In my previous post on Is “Buy Now, Pay Later” Good For Malaysians, I shared my view on how I think it is good if we can use it well & how it is terrible if we abuse it. In today’s post, I will share my view on “Save Now, Buy Later” (SNBL). Recently, I stumbled on this post on an app called Sugar. As it is pretty new, it is tough to get much information on them, and even when I searched on Google, most of my search results were related to Sugar Daddy/Baby or even Sugar-related results. LOL. Anyway, I have installed the app & did some research on it.

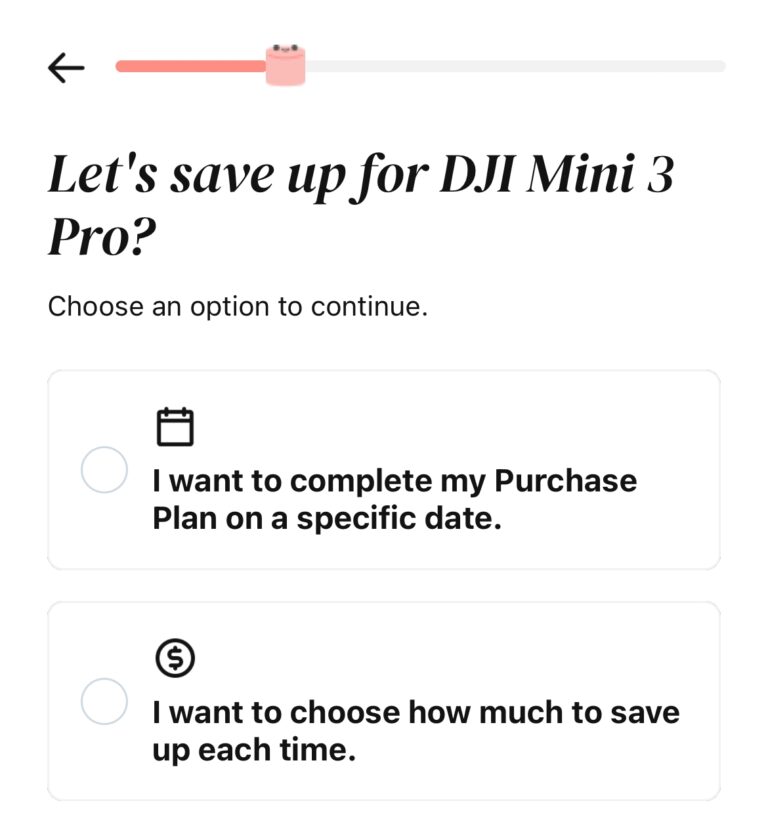

There are a few things that caught my eye which are on their cashback when you save up to buy. Since this app is new, there are not many vendors available at this moment(approximately 10 vendors). Aside from that, they are having few different payment plans that you can customize to suit your budget & targeted timeline for your purchase. I have tried a sample purchase for a DJI Mini 3 Pro & based on that purchase, I can choose to complete my purchase on a selected date or I can choose how much to save. As for the payment timeline, it varies from weekly to monthly.

Is It A Gimmick?

It actually depends on how you actually see it. I don’t find much difference between BNPL & SNBL at this point. Perhaps my understanding is wrong but I don’t see much difference in it. For BNPL, you get to have the products on the spot while for SNBL, you only get the product after you complete the purchase. Perhaps for SNBL, it can be a good thing that if you somehow can’t afford to pay, you might need to forfeit the items. But it also depends on how you actually link the payment to both BNPL and SNBL apps. If you are linking your credit card, there is not much difference when you use BNPL or SNBL since the end of the day, you are paying everything back to your credit card. It requires discipline to control your credit card spending. It also makes no difference if you are linking your debit card with both BNPL or SNBL since it is deducting directly from your debit card which means you have to ensure your debit card has extra cash. End of the day, it really goes back to your spending habits to determine which is the best option for you.

Is It Good Or Bad?

Personally, I will use BNPL or SNBL if both apps or companies offer a good deal on the items. I have personally saved money using BNPL in the past, therefore, I think you should explore how can you use both BNPL and SNPL to your advantage especially when it comes to their reward or cashback program. As mentioned earlier, it is bad if you don’t have proper planning on how to pay but if you have proper planning, both BNPL and SNPL are actually good for you especially when it comes to their reward or cashback. Use both to your advantage & you can definitely save money from them.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?