My investment with StashAway has always been nothing short of a good experience. When I started investing with them, it was all about moving my investment portfolios from my old Mutual Funds to StashAway. Later on, they have introduced StashAway Simple but I did not invest in it as I personally don’t find anything attractive with it but their recent introduction of Thematic Portfolio has been an exciting addition!

What Is Thematic Portfolios & What Is My Initial View?

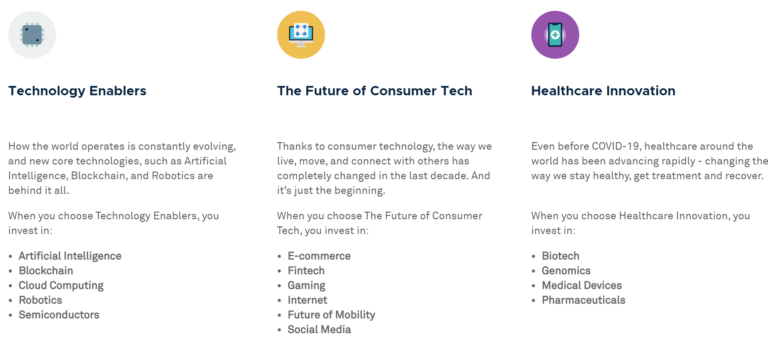

It is a portfolio where you can invest in the trends that can change the world. StashAway have categorized each Thematic Portfolio into 3 different themes which are:

I know how you feel when you are looking into 3 different themes on which one to pick. I felt exactly the same way which is why I have chosen all 3 different Thematic Portfolio to invest in. I personally believe that all 3 portfolios are able to change the world in the future therefore I will be allocating my investment with all of them with a minimum investment of RM50 each per month. Come to think about it, all 3 portfolios have a different edge & all their technology is growing at a steady pace.

Depending on the Thematic Portfolio that you have selected, they will be investing in ETF based on each portfolio. The ETFs are all managed by top fund managers in the world such as ARK Invest, BlackRock & others.

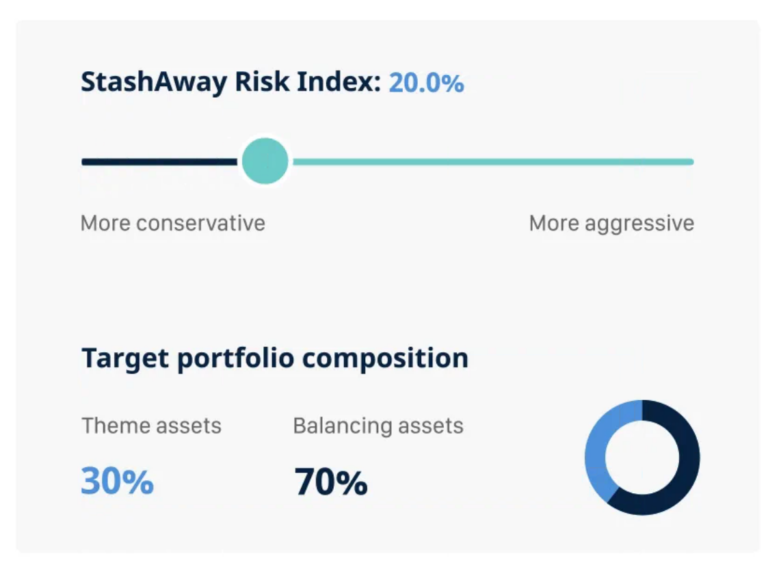

When you have selected the portfolios that you plan to invest in, the next action that is required from your end is to select the Risk Index. Personally, I have selected the most aggressive risk index at 45% where the Theme Assets are higher than the Balancing Assets. Balancing Assets are meant to be balanced investment assets that are non-thematic assets. Depending on the =Risk Index that you select, you are able to minimize the risk accordingly.

My current investment with StashAway is at RM200 per month where my current Risk Index is at 36%. With the add on of 3 Thematic Portfolios, I am adjusting my investment from RM200 to RM100 & I will be investing RM50 for each Thematic Portfolio. That makes my total investment with StashAway increase from RM200 to RM250. If you are an existing StashAway user & you are using recurring monthly transfer, you can either edit your current investment allocation accordingly under the Monthly Deposit plans or you can just top up the amount separately.

The only problem that I faced when I tried to invest in the Thematic Portfolio is the inability to search for it on the website & I can only find it on their mobile apps. Perhaps it is their system issue or maybe I am too noob to find it. LOL.

Conclusion:

As I mentioned earlier, their new Thematic Portfolios really got me excited & I truly believe that it is a game-changing investment portfolio. If you are interested to invest in it but worry about the risk, you can always adjust the Risk Index accordingly. Since Thematic Portfolios is new to me, I will be updating you guys on the progress in months to come on the performance & my experience investing in it. If you are interested to invest with StashAway, you can use my promo code via this link to enjoy 50% off their fees for the first RM100,000 for 6 months.

OSS!

You can also check out my latest YouTube video on Why I Sold My Mutual Fund To Invest With StashAway Instead: