Hello Grasshoppa,

Recently, Touch’nGo collaborated with Principal Malaysia to launch GO+, an e-wallet solution to disrupt the e-wallet market. The good news is, you get to grow your e-wallet credit while spending it. It is a low-risk investment that allows users to earn daily investment return with your e-wallet balance.

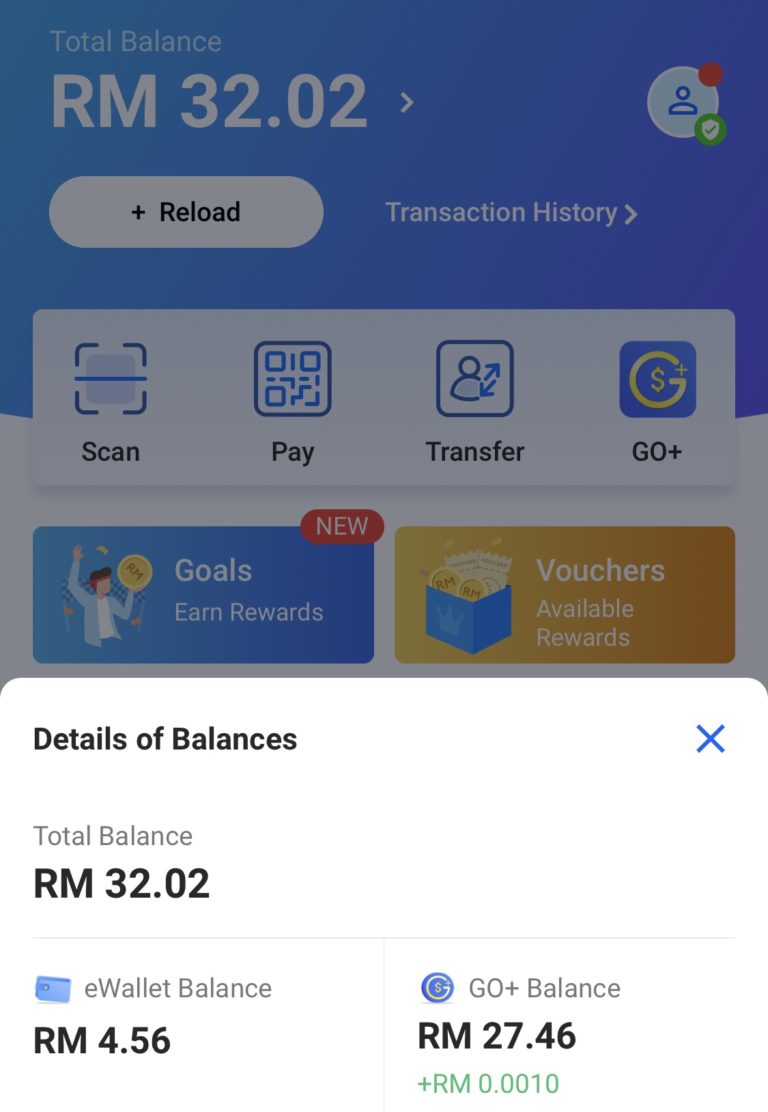

To start, you have to register as a GO+ user in the Touch’nGo e-wallet app & you are ready to earn. The minimum investment amount starts at RM10. As an inactive user of Touch’nGo e-wallet, I will usually transfer RM50 on a monthly basis. My average monthly budget for an e-wallet is RM400 where I will split between Boost (RM50) & GrabPay (RM300). After registering for GO+ & topping up money in the account, I realised that my Touch’nGo previous balance did not transfer along & it remains separated for both. Their maximum limit for GO+ is RM9,500 which is a bonus if you’re making huge purchases via this mode of payment.

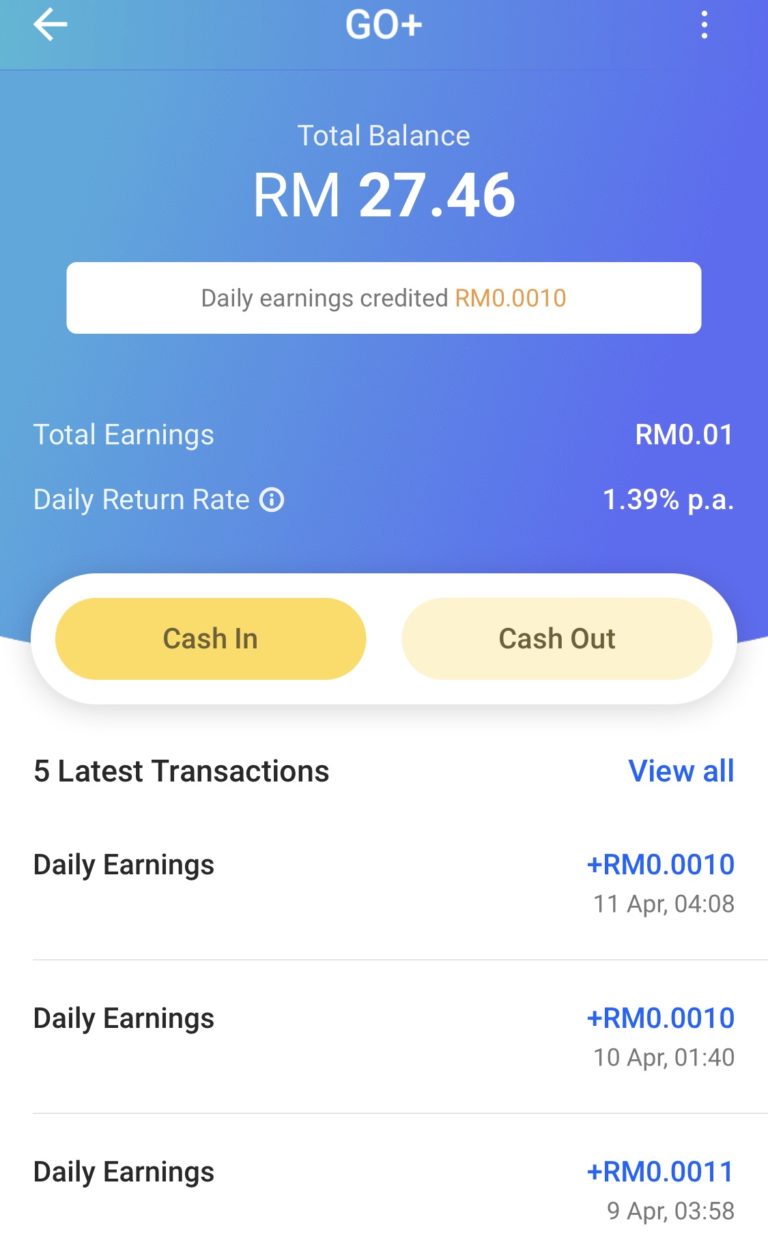

The daily return as of my writing is 1.39% per annum but there is also a Management Fee of up to 0.45% per annum & a Trustee Fee up to 0.03% per annum. Their daily return also varies within the few days that I have invested & it went between 1.39%-1.47%. Comparing to Fixed Deposit and StashAway Simple, both projected returns are slightly higher than GO+ but the benefit of GO+ is that you get to spend it anytime as long as the minimum amount remains at RM10. As you can see below, my total earning so far is RM0.01 since I registering on 1st April 2021.

I did a bit of research on where our GO+ money will be invested based on the prospectus for Principal e-Cash Fund & below is my findings.

- Money Market

- Deposits (Cash at the bank)

- Debt Instruments

- Other forms of investment permitted by the Securities Commission of Malaysia

You can also read the FAQ if you have further questions on GO+ & the fund.

My Thoughts :

I personally like the concept of investing while spending money but the return amount is too little for me to consider switching my spending from other e-wallets to GO+. Since I am a heavy user of GrabPay, the cash rebate that I can get from the points or rewards is definitely more worth it comparing to the investment return of GO+. I will still use GO+ every now and then as I look forward to seeing more investment return from them despite the minimal return. It still gets me excited with that small return. Perhaps in time to come, I may increase my spending with Touch’nGo if they have more features that can match my current preferred e-wallet.

OSS!