On my latest holiday to Thailand, I managed to use my Wise Card to help my traveling in terms of better exchange rates & also cash withdrawals. Over the years, I have been using my BigPay & AirAsia credit card for my traveling & holiday, but with the benefits featured on the Wise website, I have decided to try it out. The overall verdict is, it is not as good as what was featured on the website.

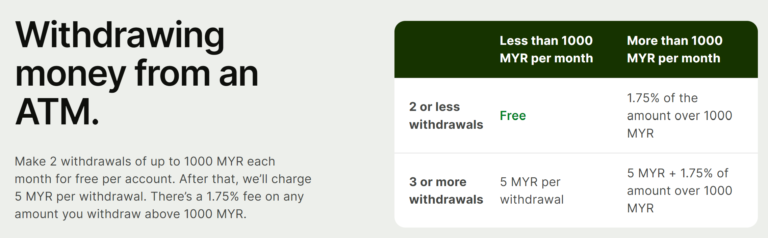

Based on the featured details, one of the benefits was a free withdrawal fee when you are overseas but based on my attempt to withdraw cash in Thailand ATM, I had to pay THB230 per withdrawal. After checking while writing this post, it seems that all foreign cards will charge around that amount for each withdrawal. Maybe it is my misunderstanding that I think that the free withdrawals of RM1,000 per month apply to overseas withdrawals as well but the funny thing is, why would I apply for Wise & withdraw money from the card in a local Malaysian bank? It doesn’t make any sense.

Aside from cash withdrawals, I have also faced issues with card payments at least 5 times in multiple places. By trying to pay wave & also pin payment, there were multiple times when the merchants had trouble reading the card & process the payment. This resulted in me using my AirAsia credit card to make payments which have zero issues on the wave & also pin payment.

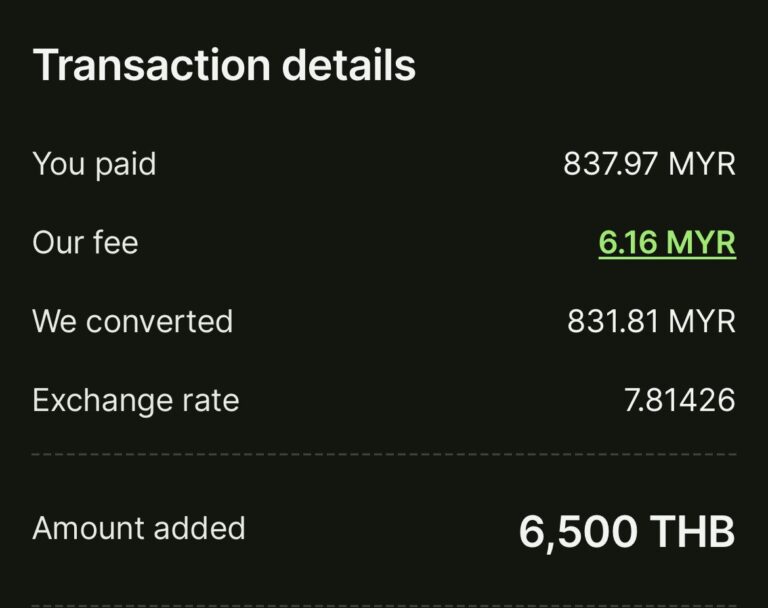

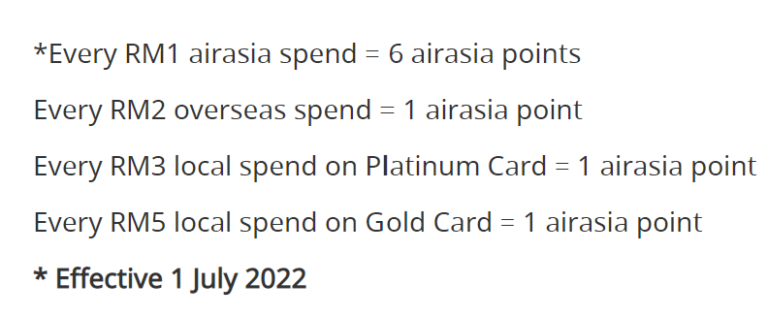

In total, I have converted RM831.81 to THB6,500 while paying a fee of RM6.16. I have to admit, compared to my credit card exchange rate, Wise Card has a better exchange rate but the card payment can be an issue during some of my payments. I would rather pay slightly more to have a smoother payment experience with my existing credit card. Aside from that, my AirAsia credit card allows me to earn 1 AirAsia Point for every RM2 overseas spent. That point can be used to redeem multiple benefits such as flights or rewards which I will be sharing in my new post.

Overall, despite having some hiccups with my Wise Card due to the withdrawal fees & payment issues, I managed to spend the majority of the amount with the balance of THB3.70 left on my Wise Card. I have another planned trip in August abroad, but I don’t think that I will be using Wise Card for that trip to avoid any possible inconvenience during that trip. Anyway, my personal experience may be different from others as I have heard many good reviews from my personal friends on this. Perhaps it is just my luck when it comes to the payment transaction or maybe it was also due to mistakes made by the staff during the payment.

Aside from multi-country cash withdrawal benefits & card payment benefits, Wise also have international money transfer that can benefit people living in 2 different countries to perform fast & secure money transfer with competitive price & exchange rate. I have not explored those benefits yet at this moment but maybe it will be a benefit that I can use in the future.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?