Is it realistic for us to be a millionaire someday by just relying on our savings? Most of us are conditioned or encouraged by the public or family to start saving when we are young in order for us to retire comfortably in the future. Usually, the tips that we are getting is a general tips without any actual plan or amount that we may get by our retirement age. Whatever it is, they are right that we should start saving at a young age &, if possible, start investing as early as possible too.

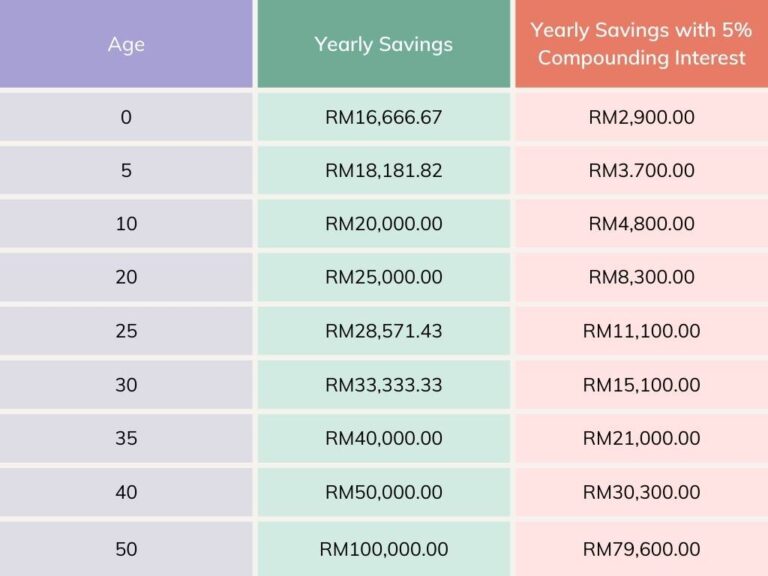

Most of us want to have a comfortable life when we are retired & based on the retirement age of 60, the more we have the better it is for us. If you are looking to retire a millionaire by age 60, how much do you think you need to start saving from a young age? Based on the below chart, I have come out with a calculation to share with you on the actual saving amount that you need from the time you were born to the selected age for your reference. In another column, I have also shared how much you actually need to save with a 5% of annual compounding interest each year.

From the chart itself, we can witness the power of compounding interest when you start investing at an early age. Assuming likely you are a parent & you want to start saving on behalf of your kids when they are born up until they are able to save when they start to work, you need to save RM16,666.67 yearly or RM1388.89 each month for 60 years in order for them to be a millionaire by 60. That is based on only cash savings with no interest. But if you decide to allocate their money into any investment that can potentially generate a 5% annual return yearly, all you have to do is to allocate RM2,900 yearly or RM241.67 monthly & they will likely be a millionaire by 60 years old.

How Much To Save Yearly To Be A Millionaire At 60 Years Old?

The older we start to save or invest, the more money we have to save or invest in order for us to be a millionaire by 60 years old. Perhaps for some young parents out there, planning for your kids at an early age can be really helpful for them for their future if you start to plan at an early age for them. Over the years, I have spoken to some parents who are using investment platforms such as FSMOne or StashAway to allocate investments for their kids by allocating a certain amount of money on monthly basis. This will definitely help them when they start to take over their investment portfolio at their eligible investing age.

For adults that have just started to work at 25, if you are allocating your cash without any investment, you may need to save as much as RM28,571.43 annually or RM2,380.95 each month. That amount is quite unreasonable to save especially for young adults that just graduated & starting to work. If we look at young adults that start to invest at 25 with a potential 5% annual compounding interest, they just have to save RM11,100 annually or RM925 each month. To be honest, saving RM925 each month sounds more doable than saving RM2380.95 each month. Do you think it is possible? I definitely think it is possible.

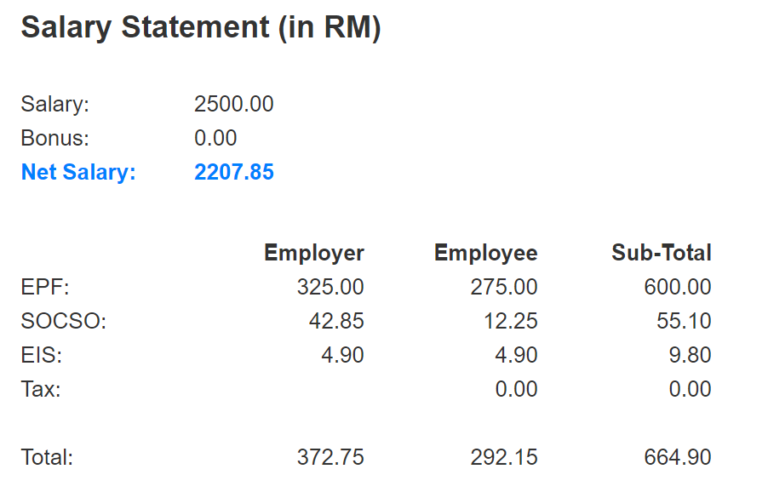

Let’s say you are earning RM2,500 when you start to work your first job. Your EPF deduction & employer contribution alone is already RM664.90 & all you have to do is invest the balance of RM260.10 into any investment platform of your choice such as Private Retirement Scheme (PRS), Mutual Funds, or even Robo-advisors. EPF also pays an annual dividend which averages around 5-6% for their members. Over the years as you are progressing in your career, earn more & allocate more money into investments, you will be able to be a millionaire before the age of 60 depending on the amount you allocate for your investments.

Cash savings is definitely not helpful if you are just saving without putting it into any platforms that are able to generate any interest in your money. Many people always mentioned that they don’t know how but don’t know is an excuse for people that are not willing to learn. If you don’t know & you are not willing to take any risk, your best bet is to place your money in a Fixed Deposit (FD). If you are willing to learn & take more risks, there are lots of investment platforms out there that can help you to generate a reasonable annual return each year.

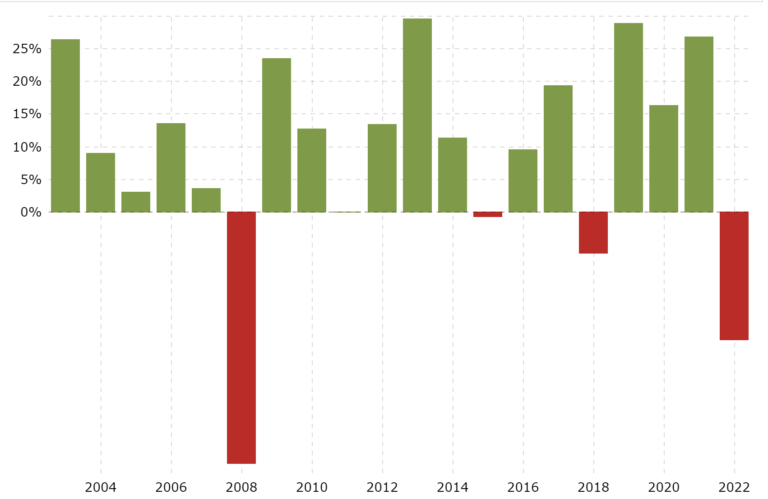

Now that you are convinced that it is doable to be a millionaire by 60 years old, what is next is for you to plan how can you achieve it. As I mentioned earlier, EPF is a good & stable platform for you to generate a good annual return each year. On top of that, you can also look into other investment platforms that can help you to generate a good investment return. The above graph is the annual S&P 500 return for the past 20 years & among those 20 years, only 4 years are years where they are generating negative returns & balance of 16 years has shown an average return of 10% or above annually.

At whatever age you plan to start, it is never too late since you already have a base with your EPF savings & all you have to do is allocate your money into any investing platform that can help you to generate an investment return of 5% or more. The guideline chart is a good reference you can use to plan how much you need to keep in order for you to be a millionaire by 60 years old.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?