Credit Score is a score on how healthy your financials is based on your payment behavior and a prediction of how likely you are to pay a loan back on time based on information from your credit reports. It is based on your credit or payment history related to credit cards & loans. To keep it simple, your repayment habits & amount of debt will determine how high or low your credit history score will be.

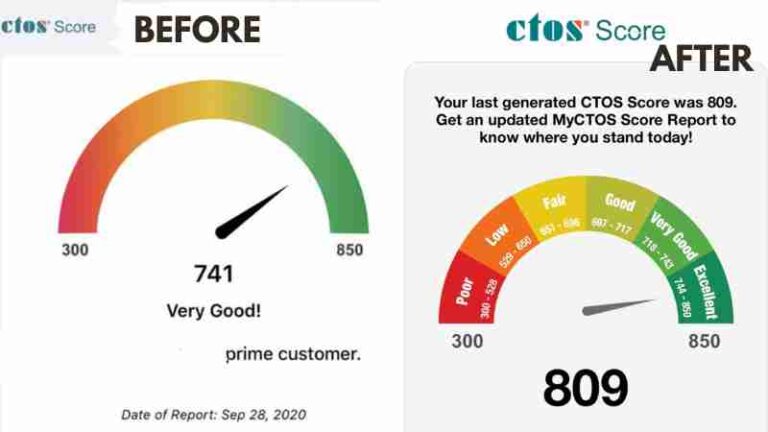

Recently, I have done my checking on my credit history out of curiosity to see what is my recent score. The result is a reflection on how much I have gone through from being in high debt with poor financial management to have no credit card debts or financial issues. The last I checked was prior to purchasing my car, my credit score was 741 which was considered good at that point. The good thing is, my loan approval took less than 24 hours due to my good credit score. 2 years plus later, my credit score has improved from 741 to 809 & the status has changed from Very Good to Excellent.

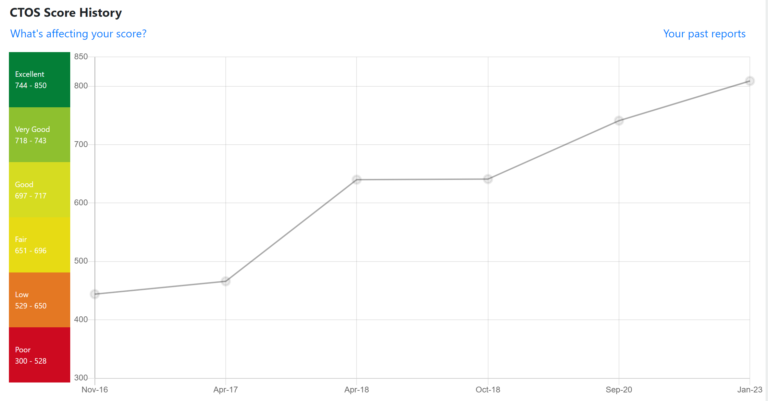

When you look at my long history of credit scores, it took me 6 years plus from Low to Excellent. Even when I started BBM blog, my credit score was only Good. Guess with my good financial habits, I have managed to improve my score over the years.

Why Do You Need A Good Credit Score?

A good credit score will help you to have a faster loan or credit card approval. Aside from that, you can have more room to negotiate for better interest for both credit cards & loans. If you are seeking to borrow a higher amount of loan or even higher credit card limit, a good credit score plays an important factor as well.

Having a good credit score is built over a long period of time & in order for you to have a good credit score, below are some of the ways & habits that can help you to build a good credit score.

1. Paying On TimePaying your loan & credit card on time plays an important role to have a healthy credit score. To ensure you pay on time, you can actually have a scheduled repayment ahead of your actual date to ensure your payment is made on time. As for your card, always pay before the repayment due date.

2. Plan Your Repayment Based On Your Current IncomeThis is a good habit that I practice over the years. While I am trying to limit my expenses & loan amount, I am also calculating the amount of loan that I am taking in advance to ensure that I am able to pay it over a long period of time. For example, for my car purchase, I am taking a 5 years loan to save on bank interest & with that shorter period, I have to pay more compared to 9 years loan. I have to make sure that I can afford to pay my car loan in that 5 years by not planning on my future income but plan based on my current income. We won’t know what will happen tomorrow, therefore, we have to always factor in the worst-case scenario to ensure we minimize any loss or income risk.

3. Always Pay ExtraI have a habit of rounding up my credit card repayment which can be a good or bad thing. By doing so, I can ensure that I won’t miss any payment & over a long period of time, I can use that extra money to “redeem” anything that I want. It is an optional habit but I find this to be a safe option for me to not miss or overlook any payment.

4. Do Not Spend Unneccasarily With Your Credit CardBased on my understanding, your credit score also will be affected if you spend an amount close to your credit card limit. Not sure how true it was as there are times when I am making some big purchase for my business that is close to my credit card limit but I do pay it back after a few days. If you are making any big purchases that are close to your credit card limit, make sure you pay it back before the repayment due date to maintain a good credit score. Another important tip is, you need to ensure you pay everything off & do not pay the minimum as it will lower your credit score.

5. Check Your Credit Score FrequentlyWhen I mean frequently, I think it’s good to check it at least once a year to ensure your credit score is good. Based on the report, you will also find some details such as how much you owe for your card & loan. You can also have details on your bad repayment details if you have any. If your current credit score is Fair & below, you should check it every 6 months if you are looking to improve your credit score.

6. Maintain A Long Term Good Credit HistoryIt took me years to improve my credit score & to achieve it, I have changed my spending habits & cleared off all my credit card & other loan debts. It is not easy but it requires a long-term habit to achieve it.

Conclusion:

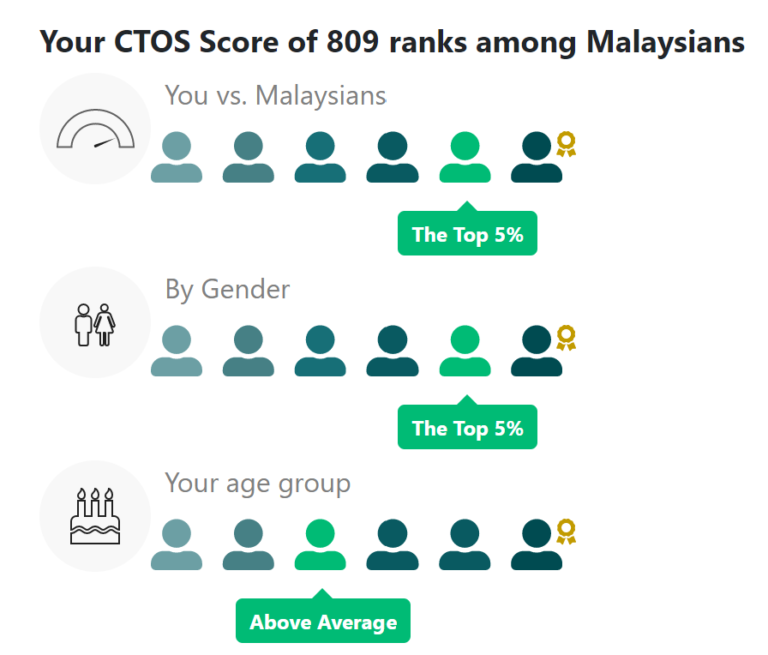

These habits of having good credit scores will help you with your future application that is related to credit or banks such as credit cards & loans. Aside from that, a good credit score is also a reflection of how healthy your spending habits & money management are. With my current credit score that I have, I am very sure that my application for credit cards or loans will be easier & faster. My ranking among Malaysians is quite high especially since I am in the top 5% of my ranking. Hopefully, in years to come, I can be the highest ranking for my credit score.

If you have a low credit score & having issues with your debt repayment, you can check out my previous post on How To Pay Your Debt Fast.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?