Somewhere in August last year, I have started to invest with Raiz as I like their concept of investing my spare change. My plan was simple, deposit RM50 each month & convert some of my spendings from my existing card or e-wallet such as petrol, food & other expenses to my MBB card as Raiz allows. Fast forward 1 year 2 months later, I have accumulated RM877.76 from my monthly & spare change investment.

I am happy with the Reinvested Dividends amount as I am able to earn between 2-5% dividend from my investment. The dividend payment was made a few months ago but I am unable to trackback what is the amount I had during that time. Their market returns always fluctuate but it is the highest investment return during my 1 year of investing with them. As for referrals, somehow it is lower than expected but it may also be because of my lack of sharing about them but please feel free to use my promo code as your help will help me to continue to fund my blog.

What I Like & What I Don’t Like About Raiz After 1 Year Of Investing With Them?

I Like Their Spare Change ConceptThis is the main reason why I invested with Raiz. Even though they have limitations on the card that you are able to use to invest your spare change, I am happy to still use my MBB card my some of my expenditure. I believe that I am able to invest more of my spare change if I am allowed to link my other cards with them.

I Like Their Daily TipsWhat I like about it is, it is really short, simple & fun. You can also check out some of their recommended articles to gain more knowledge regarding personal finance & investment.

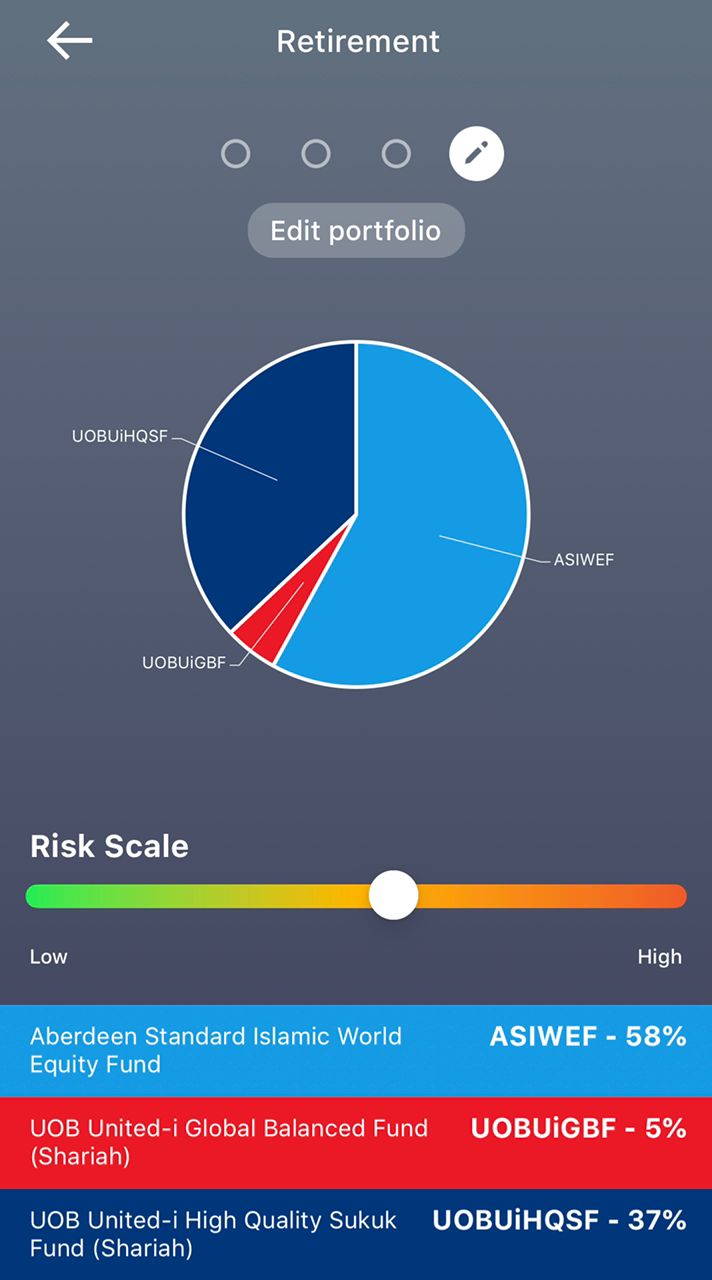

I Dislike Their Limitation Of Investment PortfolioThey started off with 3 investment portfolios which are Conservative, Moderate & Aggressive. Recently, they have introduced a new customized portfolio where you can personalize your investment portfolio based on the 3 funds. You can adjust the risk accordingly based on your risk appetite. I just recently converted my Aggressive Portfolio to the customized portfolio where I am naming it Retirement. Shall update you more on the details in many months to come.

I Don’t Like Their Monthly Fees Structure It only applies to investment that is lower value. Their minimum fees per month are RM1.50 for investment below RM6,000 or 0.025% for investment above RM6,000. Based on my current investment of RM877.76, I am paying RM18 or 2% per annum. To be honest, my ideal investment annual fees that I am willing to pay is at 1% or less a month. In order to meet 1% or below or my ideal annual fees, I have to invest at least RM1,800 or more to meet my ideal annual fees.

Conclusion:

Investing can be a simple skill nowadays especially with the introduction of Robo-advisors. You can basically invest with a goal that you have in mind, the risk you are willing to take & you are good to go. After 1 year of investing with Raiz, I tend to continue investing with them as the concept of investing with spare change is something that I like. Hopefully, in years to come, they are able to allow more linking of other cards or even e-wallet to their platform & with that, I am able to invest more of my spare change. Overall in terms of the app interface, it is simple, convenient & user-friendly for many new users. If you are keen to try, don’t forget to use my promo code to get RM5.00 from Raiz.

OSS!

You can also check out my latest YouTube video on 4 Effective Ways To Save Money From Your Daily or Monthly Spending: