I am currently on my FIRE journey, and I have 6 years left before I officially retire to travel the world. It is a goal that I set for myself before I started writing my blog years ago. Writing BBM not only helped me to record my journey & share it with all of you, but it is also a motivation for me to keep moving forward until I am able to achieve my Financial Freedom.

Over the years of planning & executing, one of my biggest worries was to lose my main income as it will definitely interrupt my planning. The pandemic itself has interrupted my plan since last year but I am adjusting my finances to ensure I am still able to meet my goals. The main key for me to able to achieve Financial Freedom is to ensure that I am debt-free. Another main key is to ensure that I have an ongoing income despite being retired.

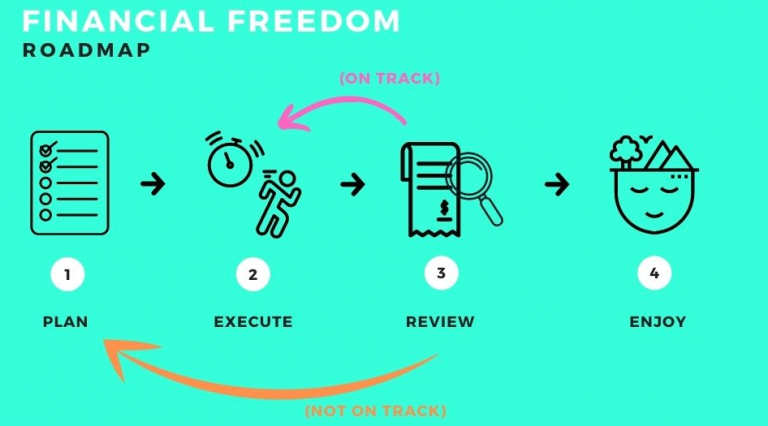

Last year, I have written on Financial Freedom Roadmap. I recommend you to read it before we continue in order to have a better understanding of the types of income that will help your FIRE Journey.

In my Financial Freedom Roadmap, types of income are under the Planning stage. You have gone through the planning on “Why Do You Want To Retire Early”, “When Do You Plan To Retire”, “How Much You Need For Your Retirement” & now you are looking at “What Will Be The Source Of Income When You Retire”.

To identify the source of income, let’s break down your income into 3 categories:

1. Active Income (Full-time job, full-time business) – Long hours

2. Hustle Income (Part-time job, part-time business, other side hustle) – Short hours

3. Passive Income (Investment income, rental income)

Active Income plays such an important role to ensure that you are able to clear your debts within your Planning stage, however active income is not conducive towards your retirement as it requires long hours of working or managing your business. As I mentioned earlier, the main key to Retire Early is to be debt-free. To achieve a FIRE lifestyle, Hustle Income & Passive Income are good choices to help you retire while still being able to generate long term & sustainable income.

Hustle Income can be income that you can generate from short working hours. Usually, we see some full-time housewives who teach tuition once or twice a week. Other hustle incomes can include online sellers who only work within short hours or YouTubers/Bloggers that use lesser working hours. The good thing about Hustle Income is, you get to have long hours to enjoy your retirement life.

The importance of Passive Income is, it is an ongoing income that you can earn from your rental or investments return. It requires lesser attention & you can still earn your income while you are asleep. There are some companies that manage your property such as Airbnb management companies. They will charge you a management fee but you are getting income from the rental itself. Investing in stocks or other investment platforms also helps you hedge against inflation & allows you to earn profit from it.

You have identified the source of income for your retirement, what is next for you? Based on my Financial Freedom Roadmap, you have to EXECUTE, REVIEW & once you are ready, you get to retire & ENJOY your life. In my financial freedom planning, I have an Active, Hustle & Passive Income. My goal is to replace my Active Income with my Hustle & Passive Income while clearing my debts such as my house & car loan. Along the way, I am also building up my net worth which is to have RM4 million once I turn 40. It is not easy but with proper planning & execution, I believe that I am able to achieve it.

OSS!

You can also check out my latest YouTube video on What Can You Invest With RM1000: