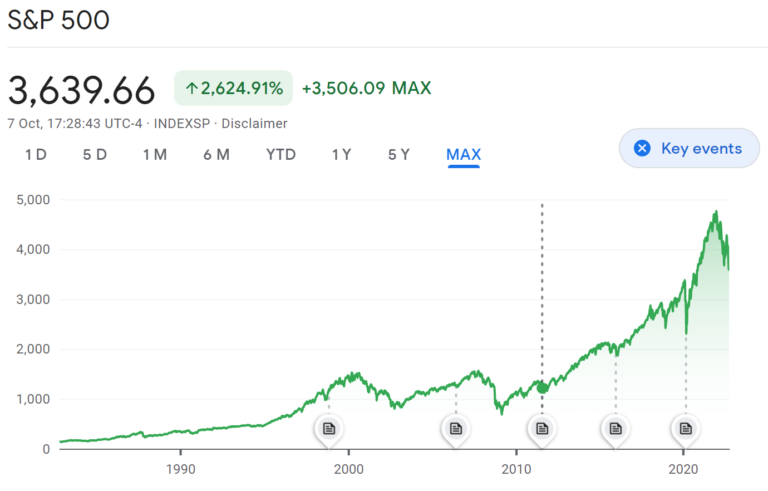

7. Invest In Index Fund Whether it is a recession or not, the market will always recover & hit an all-time high. Based on the past history of the S&P500 since the early 90s, the market tends to recover over a long period of time.

8. Search For Alternative Investment Alternative investment such as gold is a good options to gear up toward the recession. It is also a good form of investment that is used to hedge against currency & inflation. You can also check out Ray Dalio’s All Weather Portfolio which is designed to combat the market despite any situation.

Conclusion:

No matter what, we are not able to predict the future or how the market will be. Rather than us trying to time the market during this period, it is best to stay invested & invest based on your personal risk tolerance. In an economic downturn or recession, cash is king. You should also plan ahead for the situation & focus on long-term investment while allocating a certain amount of cash. Cash can be used as an emergency or it can be used to invest if there is any bargain in the market.

OSS!

You can also check out my latest YouTube video on How To Invest Like Warren Buffett: