In my upcoming holiday, I am looking for ways to save more money for my back-to-back holidays. I will be traveling again soon to another 2 countries & saving extra cash is crucial especially since my holiday gap is 3 months from each other. One of my challenges in saving extra cash is, I have fixed investment planning where I maximize my savings to invest. Using those funds to travel is definitely not something that I want to do since that fund is meant for my retirement planning.

Since I don’t plan to touch my investment funds & I’ve been maximizing my income to invest, there is not much allocation that I have to save for my holidays. On average, I can allocate around RM500-RM700 each month to save for my holiday. Traveling to countries within South East Asia may not cost that much & within 3-6 months, I am able to save to travel to any country within South East Asia except Singapore due to higher currency exchange. Whenever I decide to travel to selected places, I will be purchasing a flight ticket followed by accommodation. Cash expenses will be saved subsequently in the next few following months. For example, if I am planning to travel to Bangkok & my allocation is RM500 this month, I will be using that money to purchase my flight ticket first. If there is any balance, it will be carried forward to next month. Assuming the flight cost is RM400, I have a balance of RM100 from this month to be carried forward to next month. When the following month arrives, I will be using that RM100 from last month to add to the RM500 allocation for this month to purchase accommodation. If it cost more, I will carry forward that RM600 to the subsequent month & when that month arrives, I will have RM1,100 for accommodation or cash allocation.

That step applies easily to countries within South East Asia. For my upcoming trip to Japan, it has to be planned differently since the expenses are higher & I am looking for extra ways to save more. This extra way was inspired by a book that I’ve read called The BJJ Globetrotter where the writer was saving his cash to travel the world for 140 days. If you are into Brazilian Jiu-Jitsu & traveling, this is a book to read. Anyway, one of his methods to save was to save extra from his current fixed expenses such as his utility bills & food. After reading that book, I have also gone through some extra savings by downsizing my overall expenses. Since these savings can only be saved after my spending, there are months when I can see a saving of RM300-RM500 extra by the end of the month. These savings can be used to fund my upcoming holiday in Japan.

Aside from that, my AirAsia credit card is the best economy travel credit card in my option. First of all, it is an affordable card for everyone. I have checked other traveling cards but after doing my own research, I find that it is almost impossible to claim air miles unless your job requires frequent trips domestic or overseas where you can spend & claim using your credit card. After my purchase of a flight to Japan by using some of my AirAsia points, I am on track to redeem or get subsidized for my next holiday after Japan since my points are accumulating & up to date, I have accumulated 34,685 points/RM346.85 (as of my writing) since 14 March 2023 when I used 90,969 points/RM909.69 to subsidized by Japan flight ticket. The only less exciting thing about AirAsia is, I don’t get to travel like those influencers who are using the miles point to purchase a business class or first class. I am only able to redeem an AirAsia flight ticket which is an economy flight without a premium seat or premium lounge.

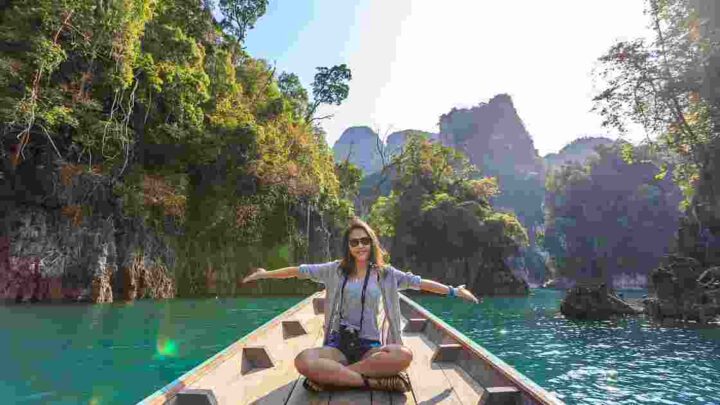

Since the pandemic ended, many people start to travel again which also cause flight prices to sky-high. If you are looking to travel soon, always look into the best way where you can save over a period of 3-6 months while looking for a way to optimize your savings for traveling. It is the best experience that you should explore while you are still energetic. Explore the world, live life to the fullest & start doing it now rather than later.

OSS!

You can also check out my latest YouTube video on Why Do You Need Financial Planning?