Hello Grasshoppa,

2020 was a rough year for most of us & 2021 seems to be a better year with the vaccine distribution. Soon enough, most of us will be vaccinated & our hope of living the old normal will be back in no time. My overall investment for 2020 was in the red especially for local Malaysian stocks but there were 2 investments that were performing well for 2020. First is my gold investment where I’ve been investing in it for a number of years & I was able to sell 23 grams of it to deposit for my new car. Second is my StashAway investment where I’ve been investing with them since 2018.

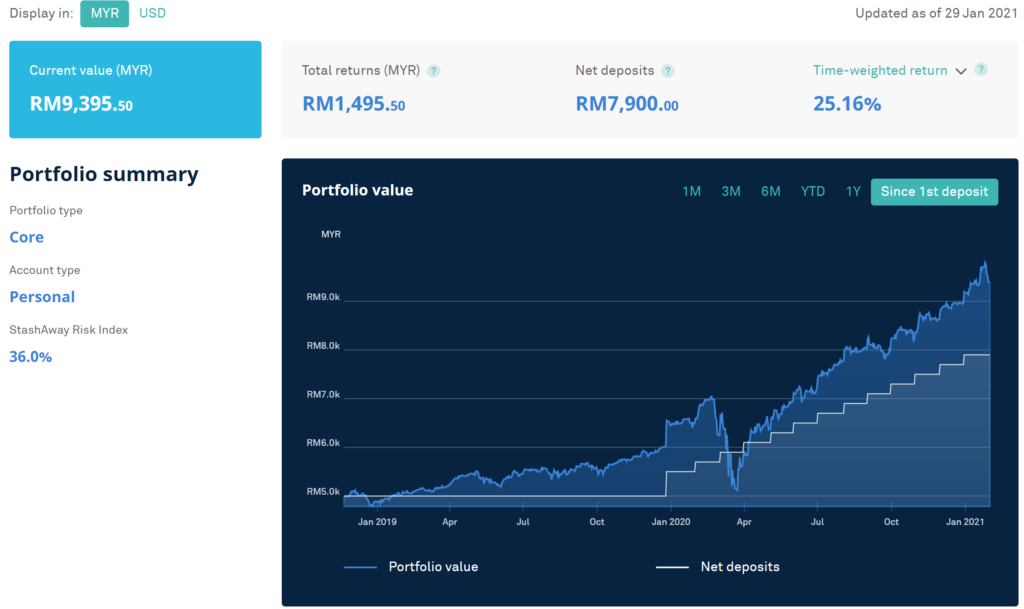

Initially, I was just transferring my investment from my mutual fund account to StashAway & I did not have any Direct Debit set up with them. All I did was invest with them whenever I had additional money. During the end of 2019 after I’d seen their investment return, I have decided to set up Direct Debit so I can get the compounding effect & dollar-cost averaging for my investment with them. Below is my portfolio performance for your reference :

Based on the graph, you may notice that my portfolio performance for March 2020 was underperforming with the start of pandemic & all of us were staying at home with the MCO announcement. At that point in time, I had received notification from StashAway where they recommended me to change my portfolio risk. Initially, my portfolio risk was at 36% until May 2020 where I was recommended to change to a lower risk. I actually agreed to it & from May-December 2020, my portfolio risk index was at 22%. Since January 2021 after the changes of new President of the United States, I have changed my portfolio back to 36% risk index.

What Do I Like About My StashAway Investment?

1. Investment Return

As you can see, I made a 25.16% return with StashAway since 2018. That is a good investment return despite a rough year for all of us.

2. Visibility

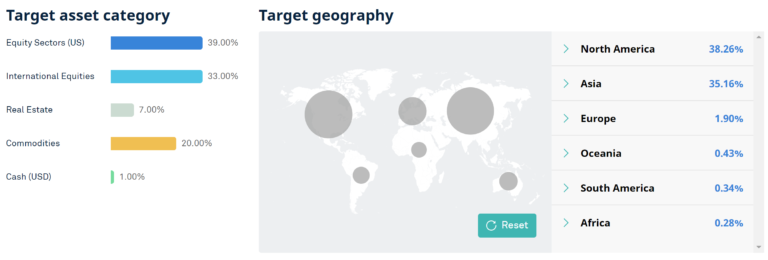

They have the best visibility in terms of where they invest my money & how much they charge to manage my investment portfolio. To view that, you can refer to the transaction column or your monthly statement. You can also view your Asset Category & breakdown to have a better understanding of your investment portfolio.

3. Projection

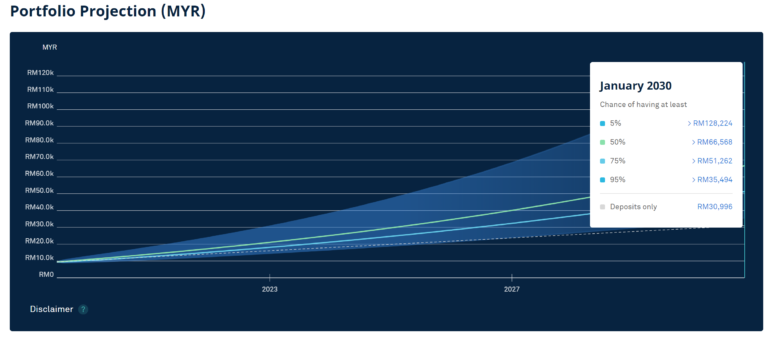

Another feature that I like about them is on their projection. It will forecast how much you may have with the amount that you are investing with them. Looking at my current portfolio projection, with the total investment of RM30,996, I may have a 5% chance to end up with RM128,224 or 50% chance to slightly double my investment. It is all based on the power of compounding interest.

4. Low Management Fee

It is so far one of my lowest cost investments. What I don’t like about mutual fund is their load fee & management fee. Unlike other mutual fund companies, StashAway does not charge any load fee. The average load fee that is charged by the mutual fund companies ranges from 0.5%-5% depending on the company. Imagine investing RM1,000 & you have to pay 5% upfront before you make any profit. StashAway is also charging one of the lowest management fees compared to other Robo-advisors or mutual fund companies.

Conclusion :

Whenever someone asks me which investment I recommend, StashAway is always my first recommendation to them because of the simplicity, visibility & how user friendly it is. As they do not have any minimum investment amount, it is also a good investment platform for students that wants to start their investment journey early with a minimum budget. You may start your investment journey for as low as RM50. Set up Direct Debit & monitor your investment portfolio from time to time. You will be amazed by how much it can grow after a few years.

Click on the link here to register now to enjoy 50% off their management fee for 6 months.

OSS!