Hello Grasshoppa,

We often hear people talked about achieving financial freedom someday & it is often something we hear from someone that does direct selling. Or maybe you’ve heard it from me if you’ve been following my blog. Do you share the same common dream where you plan to retire & won’t have any worries about your finances? It is something that I always thought of & something that I want to achieve by 40. The question is, how can I achieve it? To be specific, my goal is to be a millionaire by 35 & retire at the age of 40 with a minimum of RM4million net worth. PS: I am 33 as of my writing & I am still nowhere near a million but I am optimistic that I can hit RM1million net worth by 35. Fingers crossed.

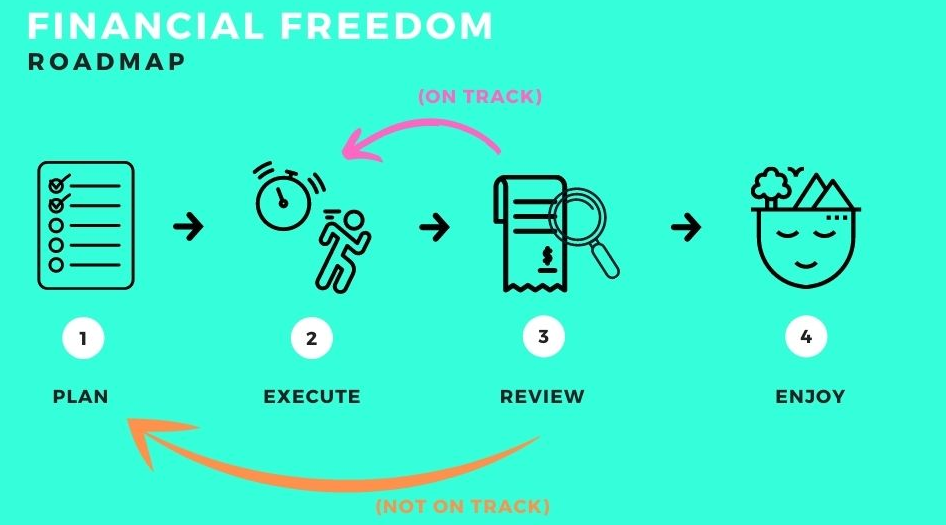

It is easier said than done. In order for me to achieve my financial freedom, I have drafted a Financial Freedom Roadmap which i hope can be beneficial to you as well. These steps include Planning, Executing, Reviewing & Enjoy. Those are the 4 steps that I believe can help me to achieve my financial freedom.

Step 1: Plan

This is the most important step of all as it will determine when & how you can achieve your financial freedom. Before we go further, if you are looking to have financial freedom in your life, have you ever thought of why do you want to achieve that goal? If financial freedom is your goal in life, ask yourself why do you want to achieve financial freedom? My ‘why’ include enjoying life, taking care of my family, exploring the world & training BJJ every day. Ask yourself, what is your why?

Next, when do you plan to retire? Retirement definition may vary from each individual. For me, retirement means I can stop working my 9-5 job & still have a source of income. As mentioned earlier, my expected retirement age is 40 years old. Your planning should have a timeline on when you plan to retire.

How much do I need for my retirement? It can be for both monthly or annually. RM4million net worth was an initial goal that I set for myself with an expected 5% investment return from my investment annually. This is the ideal amount of money that I think is enough to fund my retirement. In your mind, how much do you think you need for you to retire?

Lastly, what are my sources of income? The truth is, if I retire with RM4million with no single source of income, I don’t think that my retirement can last. My expected sources of income are from my current businesses & investment. Now think about it, what will be your source of income when you retire?

Step 2: Execute

Once you have done your planning, it’s time to execute your plan. The most important part of the execution is to stay on the course & to be focus. There might be some hiccups here & there but it is very important to stay on the course to ensure you execute your plan.

Step 3: Review

Your review can be done on quarterly & annually basis to see if you are on the right track to hit the goal. If you are not on the right track, what’s next? What can you do to make it better or change it? Those are all the important questions that you have to ask yourself. It can be in the form of monetary, investment return, your business progress or other. It relates back to those question that you asked yourself during your PLANNING stage.

There are 2 possible outcomes that will happen when you are in the REVIEW stage. First, if you are on track, then you should repeat Step 2 & 3 until you achieve your retirement goal. Second, if you are not on track, you should go back to Step 1 to work on the planning again.

Step 4: Enjoy

When you reach Step 4, it means that you have achieved your financial freedom. It may take years of hard work to achieve it but it will pay off. It’s been more than 5 years since I made the decision to pursue my financial freedom journey from having debt to turning my life around. These 5 years have been an eye-opening journey so far & I am looking forward to reaching Step 4. I hope you are on the same journey & enjoy your retirement life.

This is the quote from Warren Buffett that I set as my laptop wallpaper to remind me on my financial freedom journey.

OSS!